The EUR/USD currency pair again did not show a strong and trending movement on Tuesday. It failed to overcome the level of Murray "1/8" - 1.0864, so a new round of upward correction to the moving average line began. As we expected a day earlier, the report on American inflation provoked a surge of emotions in the foreign exchange market, but at the same time, the market reaction was not entirely logical - the US dollar fell by 50 points in half an hour. However, this reaction of traders did not affect the current technical picture in any way. The pair is still located below the moving average, and both linear regression channels are directed downwards. Therefore, the trend remains unambiguously downward at this time. However, to draw such a conclusion, it was possible not to wait for Tuesday, it has been clear for a long time. And even the report on American inflation, after which the dollar fell in price, does not change anything. The euro currency can hover for a long time around the zone of its lows near the levels of 1.0806 and 1.0864, the bulls do not have more strength and desire from this. The fundamental and geopolitical backgrounds remain very challenging for the euro. In other words, traders now find no reason to buy the currency of the European Union, which is on the verge of an energy and food crisis. But in the States, everything is relatively calm. The geopolitical conflict in Ukraine practically does not affect them, and they have the opportunity to work against high inflation. Thus, the ECB will continue to take an ultra-soft position, and the Fed is already 100% likely to raise rates at a high pace in 2022.

The consumer price index rose to 8.5% in March.

The most important event of the last day was the inflation report. This indicator accelerated in March to 8.5% y/y, justifying the most pessimistic forecasts. Core inflation increased by 6.5% y/y. And although the Fed pays more attention to core inflation (excluding food and energy prices), there is not much difference between these indicators now. 6.5% is as high as 8.5%. Both indicators continue to grow and it is unclear to what heights they will reach before they begin to decline. It is difficult to say why the US dollar fell after the publication of this report. This market reaction cannot be called logical, since the higher the inflation, the higher the chances of a faster and more aggressive tightening of monetary policy, which in itself is a "bullish" factor for the dollar. However, in the last article, we warned that an increase in inflation does not necessarily have to provoke a rise in the dollar. It turns out a picture in which the dollar declined, but the overall market mood remained "bearish" (in relation to the euro/dollar pair), so the US currency may continue to grow in the medium term. It's a bit confusing, but that's how it is.

Separately, I would like to say a few words about geopolitics. Yesterday began with a report that Russian troops could use chemical weapons in Mariupol. Initially, it was assumed that a bomb with a toxic substance was dropped from a UAV at the position of the Ukrainian AZOV. It was assumed that we were talking about sarin gas or zaman. However, as it turned out a little later, either this bomb was dropped completely wrong where the Ukrainian military was located, or there was no zaman and sarin there, but not a single person was injured by the blow. Only a few people complained of mild malaise. Thus, so far it cannot be said that the Kremlin has used chemical weapons in Ukraine, although there have already been a couple of precedents. NATO and Western countries continue to warn Moscow that the use of chemicals or any other prohibited weapons will lead to new sanctions. However, it seems that the only thing to be afraid of in the Kremlin is an oil and gas embargo from the European Union. Although now there are also reports that in the event of its introduction, China and India will buy energy carriers if Moscow provides a discount. In general, it is completely unclear how the confrontation between the West and the Russian Federation will end. It is unclear when the conflict between Ukraine and Russia will end. Well, until that happens, the euro currency has a much more favorable ground for falling than for growth.

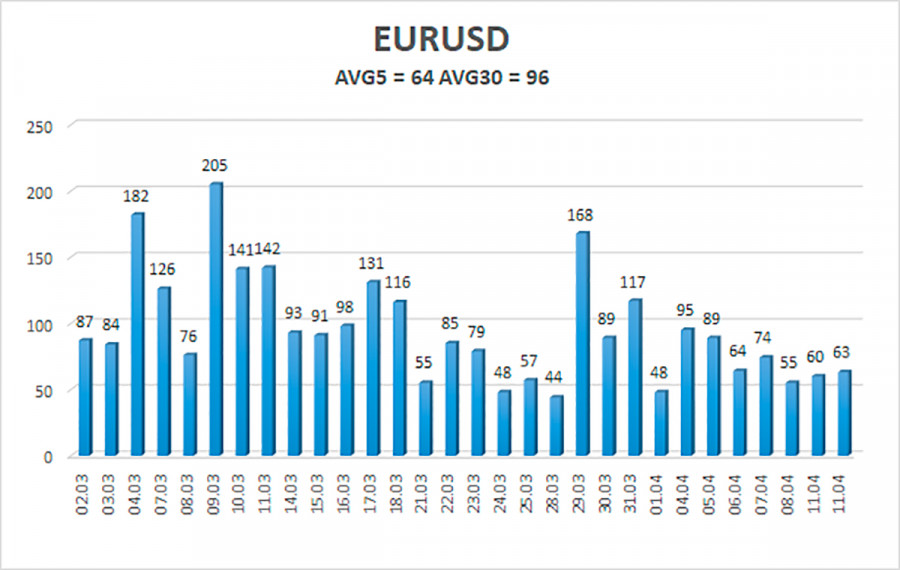

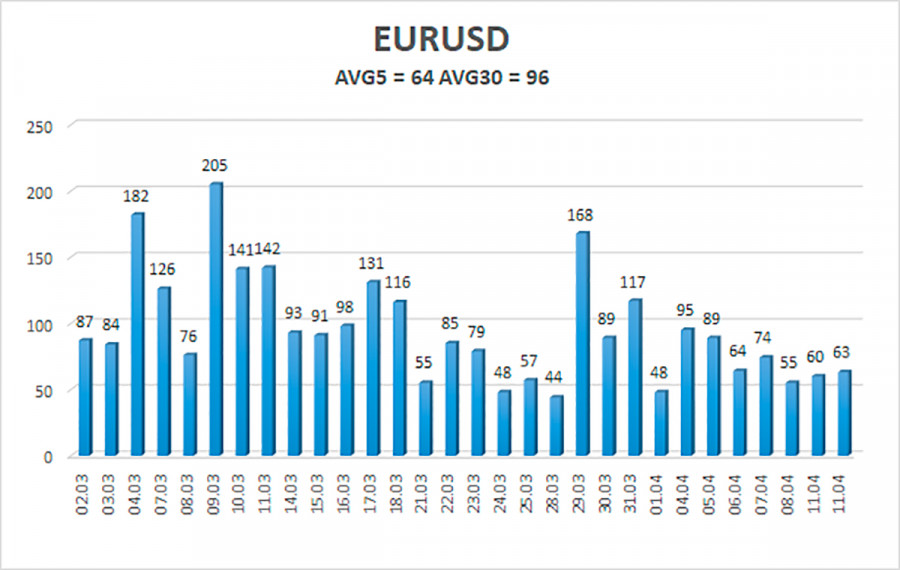

The volatility of the euro/dollar currency pair as of April 13 is 64 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0788 and 1.0916. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now we should consider new short positions with targets of 1.0804 and 1.0742 after the reversal of the Heiken Ashi indicator down. Long positions should be opened with a target of 1.0986 if the pair is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.