The GBP/USD currency pair continued its upward movement on Monday, which began on Friday. We have already said that we consider it illogical since the results of the Fed meeting and Friday's Nonfarm should have contributed to the growth of the dollar. However, it should be noted that the pound again had reasons not to decline too much against the dollar, but to grow more confidently. The fact is that last Thursday the market ignored the increase in the Bank of England rate by 0.75%. We understand that Andrew Bailey's rhetoric was simply a failure. He openly said that the British economy will fall into a recession that will last two years. Nevertheless, rhetoric is rhetoric, but for now, BA is raising the stakes and doing it at a record pace for itself, that's what's important. The market did not pay attention to this fact, so the current growth can be at least somewhat justified.

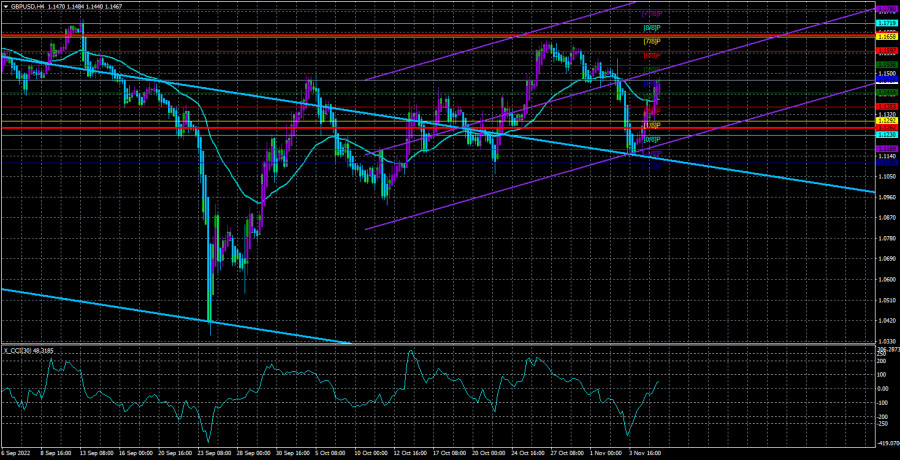

Thus, the pound/dollar pair returned to the area above the moving average line, so the trend changed back to an upward one. In the near future, the bulls will try to update the previous local maximum, which is located at the level of 1.1644. If they manage to do this, it will be another step towards a long-term upward trend. The British pound still gained a foothold on the 24-hour TF above the Ichimoku cloud, so its chances of further growth are growing. Although the "foundation" and geopolitics are still extremely difficult for all risky currencies. At the same time, it should be noted that the Bank of England will sooner or later begin to catch up with the Fed in terms of the rate, and Rishi Sunak's initiatives are much more favorable for the economy than Liz Truss' proposals. It can be assumed that if Truss' desire to lower taxes provoked panic in the financial markets and the collapse of the British pound, then Sunak's initiative to raise taxes will cause the opposite effect. The only question is whether such unpopular decisions will not become a verdict for the Conservative Party in the next parliamentary elections.

Sunak is not going to sacrifice the economy for the benefit of the British.

As it became known, the government of Rishi Sunak, who himself served as finance minister for 2 years, is going to raise several taxes to close the budget deficit by 50 billion pounds. The reasons for the "hole" in the budget were the pandemic and its consequences for the economy, as well as large-scale support for households and businesses in paying electricity bills. Already on November 17, the new Finance Minister Jeremy Hunt is due to present the government's financial plan for next year, from which it will become clear how strong household support will be and how much taxes will be raised. That is, Sunak is going to follow the path of "dual steps." On the one hand, taxes will rise, but on the other hand, the government will help the British pay their energy bills. At first glance, it is unclear what the essence of such actions is, if, with the highest inflation, the British still have to give as much money as they would give without raising taxes and without the help of the state.

However, even before his defeat in the last election, Sunak was called a talented financier, so he can present a financial plan in which the additional costs of the population will be "barely noticeable," and the state's assistance will be "obvious." This is the art of financial management. The most important thing is that the British economy will not have to get into debt, for which, again, the British themselves will pay for many years. The British pound may continue to strengthen against its competitors, and financial markets will avoid new shocks. So far, Sunak's initiatives look reasonable. However, how will the electorate react to them on the eve of new parliamentary elections? Everyone knows that Sunak is not a "people's choice" and a "representative of the workers." Will these working people respond by giving their votes in the elections for Labor? After all, now the Conservatives control Parliament, but things can change. Stability in the economy is of course extremely important for the pound now, especially on the eve of the recession announced by Andrew Bailey. However, politics always has a certain relation to the economy.

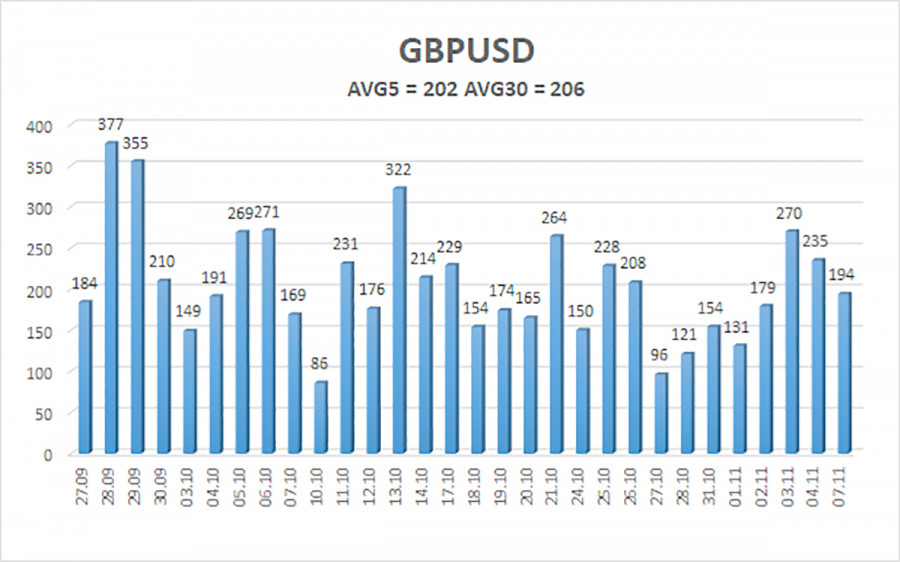

The average volatility of the GBP/USD pair over the last 5 trading days is 202 points. For the pound/dollar pair, this value is "high." On Tuesday, November 8, thus, we expect movement inside the channel, limited by the levels of 1.1262 and 1.1666. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest resistance levels:

R1 – 1.1536

R2 – 1.1597

R3 – 1.1658

Trading Recommendations:

The GBP/USD pair in the 4-hour timeframe has consolidated back above the moving average. Therefore, at the moment, you should stay in buy orders with targets of 1.1597 and 1.1658 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.1292 and 1.1262.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.