On Monday, the EUR/USD currency pair continued to trade in the same side channel 1.0132-1.0254 as in the last four weeks. As it often happens, Monday turned out to be a very boring day in terms of macroeconomics or foundations. Traders had nothing to pay attention to during the day, but the absence of important events and publications was not the main reason for maintaining the flat for the euro/dollar pair. Over the past month, plenty of important reports and events were able to influence the mood of the market so that it brought the pair out of the flat. However, this did not happen, and the European currency remains close to its 20-year lows. By and large, it was able to move away from them by only 300 points, which is very little to consider the movement of the last month and a half as the beginning of a new upward trend. Thus, the market is now just in a state of expectation. At the same time, it is not even waiting for the next important event (for example, a report on American inflation). It is waiting for a player or players whose nerves will break first, and they will open large deals, leading to the exit of quotes from the side channel. As we have already said, the flat often ends exactly when no one expects it.

The Fed meeting took place only a week and a half ago, but the markets are already discussing, you know what? The next Fed meeting will be held in September, and how much the rate will be raised at it. From our point of view, this is already some paranoia. Although the market closely follows the American statistics, it does not attempt to trade outside the side channel. Of course, all the data received in recent weeks will not be wasted. Sooner or later, the flat will end, and the market will remember the Nonfarm Payrolls report, unemployment, GDP, inflation, and everything else. Another question is how it interprets it if some reports openly contradict each other.

Everything will depend on inflation, but the Fed is still tough.

And all because last week ended with the speeches of several members of the Fed, and the new week began with the speeches of several more functionaries. And what else could the members of the Board of Governors comment on? Only future measures counteract inflation. Moreover, this time opinions were divided into two camps. For example, Mary Daly and Michelle Bowman said they supported a 0.5% rate hike. James Bullard, of course, supports the most "hawkish" option of all available. Rafael Bostic is ready to support 0.75%. One very important point should be understood here. What the Fed monetary committee members are saying now, by and large, does not matter much. This Wednesday, the July US inflation report will be published, and it will be the starting point for the Fed's September meeting. The mood of the Governing Council will entirely depend on what inflation figures they will see in August and September. If both reports show a significant slowdown in price growth, then at the September meeting of the Fed, we can expect a slowdown in the pace of monetary policy tightening. If only one report shows a slowdown or none, then we are almost sure that the rate will rise again by 0.75%.

The most interesting thing is that it doesn't matter how much the rate will rise this time for the US dollar. An increase of 0.5% or 0.75% is an aggressive tightening of monetary policy. Moreover, if earlier traders could put a final rate of about 3.5% in the dollar exchange rate, now the figure of 4.0% sounds more and more often from the sidelines of the Fed as a possible value to which the rate will have to be raised so that inflation returns to the target value. Recall that a few weeks ago, we already started talking about the fact that 3.5% is not enough to curb inflation. Thus, the fundamental background for the euro/dollar pair has not changed and remains negative. The Fed may raise the rate to 4% or even higher because, again, inflation is not responding to all the regulator's efforts.

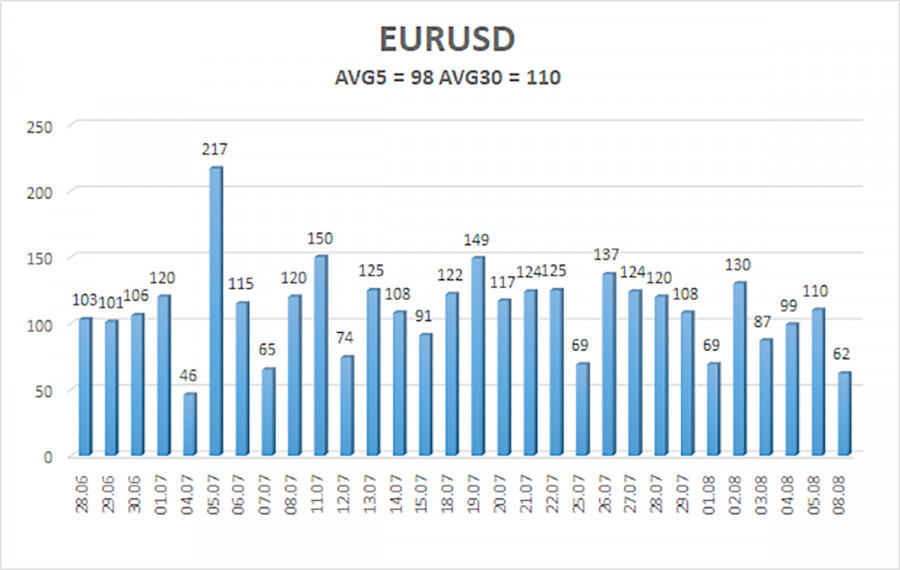

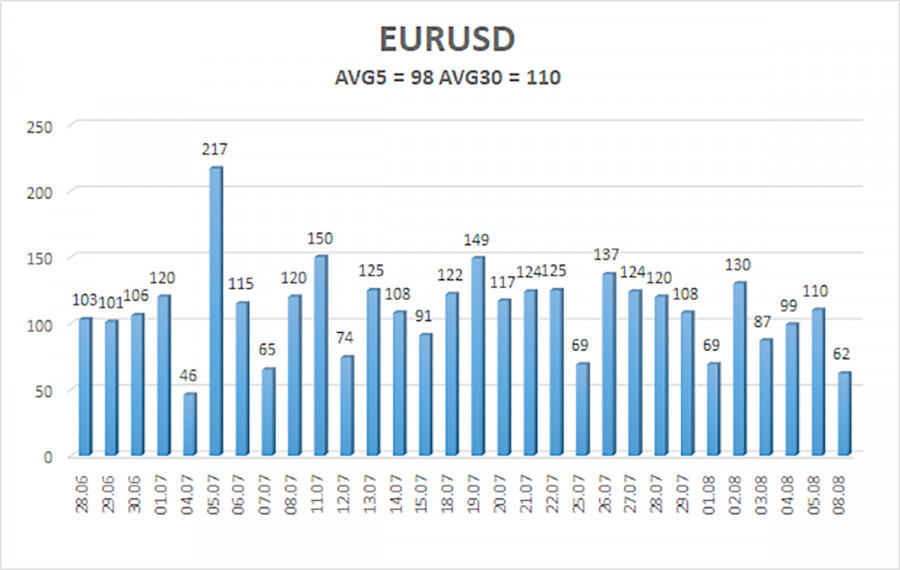

The average volatility of the euro/dollar currency pair over the last 5 trading days as of August 9 is 98 points and is characterized as "high." Thus, we expect the pair to move today between 1.0116 and 1.0311. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement within the flat.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading recommendations:

The EUR/USD pair has been moving in an absolute flat for a month. Thus, it is now possible to trade on the reversals of the Heiken Ashi indicator between the levels of 1.0132 and 1.0254 until the price leaves this channel.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.