The GBP/USD currency pair continued to remain in an upward trend on Wednesday. For several weeks in a row, the British pound has been getting more expensive against the dollar, raising some questions about the fundamentals. However, we have already said that there are no fundamental reasons for the growth of the British currency now. There are only technical reasons, which are bounces from the Murray level of "0/8" - 1.3184 on the 4-hour timeframe, as well as from the 38.2% Fibonacci level on the 24-hour timeframe. Thus, at this time, the pound/dollar pair continues to be located above the moving average line, and the lower channel of linear regression has long been directed upwards. Based on this, we could conclude that the pair could continue to move up if it were not for the corrective status of the current movement. After all, the pair is now being adjusted against the previous drop by 700 points. Recall that a few weeks ago, we warned that we were waiting for an upward movement of 400-500 points. Why is perfectly visible on the 24-hour TF, because all the movement of the pair last year is constant and deep corrections against the main movement, which is also corrective against the trend of 2020. Thus, we believe that purchases remain appropriate now, but right now, there are few grounds for further growth of the pound. It can continue to grow only in one case: if the majority of market participants have already played the factor of tightening the Fed's monetary policy, thanks to which the dollar showed steady growth in the second half of 2021. However, it will not be possible to predict whether this is the case, for obvious reasons. Therefore, we need to continue paying increased attention to technical analysis.

The political ratings of Boris Johnson and the Conservatives continue to fall into the abyss.

Throughout the entire period of Boris Johnson's rule, we have repeatedly raised this topic. In principle, the British Prime Minister almost from the first day in the office began to give reasons to talk about his early resignation or a vote of no confidence. Recall that at the very beginning, Johnson simply blocked the work of Parliament so that it would not interfere with him to implement a "hard" Brexit, substituting the Queen of Great Britain along the way, who approved the shutdown of Parliament at Johnson's request. This was followed by several different dark stories, scandals involving Boris Johnson, as well as the government's failed actions at the beginning of the coronavirus pandemic. Johnson was publicly criticized by his retired chief adviser Dominic Cummings, and there is nothing to say about the opposition. In the past few months, it has become clear that one of the members of the government participated in various schemes to promote his financial interests, and Johnson publicly defended him. The story of the government Christmas parties the year before last also surfaced, when the whole country was in a "hard lockdown", and people were forbidden even to visit relatives. As a result, the Conservatives lost the by-election in the North Shropshire constituency. In the district where they have been winning for the last 200 years. Although this defeat does not change the balance of power in Parliament, where the Conservatives still have an advantage of about 80 votes, many consider this event a landmark. And the elections in North Shropshire just happened because of the resignation of Owen Patterson, who lobbied for his interests too zealously. According to British experts, the defeat in the district in the West of England suggests that Boris Johnson is losing the trust of voters, and with him, the Conservative Party is losing popularity. Many believe that such a drop in ratings may even force the Conservatives to try to replace their leader. In addition, just before the New Year, David Frost, who led the Brexit negotiations, resigned, finally stating that he did not agree with the policy that Boris Johnson oppresses. Polls among the British population are also not on the side of the Prime Minister. Most Britons don't approve of the way Brexit is going. Most Britons do not believe that Boris Johnson will remain in office even until the end of 2022.

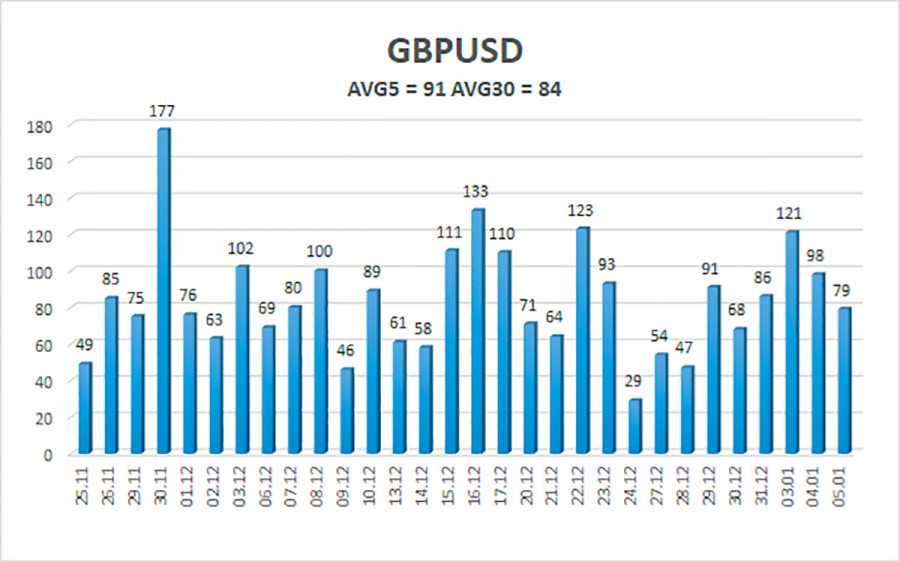

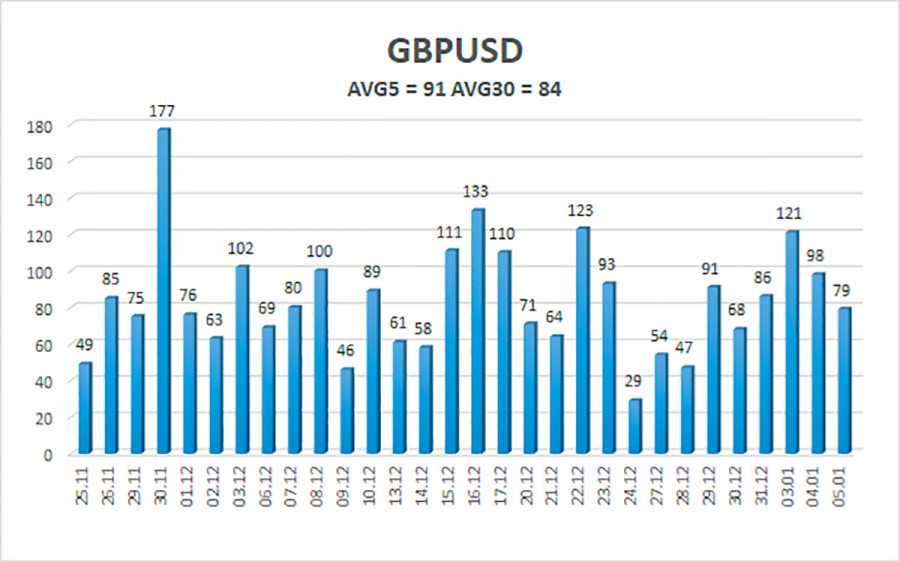

The average volatility of the GBP/USD pair is currently 91 points per day. For the pound/dollar pair, this value is "average". On Thursday, January 6, we expect movement inside the channel, limited by the levels of 1.3503 and 1.3685. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest resistance levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading recommendations:

The GBP/USD pair continues a strong upward movement on the 4-hour timeframe. Thus, at this time, stay in the longs with targets of 1.3611 and 1.3672 until the Heiken Ashi indicator turns down. It is recommended to consider short positions if the pair is fixed below the moving average with targets of 1.3428 and 1.3367, and keep them open until the Heiken Ashi indicator turns upwards.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.