The EUR/USD currency pair on Tuesday dropped once again to the Murray level of "2/8" - 1.0498, bounced off it, and began a new round of upward correction. So far, all these attempts to form an upward correction cause only laughter. The positions of the European currency are so weak, and the bears are so unwilling to let the initiative out of their hands, that it is very difficult to say what can help the euro to grow by at least 200-300 points. At the same time, although most factors remain on the side of the US currency, we believe that the pair may begin to grow in the near future. First, the Fed will hold a meeting this week. Since the market is already ready for any tightening of monetary policy, it can be assumed that it has worked them out for a long time. We believe that on Wednesday the Fed may raise the rate by 0.5%, but the US currency will fall. Second, the pair cannot constantly move in only one direction. Yes, the European Union is on the verge of an energy crisis, and at the same time a food crisis. However, we are still talking about 27 developed countries, and not about some poor African countries.

In Europe, there are technologies, there are opportunities, and there is money. Oil and gas can be obtained from other sources. In addition, Europe has long wanted to switch to "green" energy. The transition may take several years, it will be a very difficult period, and oil and gas prices may rise even more (which is beneficial to Russia). But it seems that now the introduction of an oil and gas embargo is only a matter of time. Even Hungary's official position probably won't be able to change the overall alignment on this issue. Over the past few weeks, even those countries that initially tried to take the most neutral position on the issue of the Ukrainian-Russian conflict have been supplying weapons to Ukraine. Sanctions continue to be imposed every week or two. If we consider the Russian-European conflict, then it is only getting worse every day.

The escalation of the conflict and the deterioration of relations with the Russian Federation can only aggravate everything.

Unfortunately, the more Ukraine resists, the more likely it is that the Kremlin will decide on new strikes against it. The conflict has already begun, and it lasts more than 2 months.The Ukrainian troops, who are currently being trained in NATO weapons, will sooner or later go on a counteroffensive. This is openly stated in Kyiv. The negotiations have failed, which is also openly stated both in Kyiv and Moscow. Consequently, the military operation may continue for many months or even years. All the participants in the conflict will suffer all this time. Ukraine is unlikely to be able to harvest enough to supply food to Europe, Russia is unlikely to carry out such supplies, and relations between the EU and the Russian Federation are spoiled for many years.

However, the key and most important point are that Moscow is unlikely to change its mind about its plans for this conflict and Ukraine. After 2.5 months of fighting, it is unlikely that Russian troops will simply turn around and go home. Most likely, they will try to transfer everything to the "Donbas 2.0" phase. But there is another option. The Kremlin may try to strengthen the onslaught. For several weeks, there has been talk of a possible general mobilization, the consequence of which, of course, will be the formation of a new army, new units, and a new attack on Ukraine. Only now does Ukraine has NATO weapons, and Russia, which has already realized that it will not be possible to achieve its goals in Ukraine with little blood, can send even larger groups of troops.

The longer this confrontation continues, the more the euro currency could potentially fall. After all, it is the European Union that is now practically on the front line, but the States are far away.

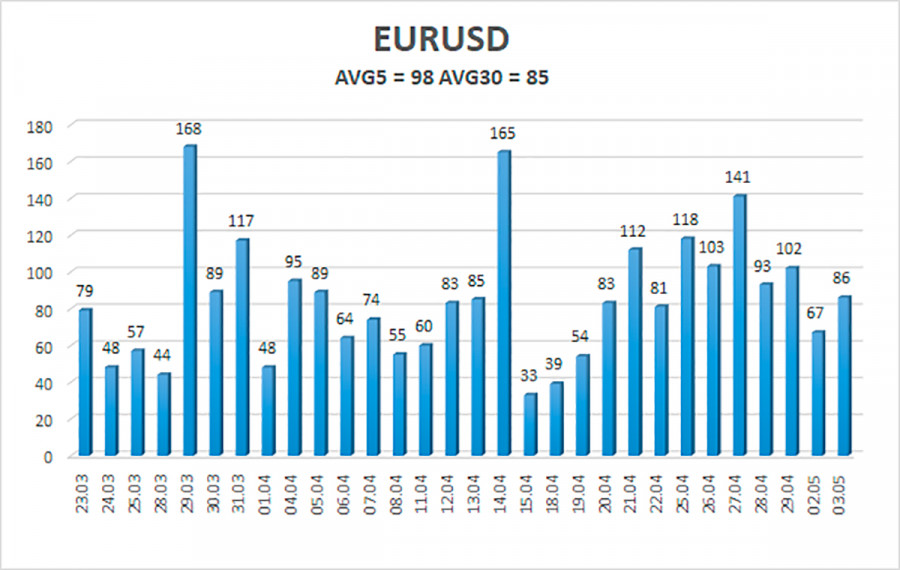

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 4 is 98 points and is characterized as high. Thus, we expect the pair to move today between the levels of 1.0431 and 1.0628. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.0498;

S2 – 1.0376;

S3 – 1.0254.

Nearest resistance levels:

R1 – 1.0620;

R2 – 1.0742;

R3 – 1.0864.

Trading recommendations:

The EUR/USD pair is trying to maintain a downward trend. Thus, new short positions with targets of 1.0431 and 1.0376 should now be considered in the case of a reversal of the Heiken Ashi indicator down. Long positions should be opened with a target of 1.0742 if the price is fixed above the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.