GBP/USD 5M

The GBP/USD currency pair also traded rather vaguely on Tuesday. Throughout the day, it was more of a sideways movement than a trend, so it was rather inconvenient to trade the pair. There were absolutely no macroeconomic statistics and fundamental events, so traders had nothing to react to during the day. However, this is not necessary now, since the Federal Reserve and the Bank of England meetings will be held on Wednesday and Thursday, and the most important NonFarm Payrolls report in the US will be published on Friday. So the second half of the week will definitely be more interesting than the first. In the meantime, it can be noted that the pound/dollar pair cannot start an upward correction, although it is located very low. The pair could not settle above the 1.2601 level. Most of the fundamental, macroeconomic and geopolitical factors continue to speak of a more likely dollar growth. However, the technical picture may change dramatically after Wednesday, Thursday and Friday.

There were several trading signals on Tuesday, and all of them can be considered false. All signals were formed near the critical line, which indicates a flat. The first one - for buying - was formed at the very beginning of the European trading session, and after it the pair went up 30 points, which was enough, at least, to set Stop Loss to breakeven. The next sell signal was formed when the pair settled below the critical line, and a loss was received on it, since the pair could not go down even 15 points. All subsequent signals should be ignored, since the first two turned out to be false.

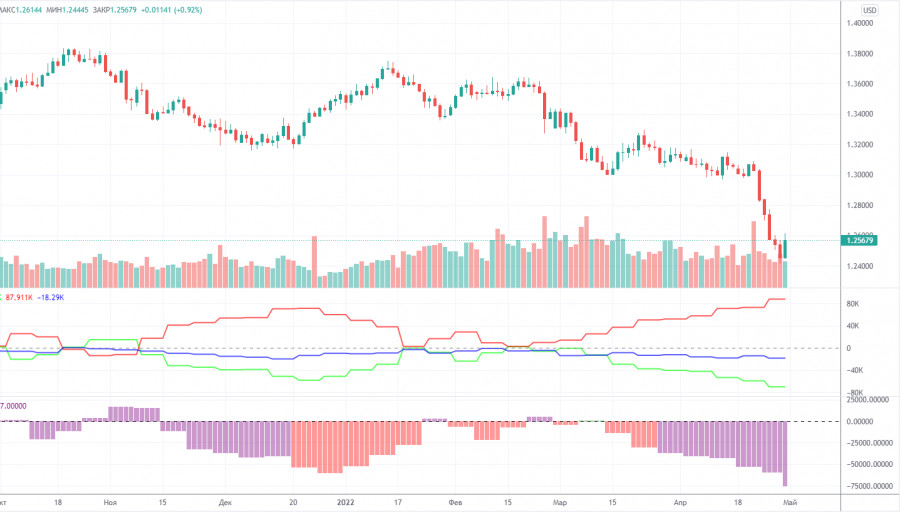

COT report:

The latest Commitment of Traders (COT) report on the British pound has witnessed a new increase in bearish sentiment among professional traders. During the week, the non-commercial group opened 3,600 long positions and 14,300 short positions. Thus, the net position of non-commercial traders decreased by another 11,000. Such changes are significant for the pound. The non-commercial group has already opened a total of 110,000 short positions and only 40,000 long positions. Thus, the difference between these numbers is almost threefold. This means that the mood among professional traders is now "pronounced bearish" and this is another factor that speaks in favor of the continuation of the fall of the British currency. Note that in the pound's case, the data from the COT reports accurately reflects what is happening in the market. Traders are bearish and the pound is falling against the US dollar. We do not see any reason to assume the end of the downward trend. COT reports, foundation, geopolitics, macroeconomics, technique, all speak in favor of the fall of the pound and the rise of the dollar. Of course, the fall of the pound/dollar pair cannot continue forever, there must be at least upward corrections, but so far, based on COT reports, we cannot assume when the downward trend will end.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 4. Will there be anything before May 9th? How can the conflict between Ukraine and Russia develop?

Overview of the GBP/USD pair. May 4. The UK is heading for nuclear power.

Forecast and trading signals for GBP/USD on May 4. Detailed analysis of the movement of the pair and trading transactions.

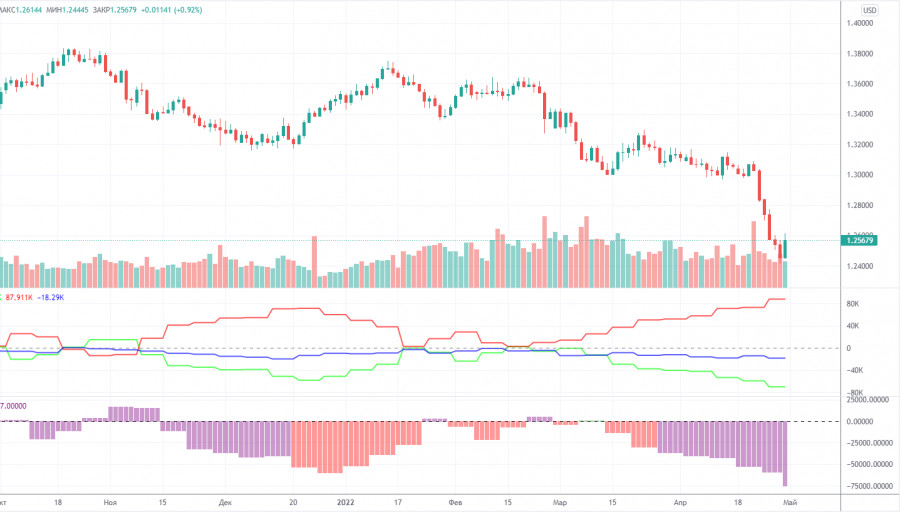

GBP/USD 1H

On the hourly timeframe, you can clearly see how much the pound has fallen in recent weeks and that it cannot correct itself normally. In the next few days, volatility may increase, but it is not a fact that the trend movement will recover. There will be many important events, but how the market will react to them, whether it wants to continue selling the pound at current price values, is a big question. The situation is very ambiguous. For May 4, we highlight the following important levels: 1.2251, 1.2410, 1.2601, 1.2674, 1.2762. Senkou Span B (1.2749) and Kijun-sen (1.2512) lines can also be sources of signals. Signals can be "rebounds" and "breakthroughs" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. There are no major events scheduled for Wednesday in the UK. Relatively important ADP reports will be published on the change in the number of employees in the private sector and on business activity in the ISM service sector in America. In the evening - the results of the Fed meeting and Jerome Powell's speech.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.