5M chart of GBP/USD

The GBP/USD pair also traded higher on Tuesday, although it had fewer reasons to rise than the EUR/USD pair. Nevertheless, the pound still grew. For now, it can be attributed to a technical correction after a two-day growth, but if it continues to move up, then we can recall yesterday's macro data from the UK, which objectively should have provoked the pound's decline, not its growth. The unemployment rate increased, and the number of claims for unemployment benefits also rose significantly. Although these are not the most important reports, we're still facing a situation where the market either ignores data or interprets it in favor of the pound. Nevertheless, the chances of a decline, which we have been waiting for a long time, remain high. The price failed to consolidate above the critical line, and above 1.2440, which has acted as the upper limit of the horizontal channel on the 24-hour chart, too.

There were few trading signals on Tuesday. At the beginning of the European trading session, the pair consolidated above the Senkou Span B line and later rose to the area of 1.2429-1.2448. The Kijun-sen and the 1.2429 level should be considered as an area, as there were only 19 points between them. The pair stopped rising in this area, and traders could gain about 15 points of profit from long positions. This is a small amount, but then again, yesterday's movements were not the best.

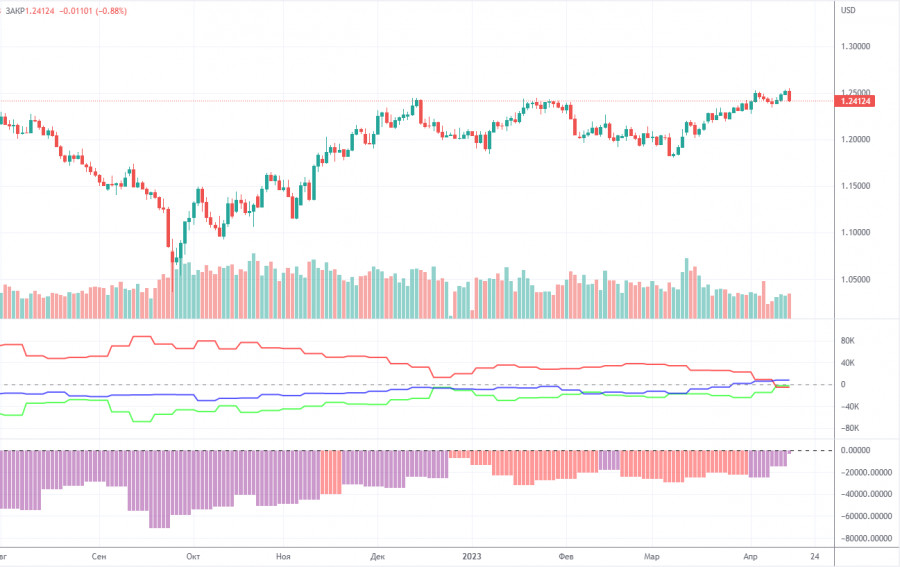

COT report:

According to the latest COT reports for the British pound, the non-commercial group opened 8,500 long positions and closed 3,800 shorts. As a result, the net position of non-commercial traders increased by 12,300 and continues to grow. The net position indicator has been steadily rising for the past 8-9 months, but the sentiment of major players remains bearish. Although the sterling is growing against the US dollar in the medium term, it is very difficult to figure out the reasons for the sterling's rally from a fundamental point of view. We absolutely do not exclude the scenario in which a sharper drop in the pound will begin in the near future. We also note that both major pairs are currently following roughly the same pattern, but the net position for the euro is positive and even implies a soon-to-be-ending upward momentum, while for the pound, it is negative, which suggests further growth. The British currency has already rallied by 2,100 points. It is stunning growth without a strong downward correction, so a further rally will be absolutely illogical. The non-commercial group now holds a total of 57,000 shorts and 55,000 longs open. We are still skeptical about the long-term uptrend of the British currency and expect it to fall.

1H chart of GBP/USD

On the one-hour chart, GBP/USD fell and crossed important lines, but then it started to lean towards growth again. We will consider this movement an error. Formally, the trend has changed to a bearish one, and traders are now entitled to expect a downtrend. However, without overcoming the level of 1.2349, this will not be possible. The pound may switch to a "swing" mode between levels 1.2349 and 1.2520. We can already see that the pair is trading strictly between them. For April 19, we highlight the following important levels: 1.1927, 1.1965, 1.2143, 1.2185, 1.2269, 1.2349, 1.2429-1.2458, 1.2520, 1.2589, 1.2659, 1.2762. The Senkou Span B (1.2400) and Kijun-sen (1.2448) lines can also be sources of signals. Rebounds and breakouts from these lines can also serve as trading signals. It is better to set the Stop Loss at breakeven as soon as the price moves by 20 pips in the right direction. The lines of the Ichimoku indicator can change their position throughout the day which is worth keeping in mind when looking for trading signals. On the chart, you can also see support and resistance levels where you can take profit. On Wednesday, the UK will release its inflation report, which could be very interesting. The main thing is that the market does not interpret any new information in favor of the pound. The correlation between inflation and rates is already quite weak, so the market can interpret the report as it pleases. In the US, there is only the "Beige Book", and traders are hardly interested in it.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

Kijun-sen and Senkou Span B are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.