The GBP/USD currency pair continued to stand in one place on Tuesday. If the European currency continues to fall, then the pound sterling has frozen around the 31st level and is not moving in any direction. From our point of view, the recent price changes in the euro currency are because already today the European Union may introduce a new package of sanctions against the Russian Federation, which, of course, will affect its economy, which is now far from its best condition. The British pound does not suffer from this news, since the UK has already imposed all the sanctions against the Russian Federation that could only be imagined. Therefore, the British government may not be able to further worsen the situation with the currency, but the general geopolitical situation continues to force traders and investors to flee to the most stable currency. And that currency is the dollar, not the euro or the pound. More precisely, the pound is not one. We have seen from the latest COT reports that major players are actively buying euros at this time. And at the same time, the euro is falling. It is falling because the demand for the dollar is even higher. But the demand for the pound, according to COT reports, continues to decline, so the fall of the pound just does not raise any questions.

However, the British currency is also very close to its 15-month lows. And given the fact that new purchases of the British pound still do not begin, and the conflict in Ukraine may drag on for many months and even years, we are inclined to the point of view that the pound will also resume falling. Perhaps not as strong as the euro, but still falling. At the same time, it cannot be said that the energy or food crisis will not affect the UK. The country has already seen a strong increase in prices for gasoline, electricity, and heating. The more energy prices rise, the more prices rise for almost everything in the country. Of course, the UK has already refused to buy oil and gas in Russia, but it will still buy it, just in other places. Therefore, at new prices. Of course, the British are not poor people. For example, according to the IMF and the World Bank, in terms of GDP per capita, Britain is ranked 25th and 24th in the world, respectively. Russia in these ratings is on 51 and 47 places with values 1.5 times lower. Thus, the British will survive an increase in the cost of fuel or heating even twice. However, in any case, we are talking about the deterioration of the economic situation. Why, if the economy is falling in Russia, does this lead to a fall in the ruble, and in the UK it should not?

Andrew Bailey predicts an "energy shock" to the country.

The head of the Bank of England, Andrew Bailey, also understands the danger of the situation. He said last week that the UK is facing a severe energy shock, a rising cost of living, and high inflation. This is the payment for sanctions, the conflict with Russia, in which the UK occupies one of the leading roles. Thus, the British pound now also has no special reason for growth. Especially against the dollar. The Bank of England has just started raising the key rate, which means there is no need to stimulate the economy. But if the economy falls into recession, it will have to be stimulated anew. And monetary policy should be softened again. Any easing is potentially a blow to the national currency. But in the States everything is fine. Their economy is practically not affected, on the contrary, it can only benefit if America starts supplying LNG to Europe and the UK instead of Russia.

At the same time, British Foreign Minister Liz Truss called on the allied countries to introduce a new package of sanctions against Russia after it became known about the war crimes of the Russian military in the Kyiv region. The Kremlin, of course, made an official statement that the killings of civilians are fakes, and when the Russian military left Kyiv, there were no bodies. However, satellite images published just the other day clearly show that during the period when the region was under Russian control, the bodies of the killed civilians were already on the streets. Russia demanded an emergency meeting of the UN Security Council to provide evidence that the Russian military was not involved in these murders, but the UK blocked this demand.

