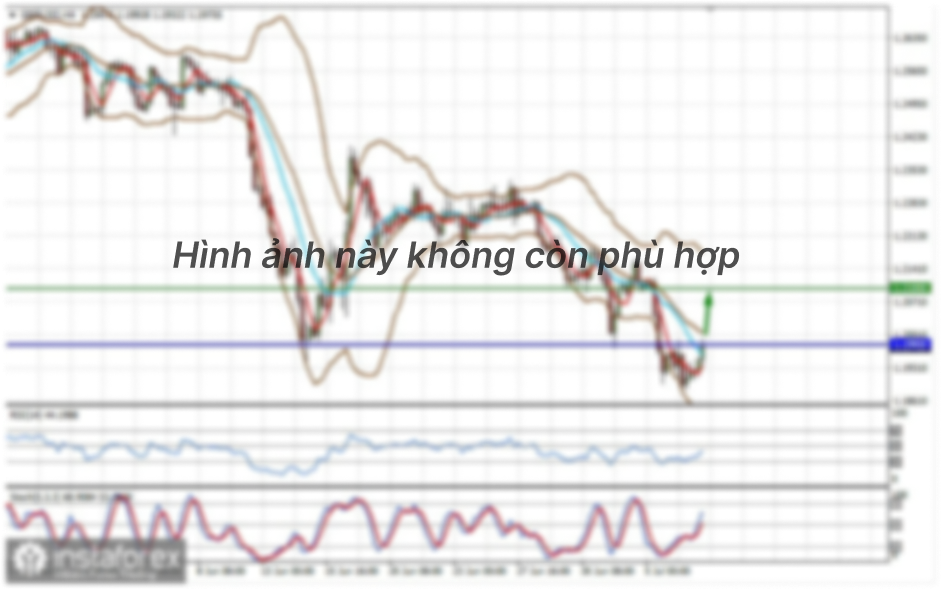

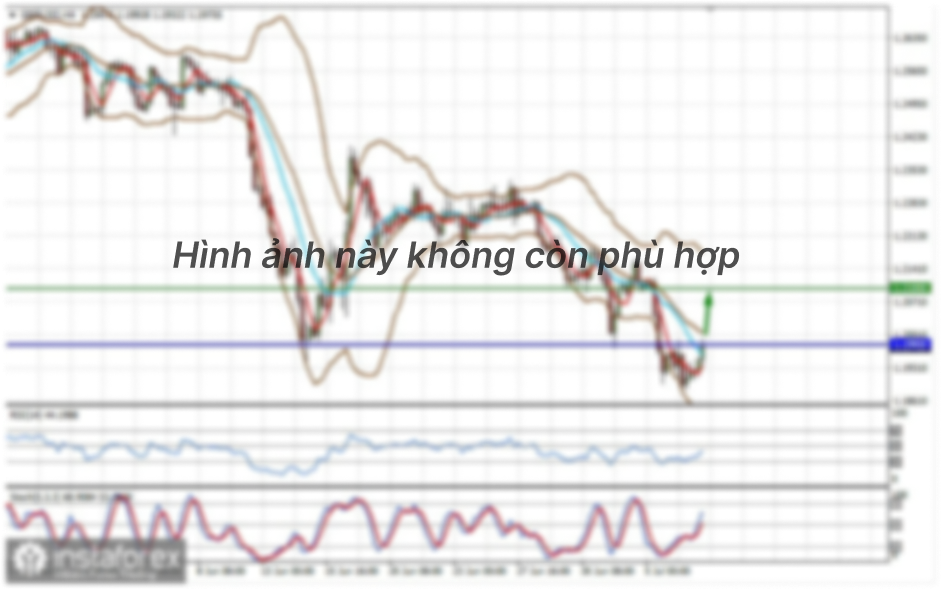

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

CCI: -120.8191

The British pound also started an upward movement on the first trading day of the week, but in this case, we are talking about a correction against the downward trend. The upward movement was quite strong; the pair passed more than 140 points during the day. Since the pair has already got out of the side channel earlier, we continue to consider the option with the continuation of the downward trend as the main one. Therefore, we expect a rebound from the moving average and a resumption of the downward movement with a target of 1.2085 or lower. Most of the macroeconomic publications continue to be ignored by traders, but now the fundamental background is significant for the pair. And it remains not in favor of the British currency. Thus, the pound is again under the pressure of the market.

