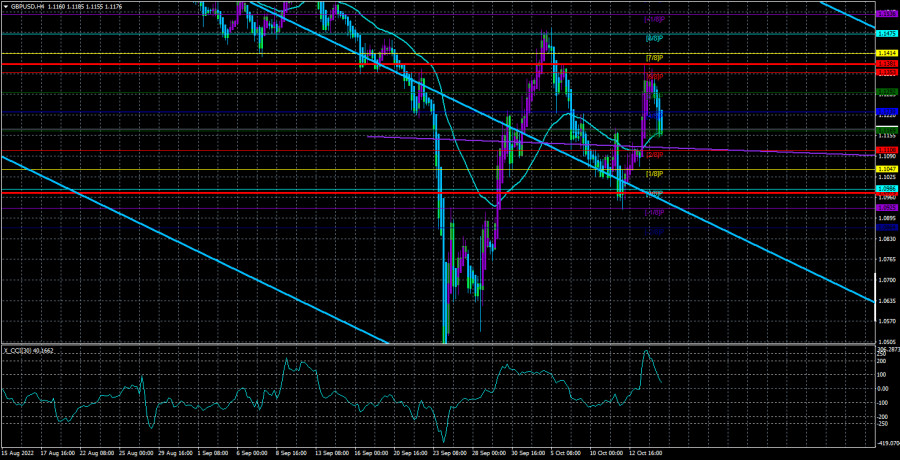

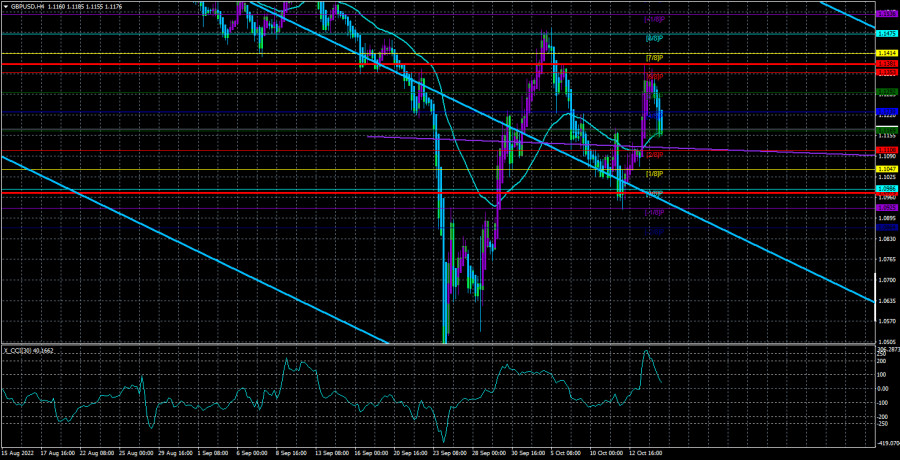

The GBP/USD currency pair was trading down again on Friday, ending the week near the moving average. Now it seems that the entire movement of the pair after its growth by 1100 points is just a calming of the market because we see how each subsequent turn of the movement is smaller than the previous one. Most likely, the price will "settle down" around 1.1100, after which the market will need new grounds for certain movements. Recall that, from a technical point of view, there is a probability of the end of a long–term downward trend since there was a sharp drop in quotes to absolute lows and then a sharp increase. Such "injections" often end strong trends. However, nothing has changed from a geopolitical point of view. From a fundamental point of view, the British pound has become more problematic. Last week, it became known about the resignation of Kwasi Kwarteng, the British Finance minister, who had been in his position for a little more than a month. Such high-profile layoffs against the background of a new tax reduction plan do not add calmness to buyers of the British pound.

The government of Liz Truss is under the strongest pressure. If her geopolitical worldviews in the UK do not bother anyone, then her ability to stabilize the economy and the financial sector raises concerns. Recall that her main opponent in the fight for the prime minister's chair was Rishi Sunak, the former head of the Treasury. He is a talented economist and probably would have handled the economy much better than Truss. But the problem was that Sunak was not experienced in international politics and did not enjoy strong support among the British themselves. It does not matter what Sunak would do as the head of state. A vote of no confidence in Liz Truss may be "launched" but is unlikely to be announced. Most likely, in this way, parliamentarians make it clear to Truss that her plans to reduce taxes, which will inevitably lead to a huge budget deficit and have already led to the collapse of the pound and the debt market, are unacceptable.

Apart from the inflation report, Britain will have no interesting events.

There will be frankly few macroeconomic statistics this week. The week's most important report is British inflation, which fell from 10.1% to 9.9% last month. This is not surprising since the Bank of England has already raised the rate seven times in a row. At the same time, we draw attention to the fact that the BA rate remains below the Fed rate. And in America, inflation slowed down by less than 1% of the maximum value, which is considered its mission accomplished. Therefore, most likely, inflation in the UK will not show a serious slowdown in the near future, which means that the regulator will continue to tighten monetary policy. At the same time, we are already talking about aggressive tightening and not a formal increase in the rate by 0.25-0.5%. However, this is still a very weak consolation for the British pound, which is unlikely to lead to its strong strengthening. Traders are much more attentive to the actions of the Fed than the BA or the ECB. Therefore, by and large, the inflation report will not change anything for the pound. We may see a strong market reaction to this report, but at the same time, it will not affect the balance of power dramatically. Also, on Friday, a report on retail sales will be published in Britain.