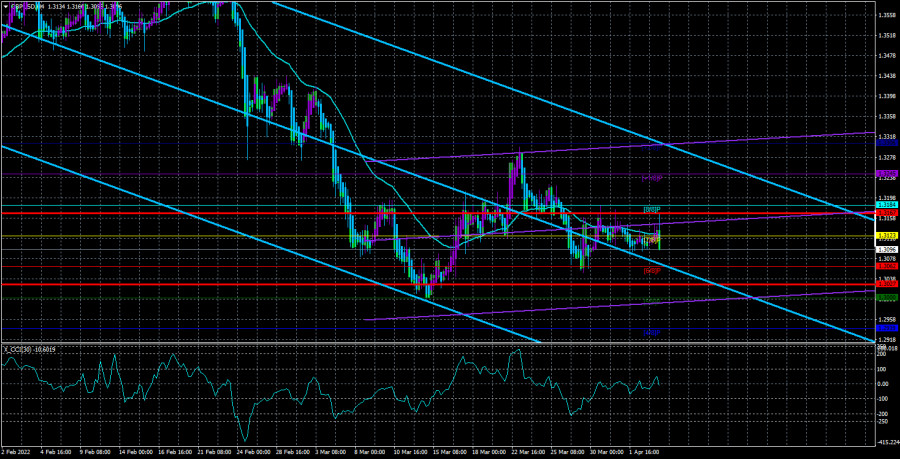

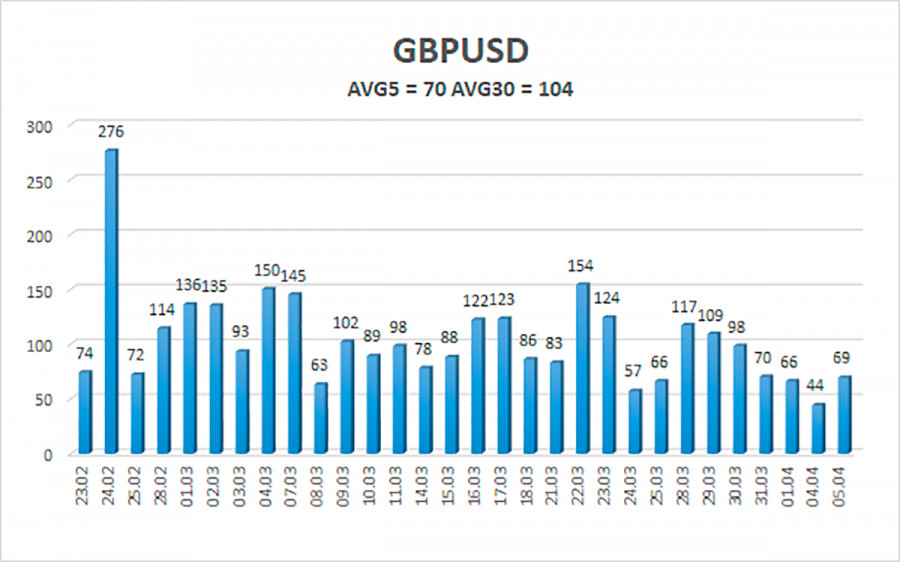

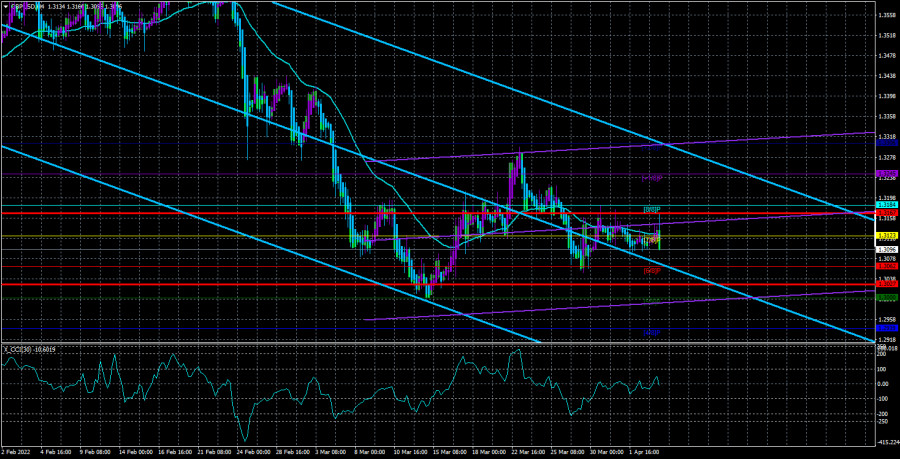

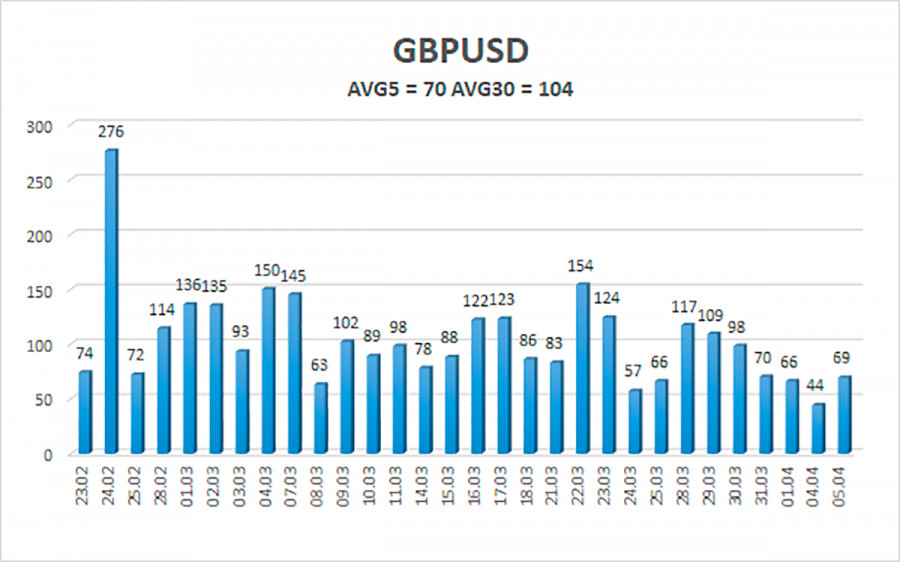

The average volatility of the GBP/USD pair is currently 70 points per day. For the pound/dollar pair, this value is "average". On Wednesday, April 6, thus, we expect movement inside the channel, limited by the levels of 1.3027 and 1.3167. A reversal of the Heiken Ashi indicator upwards will signal a round of upward movement inside the flat.

Nearest support levels:

S1 – 1.3062

S2 – 1.3000

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3123

R2 – 1.3184

R3 – 1.3245

Trading recommendations:

The GBP/USD pair has started a new round of downward movement in the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.3062 and 1.3027 until the Heiken Ashi indicator turns up. It will be possible to consider long positions no earlier than fixing the price above the moving average line with targets of 1.3167 and 1.3184. At this time, the probability of a flat is high.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.