On Friday, the EUR/USD currency pair was trading higher once more, but this is hardly shocking given that the euro has been increasing almost daily in recent weeks, almost without any real support. The fundamental background occasionally lends support to the euro but does so infrequently while the pair continues to increase. On Friday afternoon, we issued a warning, stating that even if the non-farm payrolls come in strong, we shouldn't prematurely declare the euro's demise because we might experience the opposite trend by day's end. We didn't think it was possible, but that's how it turned out. However, the market only worked out strong non-farms, good unemployment, and well-grown wages for a half hour or an hour before forgetting about them and returning to its recent favorite activity. As a result, we are still attempting to relate the foundation to macroeconomics and market behavior. They are utterly at odds with one another, and the pair is currently moving upward, although this is illogical. Tomorrow, it may also move downward illogically. This is the threat posed by the current circumstance.

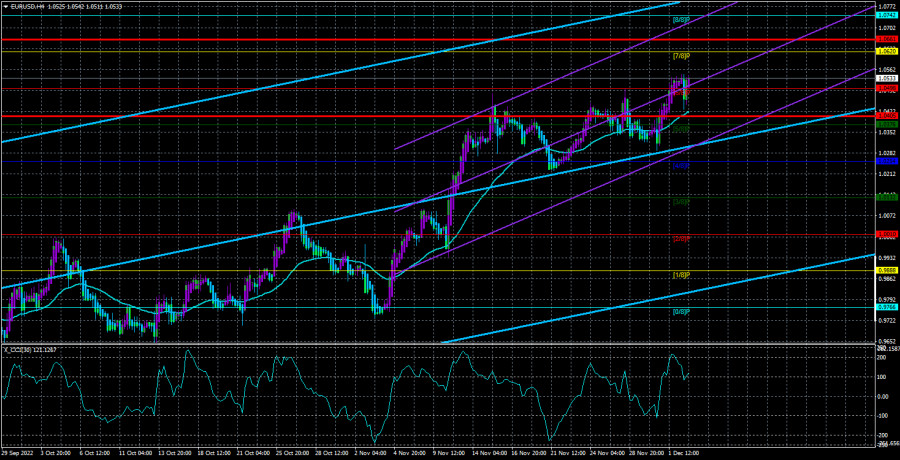

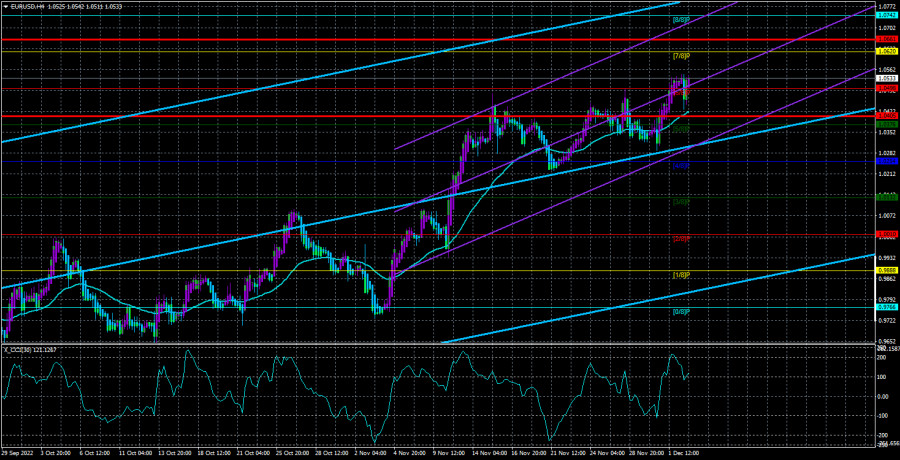

Technically speaking, the upward trend continues and doesn't raise any concerns or doubts. There is no longer any indication of a correction based on the 4-hour and 24-hour TF indicators, which all point upward. Corrections occur occasionally, but this is a relatively uncommon occurrence, and they are quite weak. Accordingly, the pair may continue moving north this week based on the "technique," even though there will be a few reasons for this, as we will see below.

GDP and Christine Lagarde's speeches

There would be few macroeconomic statistics this week if there were significant events and reports last week that the market either ignored or misinterpreted. It should be noted that traders acted as if the most recent EU inflation report did not exist by not paying any attention to it. Most likely, this week will bring similar events. But everything is generally in order.

The next speech by Christine Lagarde, the head of the ECB, will take place on Monday. Although we don't anticipate her to say anything fundamentally novel on the eve of the regulator's meeting, we still need to be on the lookout for any surprises. The index of service sector business activity and retail sales will also be released on this day. Though not the most crucial indicator, business activity will likely continue to be below the "waterline" of 50.0.

