To open long positions on EUR/USD, you need:

Last Friday, in the first half of the day, the bulls gave some hope for sustaining the upward trend, formed on Thursday, but failed to protect the 1.2177 level. Let's take a look at the 5 minute chart and talk about what happened. The bulls formed a false breakout at the 1.2177 level, which resulted in creating a signal to open long positions, but we did not see a continuation of the upward trend. After a while, a repeated test occurs and the 1.2177 level will be surpassed. But for opening short positions, the condition for updating this level from bottom to top did not take place, so I missed the entry point.

The second half of the day was completely under the control of the bears. A breakthrough of 1.2144 also did not lead to a reverse test of this level from the bottom up, which did not allow entering the market in continuation of the downward trend, after which the pair fell to the support at 1.2105. There, the bulls tried to somehow protect this level, but I did not see a large rebound from it.

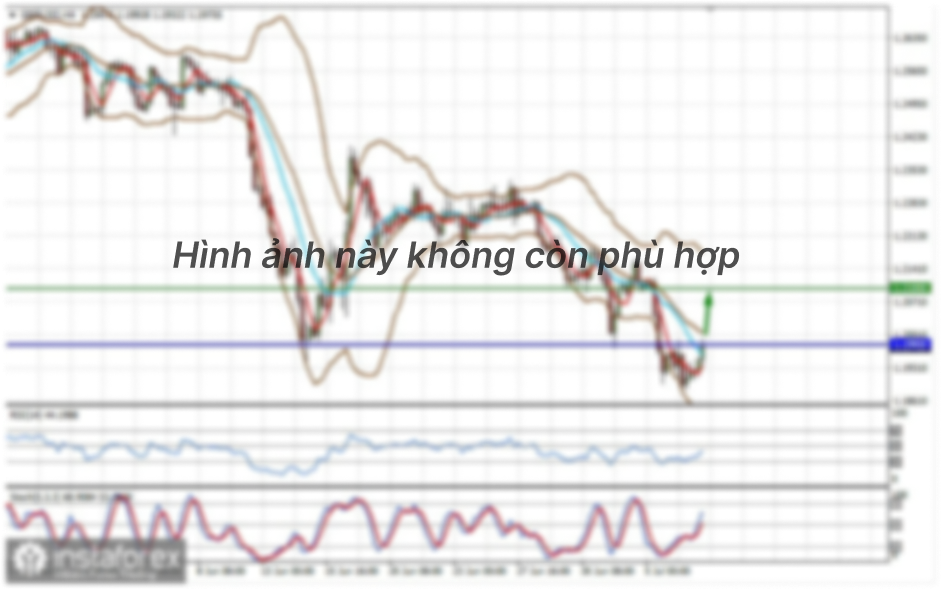

A report on industrial production in the eurozone will be released in the morning, which may turn out to be worse than economists' forecasts, which will only increase the pressure on the European currency and continue its downward trend. The main task for the European session is to protect the support at 1.2073, where the pair is now heading. Forming a false breakout in this range, along with the divergence on the MACD indicator, which is now looming after Friday's huge fall in the euro, all this forms a signal to open long positions in order to return to the resistance of 1.2126. It will not be easy to rise above this level, given that there are moving averages playing on the side of the bears. Only a breakthrough and test of this area from top to bottom on volume can create an entry point to long positions in hopes of an upward correction in order to renew the high of 1.2158. A larger resistance level is seen around 1.2190, where I recommend taking profits. If the bulls are not active in the area of 1.2073, it is better to postpone long positions until the test of support at 1.2023 from where you can buy EUR/USD immediately on a rebound, counting on an upward correction of 15-20 points within the day.

To open short positions on EUR/USD, you need:

The bears need to carefully think of a way to defend the resistance at 1.2126, which the bulls will clearly aim for this morning. A very disappointing report on industrial production in the eurozone can provide help to the bears, which for the reporting period may clearly decline compared to the previous month. Forming a false breakout at the level of 1.2126 generates a signal to sell the euro in hopes of pulling the quote to the area of the new local low at 1.2073, on which a breakthrough of which quite a lot will depend. Testing 1.2073 from the bottom up will form another signal to sell EUR/USD, expecting a fall to the new support at 1.2023, where I recommend taking profits. The next target will be the low of 1.1988. If the bears are not active around 1.2126 and we receive good data on production in the eurozone today, then I recommend postponing short positions until the resistance test at 1.2158, where you can immediately sell the pair on a rebound, counting on a downward correction of 15-20 points. The next serious level is at the new local resistance 1.2190.

The Commitment of Traders (COT) report June 1 shows that long positions increased while short positions decreased, which indicates a growth in demand for the European currency in the last month of the second quarter of this year. The European economy is expected to show a particularly strong recovery in the summer, which will lead to new growth for the euro in the area of annual highs. Lifting a number of quarantine restrictions, which are still in effect in European countries, will lead to an even greater revival of the economy, which will provide momentum through an increase in retail sales and inflation, which, according to the latest report, has seriously increased in the eurozone. The data on activity in the manufacturing and service sectors also continue to delight economists, which again indicates a serious recovery. Any strong downward movement of the EUR/USD pair is now perceived by traders as a good opportunity to gain long positions in continuation of the bull market. The dollar can only hope that in the summer, the Federal Reserve will start to seriously talk about reducing the volume of purchases of bonds, but we will know about this only by mid-June. The COT report showed that long non-commercial positions jumped from 236,103 to 237,360, while short non-commercial positions fell from 132,103 to 128,038. This indicates an influx of new buyers that expect the euro to continue rising, while sellers have a wait-and-see attitude. Considering the fact that the pair significantly recovered last Friday, this may indicate the formation of a new upward trend and the return of EUR/USD to local highs. This is where the bulls will continue to accumulate long positions in hopes of going beyond them. This indicates a possible breakthrough of last month's highs in the near future and the continued growth of the euro. The total non-commercial net position rose from 104,000 to 109,322. The weekly closing price also increased from 1.22142 to 1.22326.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates problems for the bulls and its further decline.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Surpassing the lower border of the indicator in the area of 1.2073 will lead to a major downward movement of the euro. Growth will be limited in the area of the upper level of the indicator at 1.2158.

I recommend for review:

I recommend that you familiarize yourself with the COT report and the forecast of the GBPUSD pair for today

The EU-UK wars have been postponed until June 30. ECB meeting

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.