To open long positions on EUR/USD, you need:

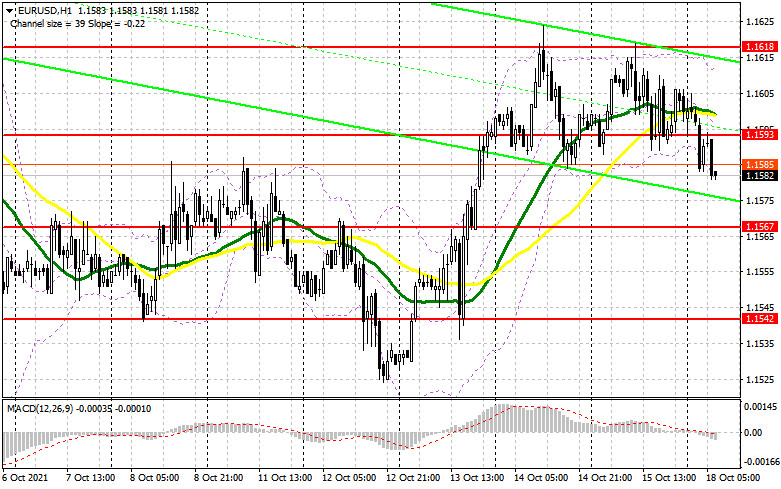

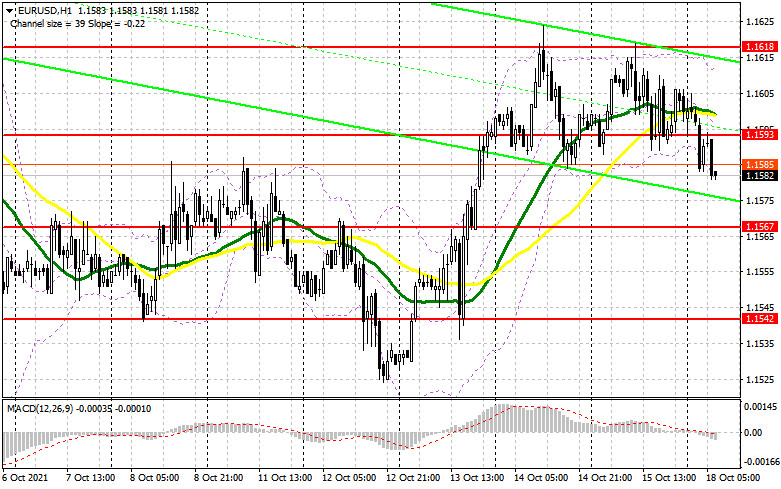

Last Friday, the pressure on the euro returned after the data on the volume of retail sales in the United States was released. Let's take a look at the 5 minute chart and understand the entry points. In the first half of the day, the formation of a false breakout in the resistance area of 1.1618 resulted in creating an excellent entry point for short positions, which pushed the euro towards the support of 1.1589. The bears tried to break through below this level several times, but to no avail. As a result, the formation of a false breakout and a buy signal. However, this did not lead to a large upward movement of the pair, and we ended the trading day in a horizontal channel.

Today there are no important statistics on the European economy, which could harm the euro bulls, who are counting on a more active recovery of the pair in the first half of the day. It is very important to quickly return the resistance of 1.1593, which was formed following the results of the morning session. Only a breakthrough and consolidation above this range, as well as its reverse test from top to bottom, can create a signal to buy the euro, which will preserve the pair's growth potential and allow us to count on a recovery to the high of 1.1618. A breakthrough of this range with a similar test from top to bottom will allow the bulls to continue the upward trend with the prospect of EUR/USD strengthening to the 1.1637 area, where I recommend taking profits. The next target will be the 1.1656 high. If the pressure on the pair persists, and most likely it will be so in the first half of the day, an equally important task for the bulls is to protect the support at 1.1567. Forming a false breakout there creates a good entry point into long positions, and will also lead to forming the lower border of the upward channel formed on October 12. If the bulls are not active at this level, I advise you to postpone long positions to the 1.1542 area, or even lower - from the 1.1510 low, counting on a rebound of 15-20 points.

To open short positions on EUR/USD, you need:

The bears tried to take control of the market on Friday, and in today's Asian session one could observe the continuation of active selling. Today, a very important task is to protect the resistance at 1.1593, slightly above which the moving averages, playing on the side of the bears, pass. Only a false breakout there will return the real pressure to the pair, which will push it to the support of 1.1567. A breakthrough and test of this level from the bottom up will lead to forming a signal to open new short positions, which will quickly push EUR/USD to 1.1542. The next target will be the 1.1510 low, but its test will mean the resumption of the bearish market for the euro. In case the bears are not active at 1.1593, it is best to postpone selling until the test of the major resistance at 1.1618, which was formed at the end of last week. It is possible to open short positions immediately on a rebound, counting on a downward correction of 15-20 points from a new high like 1.1637.

I recommend for review:

The Commitment of Traders (COT) report for October 5 revealed a sharp increase in short positions and only a slight increase in long positions, which reduced the net position. A large increase in short positions only confirms the formation of a bear market for the European currency. Political problems in the United States, some of which have already been resolved at the moment, also affected the players' current positions in the report under consideration by the COT. Friday's report from the US Department of Commerce on the labor market (it is not taken into account in this COT report) most likely will not affect the balance of power between bulls and bears, as the data turned out to be rather ambiguous. All this only confirms the preservation of the bullish trend for the US dollar, which will be observed this week as well. The prospect of changes in the Federal Reserve's monetary policy as early as November of this year allows traders to build long dollar positions without much difficulty, as many investors expect the central bank to start cutting back on the bond buying program towards the end of this year. The demand for risky assets will remain limited due to the wait-and-see attitude of the European Central Bank. Last week, ECB President Christine Lagarde talked a lot about how she will continue to adhere to a wait-and-see attitude and keep the stimulus policy at current levels. The COT report indicated that long non-commercial positions rose from 195,043 to 196,819, while short non-commercial positions jumped quite seriously - from 194,171 to 219,153. By the end of the week, the overall non-commercial net position went into the negative zone and dropped from the level of 872 to the level of -22334. The weekly closing price also dropped to 1.1616 from 1.1695.

Indicator signals:

Moving averages

Trading is carried out below the 30 and 50 daily moving averages, which indicates an attempt to build a downward correction in the pair.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator at 1.1610 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.