We have already discussed the general fundamental background many times, even before the "coronavirus" epidemic around the world, which affected the United Kingdom and the United States the most. Before the pandemic, the position of the British pound already looked extremely unattractive due to Brexit, the "hard" policy of Boris Johnson in negotiations with the European Union on agreements that will operate after the completion of the "divorce". The Kingdom's economy was also experiencing much greater problems than, for example, the American one, which was simply suffering from a trade war with China. But with the arrival of the pandemic, the situation has become even worse. And the greatest concern is the lack of trade deals with the EU and the US and the low probability of their signing in the near future. Thus, in the long term, the British pound will continue to remain under the pressure it has been under since 2014 (when the second wave of long-term depreciation of the British pound began).

As for regular macroeconomic statistics, they are now worse in Britain than in many countries also affected by the COVID-2019 pandemic. Of course, there are more confident leaders in the fall of the economy, but the UK is not far from them. The next reports on the state of the economy will be published today. If the unemployment rate for the month of March does not cause serious concerns (it is projected to increase from just 4.0% to 4.4%), then the number of applications submitted by British people for unemployment benefits may jump sharply up. The forecast is +150 thousand new applications in April with the "normal" value of +-25 thousand. Also today, we will publish a report on wages for March with forecasts of +2.6% and +2.7% (with and without bonuses), but we have repeatedly said that these reports are now the least important for market participants.

In the afternoon, there will be a performance of Jerome Powell in Congress. The rhetoric of Powell does not cause any issues. What can the head of the Federal Reserve talk about, if not about the economic shock of the epidemic, the fall of the economy, and the growth of unemployment? In principle, Powell has already spoken just this weekend and has already stated that in the second quarter, the US economy can decline by 20%, and the unemployment rate can grow to 25%. Notably, Jerome Powell's forecasts were higher than those previously provided by the US Department of Labor. The Fed Chairman also said that the US government will have to continue to provide assistance to households for several more months to help them overcome the effects of the economic downturn. In addition, Powell said that Congress and the Fed will need more help for American citizens and workers, and the economy will recover gradually. The main thing that will determine the timing and pace of recovery is the results of the fight against the "coronavirus". This includes developing a vaccine and reducing the number of cases. It is worth adding that according to the latest data, almost 1.5 million cases of the disease and almost 90 thousand deaths were recorded in the States.

Meanwhile, the US has received new accusations against China in the spread of "coronavirus". This time from the Director of the National Trade Council, Peter Navarro. He said: "Let's look at the facts. Correct me if I'm wrong: the virus was born in Wuhan, patient zero was recorded back in November. China hid behind the WHO and hid the virus from the world for two months, and during that time and after, it sent hundreds of thousands of Chinese people on planes to Milan, New York, and around the world to spread it. China could have left it in Wuhan, but it became a pandemic as a result of the inaction of the Chinese authorities. That's why I say that the Chinese have harmed the Americans, and they will be held responsible for it." We will remind that earlier such rhetoric was voiced by Donald Trump and Mike Pompeo, who claimed that there was a huge amount of evidence of the guilt of the Wuhan Institute of Virology and the Chinese authorities, but they have not yet been presented to the public.

If you try to look at the situation as a whole, the pound may even now be fixed above the moving average and strengthen to $ 1.23 or $ 1.24. However, this will almost always be corrective growth. All countries of the world are currently experiencing a huge number of problems. For example, at the end of last week, it also became known that a new package of assistance to the American economy, estimated at 3 trillion dollars, probably will not be provided in the near future. It's all the fault of the feud between Republicans and Democrats. This time, the Republicans almost blocked the initiative of the Democrats to allocate a new tranche of aid, calling it an attempt to promote themselves at the budget expense. Thus, it is often difficult to tell where the situation is worse at this time.

The average volatility of the GBP/USD pair remains stable and is currently 123 points. On Tuesday, May 19, thus, we expect movement within the channel, limited by the levels of 1.2070 and 1.2316. Turning the Heiken Ashi indicator down will indicate the possible completion of the upward correction.

Nearest support levels:

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest resistance levels:

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading recommendations:

The GBP/USD pair started to adjust against the downward trend on the 4-hour timeframe. Thus, it is now recommended to wait for the correction to complete and resume trading downwards with the goals of 1.2146 and 1.2085 if the quotes rebound from the moving average line or in the case of a reversal of the Heiken Ashi indicator down. It is recommended to buy the pound/dollar not before fixing the price above the moving average with the first goals of 1.2329 and 1.2390.