The GBP/USD currency pair lost more than 200 points on Tuesday, and on Wednesday, it managed to adjust only slightly. As in the case of the euro currency, the probability of further decline/growth of the pair is now 50-50. Both pairs show a high correlation with each other, so there is no doubt that if the euro falls, the pound will also fall. The pound sterling is now just about a hundred points away from its 37-year lows. The growth that we have seen recently could be the beginning of a new upward trend, but it does not seem to be it. Currently, the pair is below the moving average, and the market does not know what to do with the euro, pound, and dollar now.

On the one hand, it is dangerous to continue selling at 37-year lows. On the other hand, all attention has shifted again to the Fed and the fact that the regulator may continue aggressively raising the key rate. And this fact, we recall, is one of the key factors in the fall of the British currency over the past 6–8 months.

The market was not interested in raising the Bank of England's rate but in raising the Fed rate. The divergence between them remains, but it is not as strong as in the case of the ECB. Nevertheless, the pound has been showing an equally strong decline in recent months, which is why we believe that the markets rely on the Fed's monetary policy for 60% of their decision-making. As in the case of the euro currency, we recommend that you carefully monitor the technical picture now since a flat, a "swing," a new attempt at growth, and a new strong fall are now possible. Thus, it would help if you were extremely careful when opening positions.

British inflation has slowed for the first time in a year and a half.

So, the British consumer price index fell by 9.9% in August. The decrease was 0.2% compared to the previous month. Thus, it may be a simple accident. Recall that inflation in the UK began to rise in March 2021. That is, it has been growing for a year and a half. During this time, it grew from 0.4% y/y to 10.1% y/y. The tendency to grow, as they say, on the face. No one denies that sooner or later, a slowdown in price growth will begin in the UK, but 0.2% is too little to exclude the random factor. The Bank of England's rate has risen to 1.75%, and the British regulator is raising it more slowly than the Fed. Therefore, based on this factor, more probability is given to the new dollar growth. But at the same time, if earlier the difference between the rates was visible per kilometer, there are still certain movements to bring the rates closer.

Unfortunately, the US inflation report means that the US rate will rise by another 0.75% next week. And maybe by a whole 1.00%! The Bank of England will not be able to provide the same monetary tightening. Therefore, if we start only from the factors of monetary policy, then we would say that the euro and the pound have excellent chances to continue their decline. Moreover, as we have all seen, the slowdown in inflation in Britain did not provoke a serious market reaction. And it did not provoke it because the market understands that the slowdown should have the essence of a trend and not a one-time character.

Moreover, since inflation has started to slow down, the Bank of England may raise the rate next week by only 0.5%, which is a significant tightening. There is no hope for 0.75% or more. Consequently, the BA and Fed rate gap will increase again. Consequently, the US dollar may move into growth again. And the pound sterling can drag the euro currency down since these pairs like to trade identically. A quick return to the area above the moving average can bring the bulls back to the market and assure them that the bears are not as strong as they seem. But when a pair falls by 200 points in one report, it says a lot. And, first of all, about the power of bears.

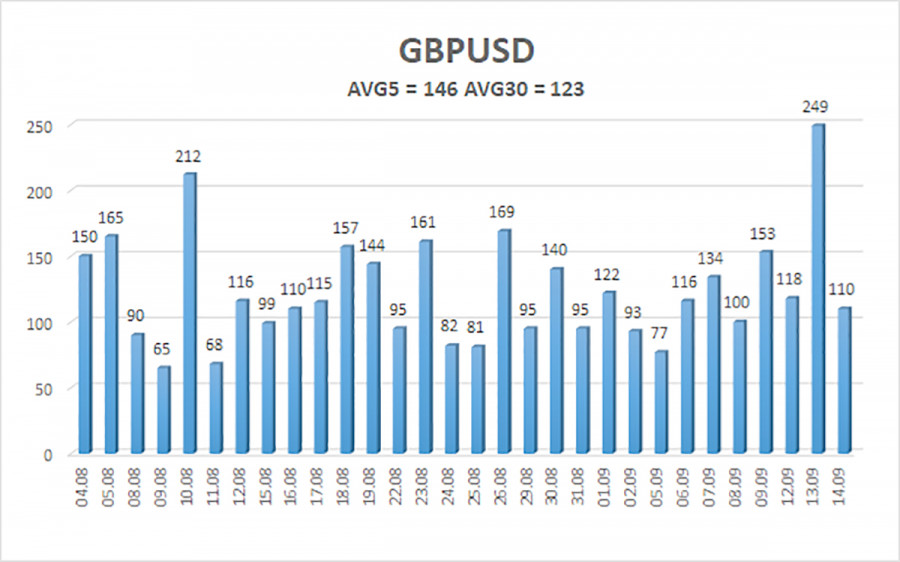

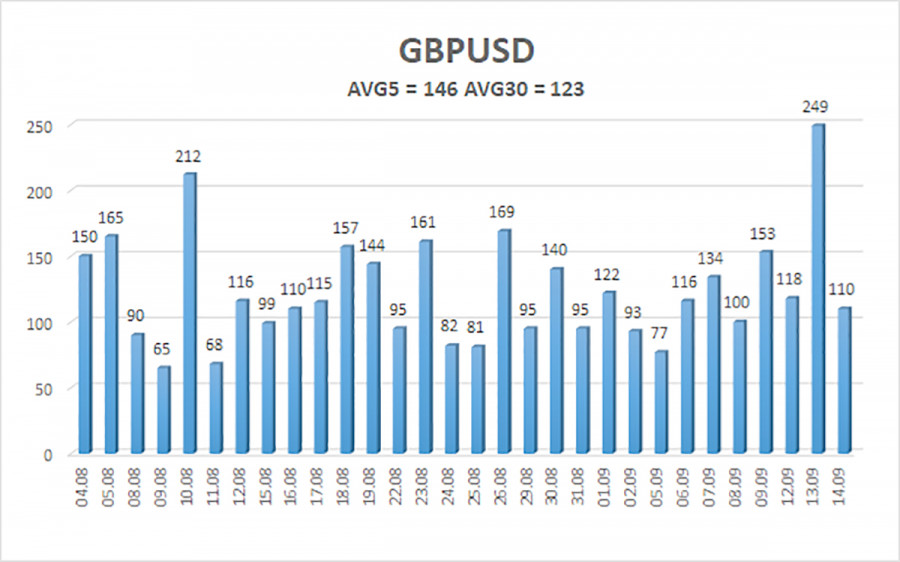

The average volatility of the GBP/USD pair over the last five trading days is 146 points. This value is "high" for the pound/dollar pair. On Thursday, September 15, thus, we expect movement inside the channel, limited by the levels of 1.1416 and 1.1709. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.1536

S2 – 1.1475

S3 – 1.1414

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1658

R3 – 1.1719

Trading Recommendations:

The GBP/USD pair has overcome the moving average on the 4-hour timeframe and may begin a new round of downward movement. Therefore, at the moment, sell orders with targets of 1.1475 and 1.1414 should be considered if the Heiken Ashi indicator turns down. Buy orders should be opened when fixed above the moving average with targets of 1.1658 and 1.1709.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.