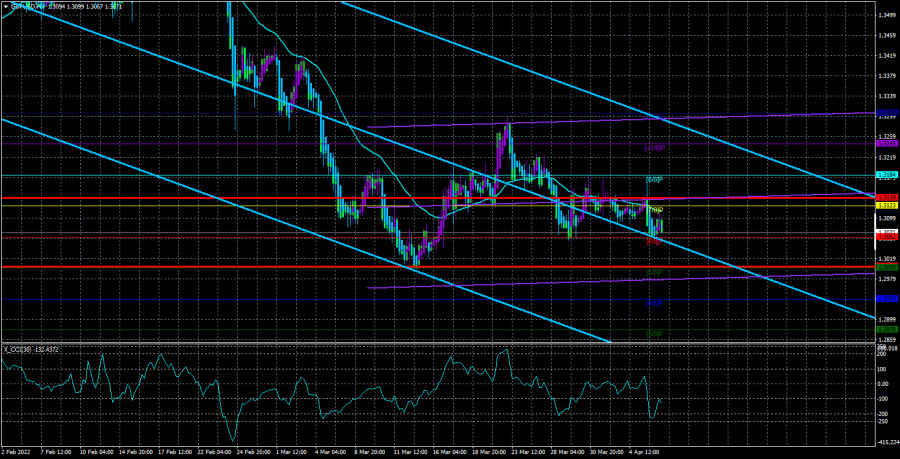

The GBP/USD currency pair on Wednesday fell to the Murray level of "6/8" - 1.3062 and even rebounded from it, starting a weak upward pullback. Both major currency pairs have been moving almost identically in the last couple of days. This suggests that the reasons for this movement lie in the United States or Ukraine. The pound continues to remain near its 15-month lows and may soon update them. As in the case of the European currency, there are practically no factors that speak in favor of the growth of the British pound. More precisely, there is, but only one. The Bank of England, which is also going to continue to raise its key rate in 2022, as well as the Fed. That is why the pound may show a slower decline against the dollar than the euro. But practically none of the experts doubts that it will be a fall.

The pound has spent the last two weeks in a very limited price range. We can say that a flat was observed on it. However, the junior linear regression channel is also turning down at this time, and all other trend indicators are already pointing down. Yesterday, we wondered why the pound and the euro collapsed synchronously on Tuesday, given that the ISM business activity index could hardly provoke such a movement. A little later, it became clear what exactly provoked this movement. The fact is that there were speeches by several members of the Fed, who significantly tightened their rhetoric regarding monetary policy. If earlier representatives of the Fed actively talked about the need to increase the pace of rate hikes and bring it to a neutral level as quickly as possible, now we are talking about the fastest possible sale of mortgage and treasury bonds from the Fed's balance sheet, which is an "anti-QE" program. The chairman of the Federal Reserve Bank of Minneapolis, Lael Brainard, said that the sale of bonds could begin as early as May, although later dates were previously called. All this suggests that the tightening of monetary policy in 2022 will be rapid. And this prediction is very easy to believe. The American economy is on the move, its growth rates are much higher than the British or European ones, the labor market is strong, and inflation is high. What else is needed to raise the rate and unload the Fed's balance sheet?

The increase in the yield of treasuries + the increase in the cost of gas = the growth of the dollar.

Naturally, the above news supports the US currency. In addition, the yield of ten-year American treasuries has already exceeded 2.6%. This makes them a banal attractive investment tool. And also very safe. And with an increase in the key rate, the yield will only grow. Accordingly, money will flow into the US debt market, and to purchase bonds, dollars are needed. The demand for the dollar will also continue to grow. And at the same time, gas continues to grow. Since there is no single price for this natural fuel and it costs differently at different hubs, then we have to take a certain average price. It currently amounts to $ 1200-1300 per 1000 cubic meters. This is about five times higher than Europe currently pays for gas supplies from Russia. However, if Europe refuses Russian gas, it will have to buy it elsewhere. In particular, the United States has already assured the European Union of its readiness to provide them with 100% gas. Who will benefit if the EU and Russia break their gas contracts? As usual, the States will receive a lot of money for selling gas to Europe. Naturally, this will further strengthen its economy, respectively, and the US dollar. As for the British pound, the UK economy is now more independent than the European one. Britain has its oil and gas and no longer needs to take into account the interests of 27 EU member states at once. Therefore, one could even conclude that the pound sterling would not have fallen if there had not been such a high demand for the dollar. But demand for the pound is also falling, according to COT reports, so the British currency is likely to continue its decline in 2022.

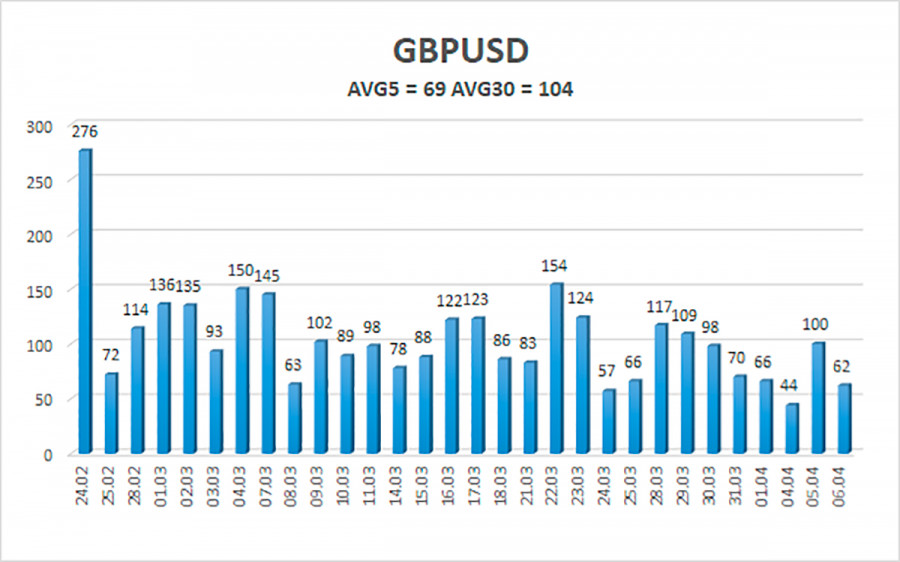

The average volatility of the GBP/USD pair is currently 69 points per day. For the pound/dollar pair, this value is "average". On Thursday, April 7, therefore, we expect movement inside the channel, limited by the levels of 1.3001 and 1.3139. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement, but the pair needs to gain a foothold below 1.3062 to continue falling.

Nearest support levels:

S1 – 1.3062

S2 – 1.3000

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3123

R2 – 1.3184

R3 – 1.3245

Trading recommendations:

The GBP/USD pair continues its downward movement in the 4-hour timeframe. Thus, at this time, sell orders with targets of 1.3000 and 1.2939 should be considered if the pair is fixed below 1.3062. It will be possible to consider long positions no earlier than fixing the price above the moving average line with targets of 1.3184 and 1.3245. At this time, the probability of a flat is high.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.