GBP/USD 5M

The GBP/USD currency pair traded very poorly on Monday. However, what is there to be surprised about? The macroeconomic background was absent yesterday, as well as the fundamental one. After the overactive previous week, traders needed to take a break for at least a day. All this eventually resulted in an absolute flat during the first trading day of the week. Moreover, at the European trading session, there were even some attempts to form an intraday trend. But these attempts quickly came to naught, and at the US trading session we observed a flat in all its glory. However, there was no such serious problem as for the euro/dollar. Although a flat was observed most of the day, it was still not as "hard" as in the euro currency. However, in any case, the British currency did not show anything interesting during the day, and the volatility was about 60 points.

As for trading signals. There were only three of them during the day, which is very good for a flat day with low volatility. First, at the end of the European trading session, the price overcame the Kijun-sen and Senkou Span B lines and fell to the extreme level of 1.3489. A perfect rebound followed from this level, after which the pair grew back to the lines of the Ichimoku indicator, and then settled above them. As a result, traders first had to open a short position, and a long one on the rebound from the level of 1.3489. We cannot say that these two deals would have earned a lot, but both could have been closed at a minimum profit of 10-15 points. And what else to expect if the volatility is "at zero"?

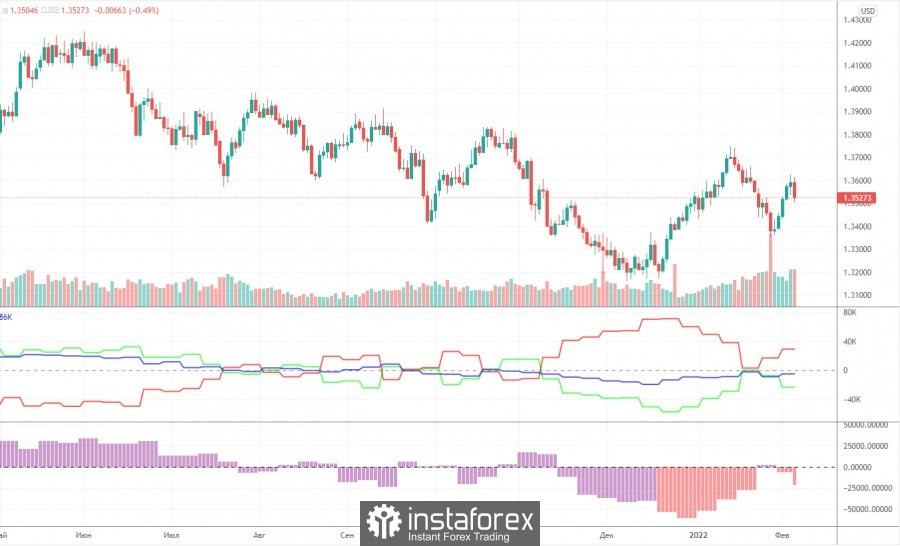

COT report:

We would call the latest Commitment of Traders (COT) report on the British pound very strange. Professional "non-commercial" traders increased their short positions during the last reporting week, which led to a new drop in their net position. Now the green line is again below the zero level, which signals the bearish mood of non-commercial traders. At the same time, in December 2021, the green and red lines of the first indicator moved far away from each other, and therefore began to move towards each other, which signals the end of the trend. Thus, now there is also reason to assume that a new, upward trend in the pound has begun. However, the major players are not in a hurry to stock up on the British currency yet, therefore, from the point of view of COT reports, the new upward trend is not entirely unambiguous. It is quite possible that the pound will still try to fall again to the level of 1.3163 before starting a new trend. Here, of course, you need to turn to technical analysis, which visualizes everything that is happening in the foreign exchange market. The situation with COT reports is not clear now, so caution is needed when making trading decisions.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. February 8. Christine Lagarde still refuses to acknowledge the problem of high inflation.

Overview of the GBP/USD pair. February 8. Boris Johnson has decided to purge the ranks in order to avoid a looming vote of no confidence.

Forecast and trading signals for EUR/USD on February 8. Detailed analysis of the movement of the pair and trading transactions.

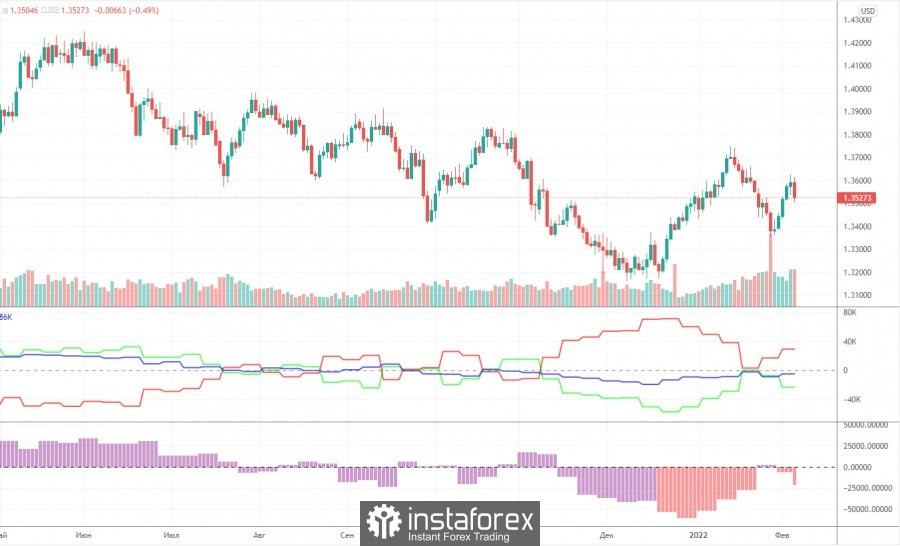

GBP/USD 1H

On the hourly timeframe, the pound/dollar pair has consolidated below the weak upward trend line, but it has not yet been able to continue moving below the Senkou Span B line. Thus, the pound/dollar pair still retains a good chance of resuming growth at the current TF. The question is different: will the bulls find grounds for new long positions if the most interesting report of the week – on US inflation - is scheduled for Thursday, and no other really important events are planned for this week? We highlight the following important levels on February 8: 1.3439, 1.3489, 1.3550, 1.3586, 1.3614. The Senkou Span B (1.3510) and Kijun-sen (1.3548) lines can also be signal sources. Signals can be "bounces" and "breakthroughs" of these levels and lines. It is recommended to set the Stop Loss level to breakeven when the price passes in the right direction by 20 points. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. No important events are scheduled for either the UK or the US on Tuesday. Therefore, the flat may persist, as well as weak volatility. There's nothing you can do about it. Let's hope that the market will find a desire to trade actively due to technical factors, but if there are signs of a flat today, you can even decide not to enter the market during the day.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.