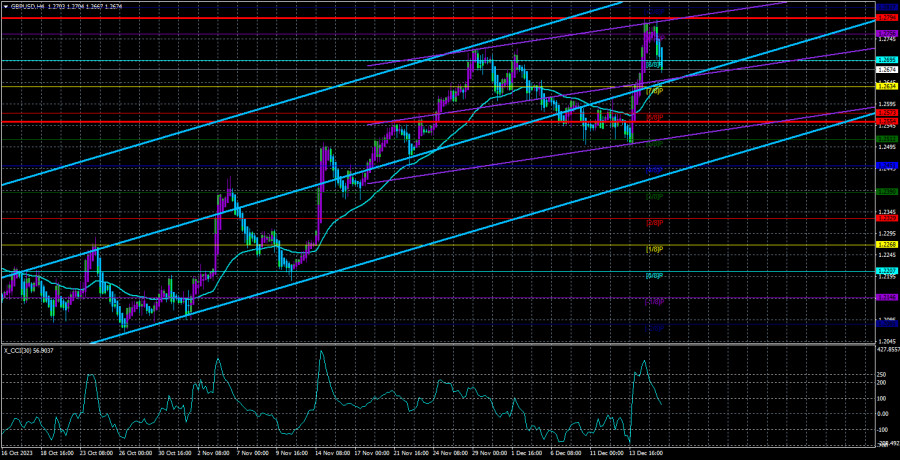

The GBP/USD currency pair also continued its confident upward movement on Thursday but sharply plummeted on Friday. We have repeatedly mentioned that the British pound (similar to the euro) is heavily overbought. The CCI indicator for the pound also entered overbought territory four times. Several corrections followed these signals, but it's not enough. The British pound is fundamentally overbought and lacks grounds for further growth. Let's delve into the details.

The fact that we have witnessed the rise of the British currency over the past two months cannot be denied. Some may argue that the pound is rising, so why wait for a downturn? However, we want to remind you that any forecasts are based on certain factors. We have repeatedly analyzed macroeconomics, fundamentals, and technical aspects. Each time, the majority of factors favor a new decline in the British pound. The possibility that the Bank of England may hypothetically raise the interest rate again is just an assumption, not a fact. With the same logic, it could be said that the Fed might also raise the interest rate again. Jerome Powell said it's unlikely, so what? Two weeks ago, he was quite open to further monetary policy tightening. Tomorrow, inflation in the United States will begin to rise again, and FOMC representatives will once again discuss the advisability of new tightening.

Inflation could well start rising again. Geopolitical instability can lead to new conflicts; oil tends to rise in price, and during winter, many goods and services become more expensive as heating bills need to be paid. Therefore, we believe that after inflation falls below the "Bailey level," the Bank of England will no longer raise the interest rate. And even if it happens, buying the pound now in anticipation of this is illogical. Plus, let's not forget about four entries of the CCI indicator into overbought territory and the perfect bounce from the Fibonacci level of 61.8% on the 24-hour TF.

America: many reports, few significant ones.

What interesting events will unfold this week in the UK? There won't be much of interest. On Wednesday, a truly important inflation report for November will be published. According to experts' forecasts, inflation is expected to decline from 4.6% to 4.3-4.4% y/y. It's a slight slowdown, but a slowdown nonetheless. At the same time, the core inflation may drop from 5.7% to 5.5%, which is not bad, considering how reluctantly it decreases. A new decline in inflation would make a rate hike, which Andrew Bailey allowed, even less justified.

On Friday, the UK will release GDP reports for the third quarter and retail sales for November. The final GDP estimate may differ from the two previous ones, but we are unlikely to see a significant deviation. Most likely, the economy will lose 0.1%, which will not add optimism to the bulls. As for retail sales, this is a relatively secondary report that is unlikely to provoke a strong market reaction.

In the United States, the situation with reports and events will also not be the most favorable. Real estate market reports, which are inherently secondary, will be published, the final GDP figure for the third quarter, which is expected to show a growth of 5.2%. The standard report on unemployment claims, the personal consumption expenditures price index, durable goods orders, personal income and spending, and the University of Michigan consumer sentiment index. As we can see, there will be a lot of data, but many reports are secondary and can only trigger traders' interest in working with them in the event of a significant deviation from the forecast. We believe that the most interesting reports will be durable goods orders and the University of Michigan index, which will be released on Friday.

The average volatility of the GBP/USD pair over the last 5 trading days as of December 17 is 120 points. For the pound/dollar pair, this value is considered "high." On Monday, December 18, we expect movement within the range bounded by the levels of 1.2554 and 1.2794. A reversal of the Heiken Ashi indicator back upward will indicate a possible resumption of the upward movement.

Nearest support levels:

S1 - 1.2634

S2 - 1.2573

S3 - 1.2512

Nearest resistance levels:

R1 - 1.2695

R2 - 1.2756

R3 - 1.2817

Trading recommendations:

The GBP/USD currency pair has settled above the moving average line, but its growth may be short-lived. For now, traders can consider long positions, but we all understand that this week's growth was provided by two ultra-important events. Therefore, be cautious with longs. Short positions can be opened in case the price consolidates below the moving average with targets at 1.2573 and 1.2512. We still believe that a decline is more likely (fourfold overbought CCI).

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should currently be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (below -250) or the oversold area (above +250) indicates that a trend reversal in the opposite direction is approaching.