The EUR/USD currency pair showed "crazy" volatility of 33 points on Friday. Needless to say, it's not even a flat, this pair has been standing in one place all day, not moving from it. Although there was, in fact, no trading on Friday, the euro/dollar continues to be located below the moving average line, maintaining an almost unambiguous downward trend. We have already said that last week the pair managed to update its 15-month lows and remain near them. That is, no rebound from these price values, a quick pullback or correction has begun. Bears systematically push the pair down. And ahead is the level of 1.0636, which is a 5-year low. So unexpectedly, the euro currency, which was just correcting against the dollar 6-8 months ago and was preparing to resume the global uptrend, now does not know how to resist a new fall, which brings it closer and closer to price parity with the US currency.

By and large, there is simply nothing new to say now. On Friday, nothing was interesting either in macroeconomic terms, geopolitical terms, or fundamental terms. A single report on industrial production in the United States did not affect the pair's movement. Thus, nothing has changed for the euro and the dollar, although last week there was one surge of emotion among the bulls, when the pair suddenly rose by 120 points, although there was no reason for this. However, the very next day it returned to its original position, so you can forget about this round of growth. The technical picture clearly shows that both linear regression channels are directed downwards, as is the moving average line. Therefore, now there is no reason to expect the growth of the European currency. The maximum is a technical correction or rollback.

The euro currency has no place to wait for help and support.

The market is now practically not paying attention to macroeconomic reports. It should be understood that one single report, even an important one, cannot change the direction of the whole trend. Rather, we should consider the entire macroeconomic background as a whole. And what do we get? The EU economy is much weaker than the US economy if you look at the GDP reports. Inflation in the EU is almost as high as in the US, but the ECB has nothing to fight it with since any tightening of monetary policy will lead to an even greater slowdown in the economy. That is, it turns out that the macroeconomic background now supports the dollar. As well as geopolitical and fundamental.

In the new week, several secondary reports will be published in the European Union, which may provoke a surge of emotions among traders (small), but are unlikely to affect even intraday movements cardinally. There are no important events scheduled for Monday and Tuesday in the European Union. On Wednesday, a report on industrial production. On Thursday - the final inflation value for March. On Friday, the indices of business activity in the fields of production and services for April. Does anyone think that in the current circumstances, business activity indices can greatly affect the mood of the market? The important inflation report is no longer such because this is the second estimate for March and the market is already ready for 7.5% y/y. It turns out that the most important event of the week will be the speech of ECB President Christine Lagarde, which will take place on Friday. And what can Lagarde say at this time? Only the fact that the European economy is too weak, there is no threat of stagflation, the military conflict in Ukraine creates risks for the European economy, rising oil and gas prices pull up prices for goods and services in the EU, disruption of logistics chains leads to shortages and price increases. Traders have heard all this more than once and all this is unlikely to support the euro in any way. Thus, in the best case, the euro currency can count on a technical correction this week. However, given the fact that traders have just broken through the last local minimum, most likely, the fall will continue.

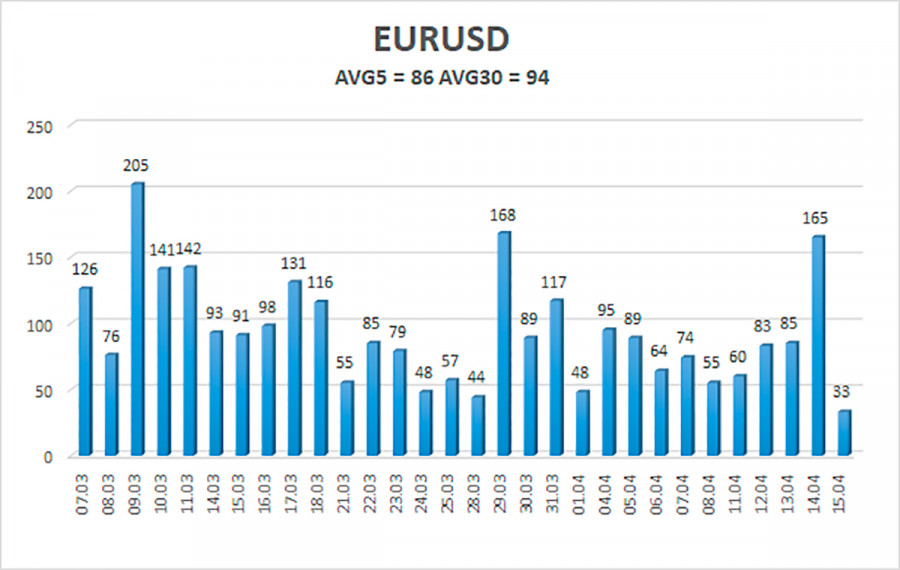

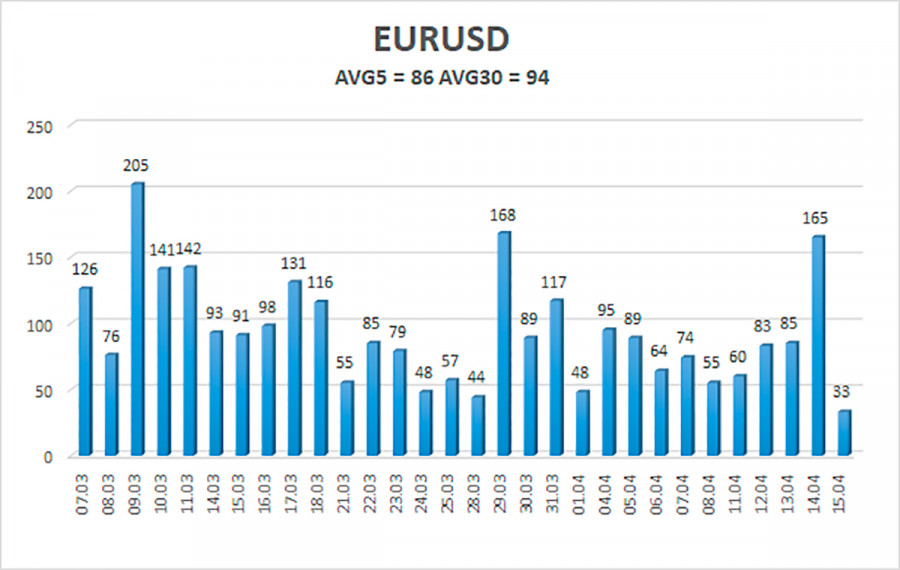

The volatility of the euro/dollar currency pair as of April 18 is 86 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0728 and 1.0900. The upward reversal of the Heiken Ashi indicator will signal a new round of upward correction.

Nearest support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now it is necessary to stay in short positions with targets of 1.0742 and 1.0728 until the Heiken Ashi indicator turns upwards. Long positions should be opened with a target of 1.0986 if the pair is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.