To open long positions on GBP/USD, you need:

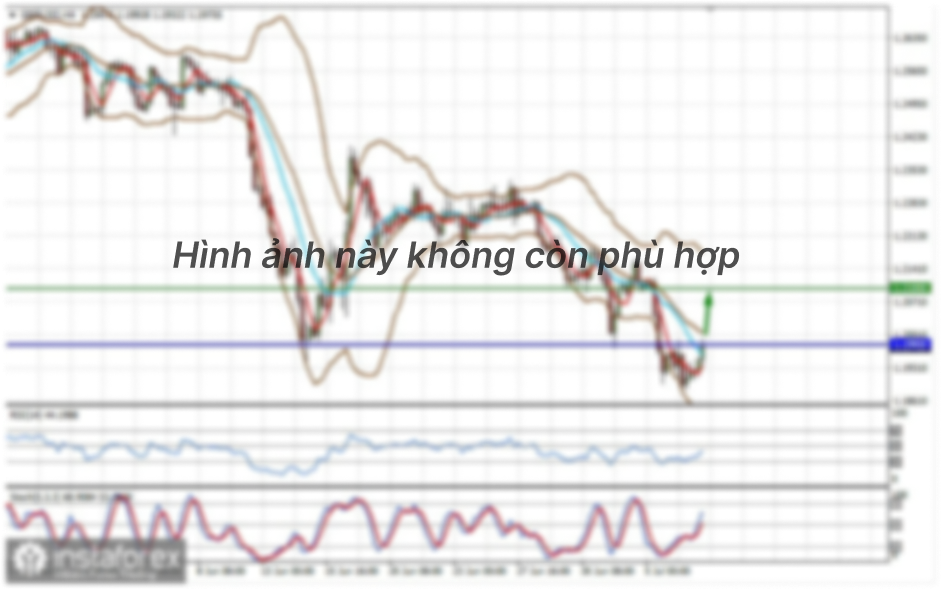

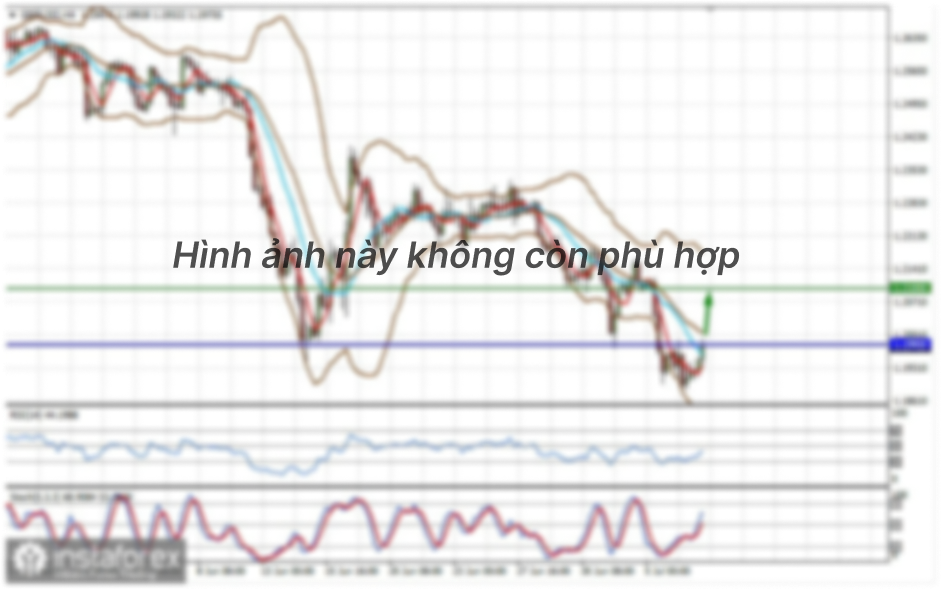

Buyers of the British pound, after the pair rapidly fell in the first half of the day, managed to regain all their positions, which preserves the upward potential. In the second half of the day, several signals were formed for entering the market. Let's take them apart. We see how the absence of bears at 1.2691 led to its breakout and consolidation above, and a repeat test of this area formed a good entry point into long positions, which quickly threw the pound to a high of 1.2722, from which I advised selling on a rebound, which happened. The entry point for selling is clearly visible in the resistance area of 1.2722. At the moment, the pair is stuck in a side channel and the direction of the market will depend on which way the breakout will occur. The bulls need to protect the support of 1.2701, forming a false breakout at this level will be a signal to open long positions to continue the current bull market. An equally important goal is a breakout and consolidating above this week's high of 1.2763, which also forms a signal to buy the pound with continued growth in the area of 1.2809 and 1.2906, where I recommend taking profits. Data on orders in the manufacturing sector, which are released today in the first half of the day, is unlikely to significantly affect the market. If there is no activity in the support area of 1.2701, it is best to postpone long positions until the update of the low of 1.2645 and buy the pound there immediately for a rebound while expecting a correction of 30-40 points within the day.

Let me remind you that the COT report for July 14 indicated that there was an increase in short non-commercial positions from the level of 56,300 to the level of 56,761 during the week. Long non-commercial positions rose from the level of 39,892 to the level of 43,175. As a result, the non-commercial net position decreased its negative value to -13,568, against -16,408, which indicates that the market is still under pressure, but there are fewer and fewer willing to sell.

To open short positions on GBP/USD, you need:

Sellers have a great chance to return to the market, but it takes hard work. First of all, you need to prevent a breakout of the 1.2763 resistance and form a false breakout on it, which will be the first signal to open short positions. The goal of such an entry is support of 1.2701, consolidating below it will only increase the pressure on the pound, which will lead to a complete overlap of yesterday's growth and updating the low of 1.2645, where I recommend taking profits. The long-term goal of sellers is still support for 1.2585. With the growth of GBP/USD above the resistance of 1.2763 in the morning, you can rely on poor reports on the UK economy, but they are unlikely to have a significant impact on the market. If there are no sellers at the 1.2763 level, I advise you to postpone short positions until an update of a high of 1.2809, or sell the pound immediately on the rebound from the resistance of 1.2906, counting on a correction of 30-40 points by the end of the day.

Indicator signals:

Moving averages

Trading is conducted just above the 30 and 50 moving averages, which indicates that the advantage of buyers of the pound remains.

Note: the period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the lower border of the indicator around 1.2690 will increase the pressure on the pair. Breaking the upper limit of the indicator in the area of 1.2763 will lead to a new wave of growth of the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.