The third estimate of the GDP for the third quarter will be released on Wednesday, and, likely, it will be similar to the second estimate. Again, since traders are already very familiar with the value of GDP, they will have little to react to. On Thursday, Christine Lagarde will give two more speeches, and other ECB officials will also speak during the week. Therefore, it is generally possible to receive interesting information, but only in the event of something "loud" will it be possible to wait for the market's response.

However, does the market currently require "loud" information? The pair's movement is still extremely volatile and trending. Whether macroeconomics or the foundation are involved, the euro is strengthening. As a result, traders won't even need news and reports to make trading decisions. The market can start selling the euro just as it is currently buying it irrationally. The current situation is like a "trap" designed to raise the pair's rate as high as possible before actively selling. However, since this is only an assumption, it is impossible to know. In any case, the start of a potential downward movement can be identified by fixing the price below the moving average line. Selling the pair is advised at that time.

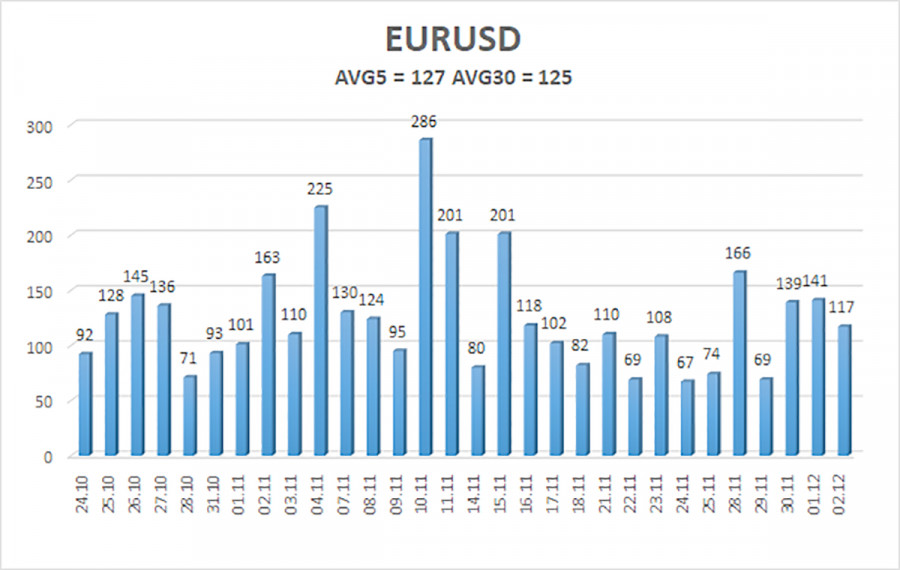

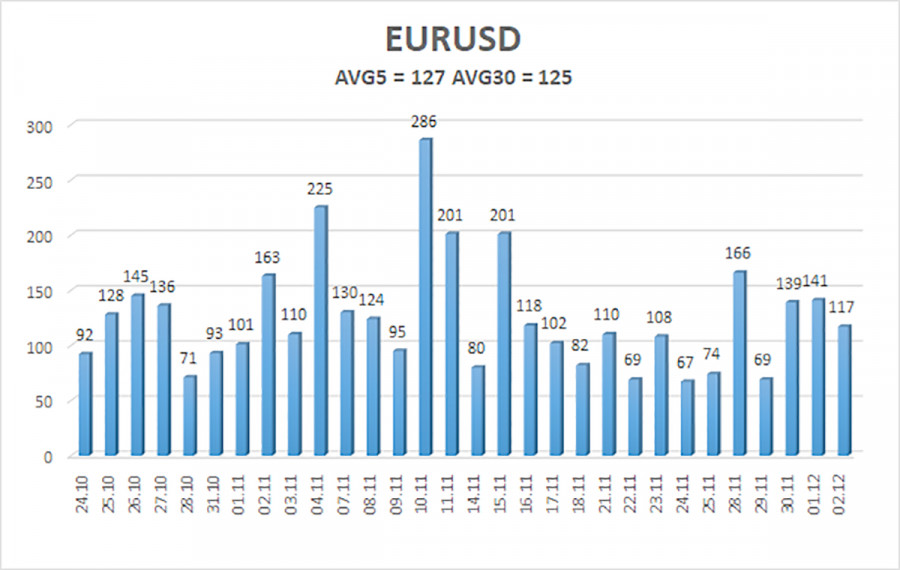

As of December 5, the euro/dollar currency pair's average volatility over the previous five trading days was 127 points, considered "high." So, on Monday, we anticipate the pair to fluctuate between 1.0405 and 1.0661. The Heiken Ashi indicator's turning downward indicates a new phase of the corrective movement.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Suggestions:

The EUR/USD pair is still in an upward trend. As a result, you should continue holding long positions until the Heiken Ashi indicator turns down, with targets of 1.0621 and 1.0620. Sales will become significant only when the price is fixed below the moving average line with a target of 1.0254.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.