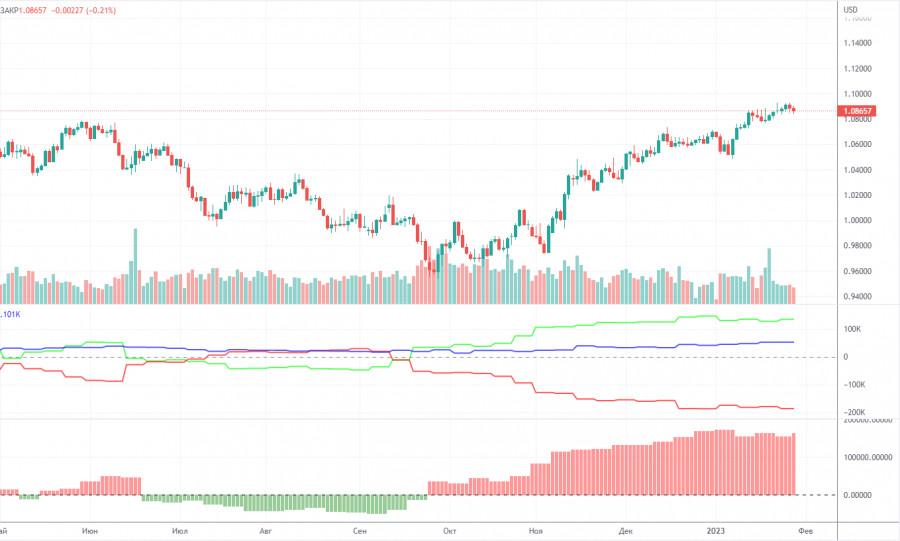

M5 chart of EUR/USD

EUR/USD continued to grow quietly on Wednesday. Naturally, late in the evening, when the results of the US central bank meeting were announced and Federal Reserve Chairman Jerome Powell's speech took place, volatility increased. The euro grew even more. We don't want to talk about the logic of the movement. Yesterday, the euro rose after the market found out that EU inflation fell and also due to Powell's hawkish rhetoric. Once again we are facing the same situation when the fundamental or macroeconomic background does not matter for the traders. They just use any excuse to open long positions. Yesterday, according to all canons of technical and fundamental analysis, the euro was supposed to start a powerful fall. And that seems to be the reason why it didn't. EUR demonstrated some growth even despite Powell's words about the necessity to keep raising rates and refusing to pause on aggressive monetary policy. What else is there to talk about? The results of the Fed meeting may not be analyzed at all.

But traders got lucky with yesterday's trading signals. At the very beginning of the European session, there was a buy signal at 1.0865-1.0868, and the pair managed to rise 40 points till the Fed meeting, which traders could get on a single deal. It was also possible to place the Stop Loss at breakeven before the results of the meeting were announced, hoping for higher profit. In this case, traders could earn about 100 pips. Anyway, the day turned out to be successful in terms of trading.

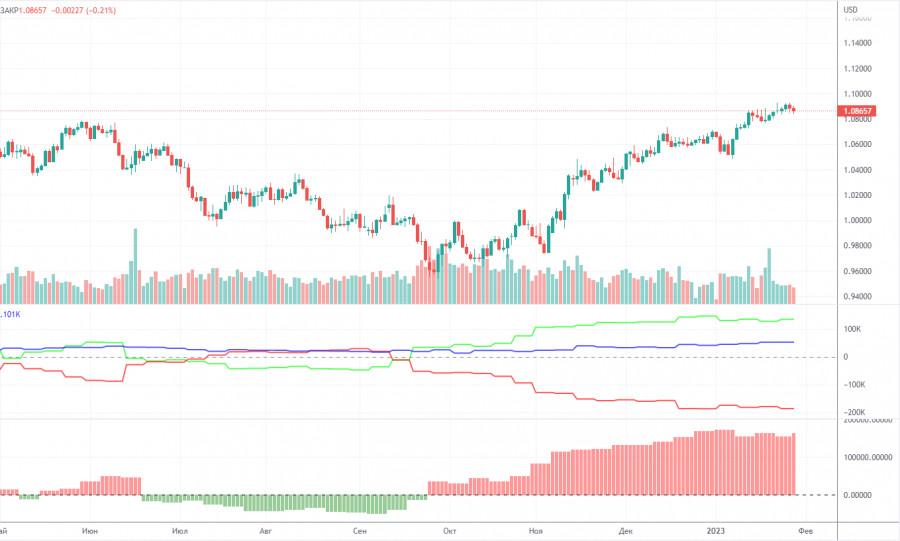

COT report

The COT reports for the euro in the last few months have been fully consistent with what is happening in the market. You can clearly see on the chart that the net position of big players (the second indicator) has been growing since early September. Around the same time, the euro started to grow. At this time, the net position of the non-commercial traders has been bullish and strengthens almost every week, but it is a rather high value that allows us to assume that the uptrend will end soon. Notably, the green and red lines of the first indicator have moved far apart from each other, which often precedes the end of the trend. During the given period, the number of long positions held by non-commercial traders decreased by 9,500, whereas the number of short positions fell by 2,000. Thus, the net positions decreased by 7,500. Now the number of long positions is higher than the number of short positions opened by non-commercial traders by 134,000. So now the question is: how long will the big players increase their longs? From a technical perspective, a bearish correction should have started a long time ago. In my opinion, this process can not continue for another 2 or 3 months. Even the net position indicator shows that we need to "unload" a bit, that is, to correct. The overall number of short orders exceeds the number of long orders by 52,000 (732,000 vs. 680,000).

H1 chart of EUR/USD

On the one-hour chart, EUR/USD left the sideways channel, in which it was in for three weeks. At least something positive from yesterday. The euro may rise further because I don't expect the ECB to be dovish. But ironically, the euro might fall today. When no one is expecting it. Anyway, be careful because there is no logic in the pair's movements right now. On Thursday, the pair may trade at the following levels: 1.0806, 1.0868, 1.0938, 1.1036, 1.1137, 1.1185, 1.1234, and also Senkou Span B lines (1.0847) and Kijun Sen (1.0917). Lines of the Ichimoku indicator may move during the day, which should be taken into account when determining trading signals. There are also support and resistance levels, but signals are not formed near these levels. Bounces and breakouts of the extreme levels and lines could act as signals. Don't forget about stop-loss orders, if the price covers 15 pips in the right direction. This will prevent you from losses in case of a false signal. On February 2, the results of the European Central Bank meeting will be announced and there will be as many as two speeches from ECB President Christine Lagarde. Judging from yesterday's events, the euro will rise in any case, but there is no logic in the pair's movements so we're not sure which direction it will go.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.