Reports on industrial production, the real estate market, and applications for unemployment benefits will be published in the States this week, and several speeches by members of the Fed monetary committee will also take place. All three reports cannot be considered important; their market reaction will likely be weak. As for the speeches of Bowman, Bullard, Jefferson, and others, their rhetoric is now unambiguous – an aggressive rate hike until inflation begins to slow down significantly. Therefore, the pound remains in a twofold situation when technology allows its medium-term growth, but the foundation and macroeconomics continue to support the dollar.

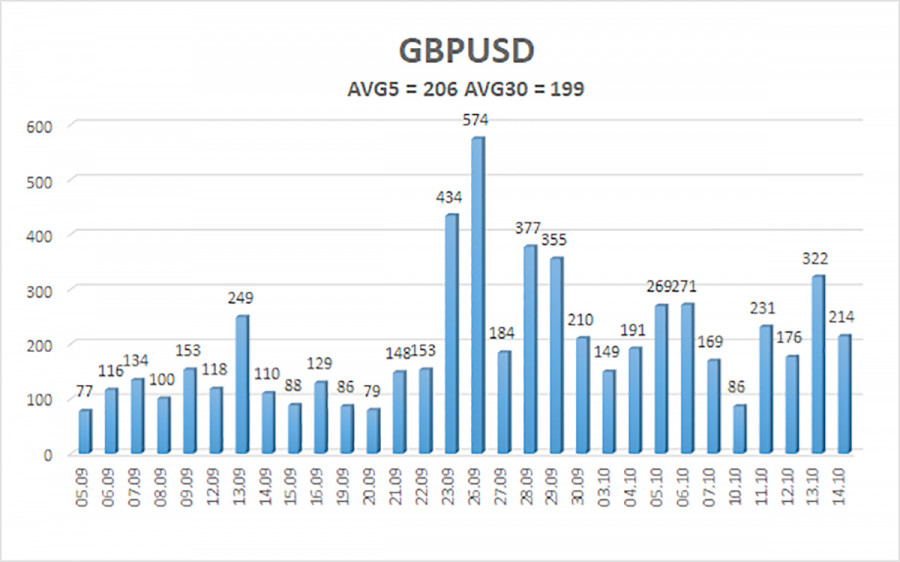

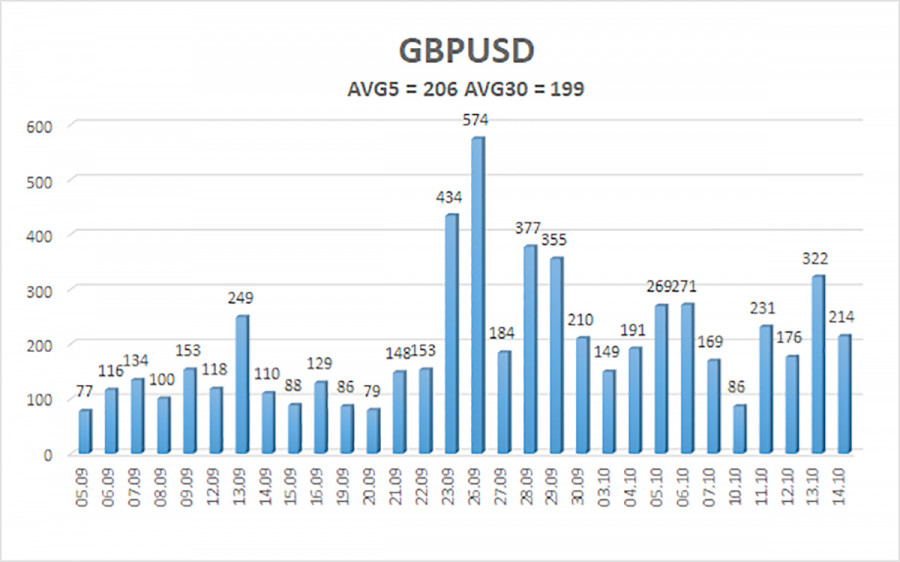

The average volatility of the GBP/USD pair over the last five trading days is 206 points. For the pound/dollar pair, this value is "very high." On Monday, October 17, thus, we expect movement inside the channel, limited by the levels of 1.0975 and 1.1381. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.1169

S2 – 1.1108

S3 – 1.1047

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1292

R3 – 1.1353

Trading Recommendations:

The GBP/USD pair has started a new round of correction in the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.1292 and 1.1353 should be considered in the event of a price rebound from the moving average line. Open sell orders should be fixed below the moving average with targets of 1.1047 and 1.0986.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.