The GBP/USD currency pair did not even try to start an upward correction on Wednesday. Thus, the fall of the British currency has been going on for four full days in a row. As we said earlier, there is no single reason why the powerful fall of the British currency, which already totals more than 500 points, has begun. And after all, this is only the last round of the downward trend. We have already said that a whole range of geopolitical, macroeconomic, and fundamental reasons are currently working against the pound and the euro. And this complex of reasons does not change at all. Accordingly, there is no reason to expect the completion of the fall of the pound sterling. We can only expect an upward correction. Sooner or later, bears will start taking profits on short positions, which will lead to a pullback, maybe even a strong pullback, up. But so far, the pound is only falling, surprising traders every day with this movement, which is not fueled by new data or important news.

Unfortunately, it is not possible to talk about the UK or US economy now. First, all the key points and aspects have long been known to traders. It makes no sense to repeat them from article to article. Second, we strongly doubt that the current fall in the pound and the euro have anything to do with the economy or the monetary policy of the Fed or the Bank of England. The fact is that the approaches of both central banks have been known for a long time. And the approaches of the ECB and the Bank of England are also radically different, but at the same time, the euro and the pound are equally falling. Thus, we conclude that the main reason is geopolitics. As we have already said, any complication or escalation of the conflict in Eastern Europe will lead to an outflow of capital from Europe, which will suffer more than America from a full-scale war "on its doorstep" and between its neighbors who supply it with energy and food. Thus, it is certain that geopolitics has a devastating effect on European currencies. If macroeconomics had supported these currencies, maybe they would not have shown such a strong depreciation against the dollar. But macroeconomics does not support it.

What is the lend-lease program, which is probably already accepted in the USA?

Lend-Lease is a program that allows the United States to supply its ally with any weapons and in any quantities without various bureaucratic delays. In this case, the ally in Ukraine. The first and last time the Lend-Lease program worked was during the Second World War when the United States actively supplied weapons to its European allies of the "anti-Hitler coalition". This program means that the United States becomes the guarantor of the supply of any necessary weapons to Ukraine without any exceptions. That is, now Washington will not divide weapons into defensive or attacking. Any weapon will be supplied to Ukraine, and Kyiv has every right to "order" the weapons that it needs most. Moreover, the United States has every right to buy any weapons from its allies under the same program to provide them to Ukraine. By and large, America is becoming for Ukraine a huge factory for the production of tanks, howitzers, MANPADS, heavy and armored weapons, and even aircraft with tanks.

The Senate has already voted "For" the activation of this program on April 6, and the House of Representatives was supposed to vote late last night. However, from our point of view, this is already a mere formality, since if the Senate approved the bill, there is no reason to assume that the Lower House will block it. Moreover, both Democrats and Republicans support Lend-lease for Ukraine. Based on all of the above, we can assume only one thing: Russia will continue to attack Ukrainian lands to fulfill at least part of the tasks set, and Ukraine will continue to resist, which will now be much easier and easier to do, and in a few weeks, it can go on a counteroffensive, having almost any weapon of the West. Consequently, this conflict, as we assumed earlier, will continue either until the complete defeat of one of the parties or until the change of power in Moscow or Kyiv.

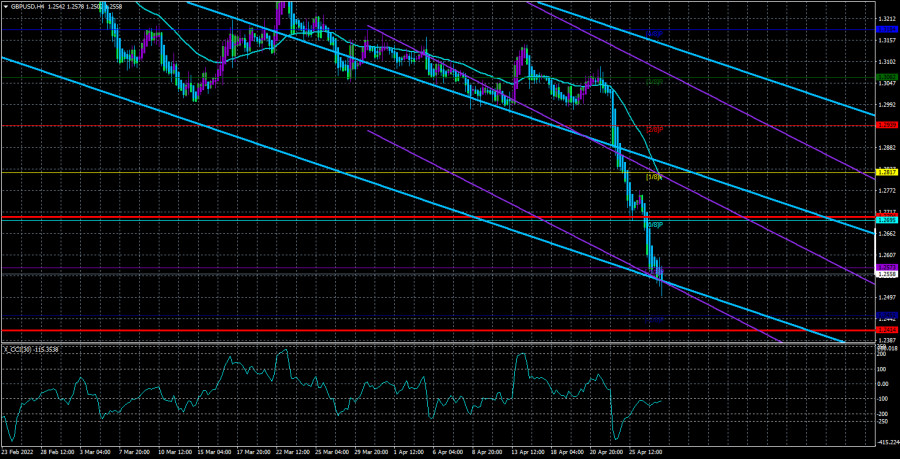

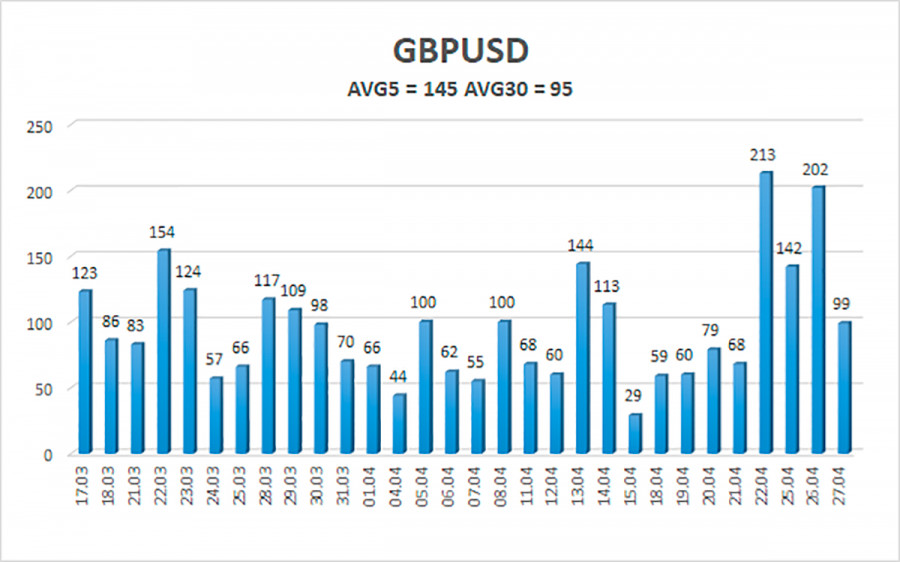

The average volatility of the GBP/USD pair over the last 5 trading days is 145 points. For the pound/dollar pair, this value is "high". On Thursday, April 28, thus, we expect movement inside the channel, limited by the levels of 1.2414 and 1.2704. The upward reversal of the Heiken Ashi indicator signals the beginning of an upward correction.

Nearest support levels:

S1 – 1.2451

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2695

R3 – 1.2817

Trading recommendations:

The GBP/USD pair continues its strong downward movement in the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.2451 and 1.2414 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2939.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.