Analysis of Trades and Trading Tips for the British Pound

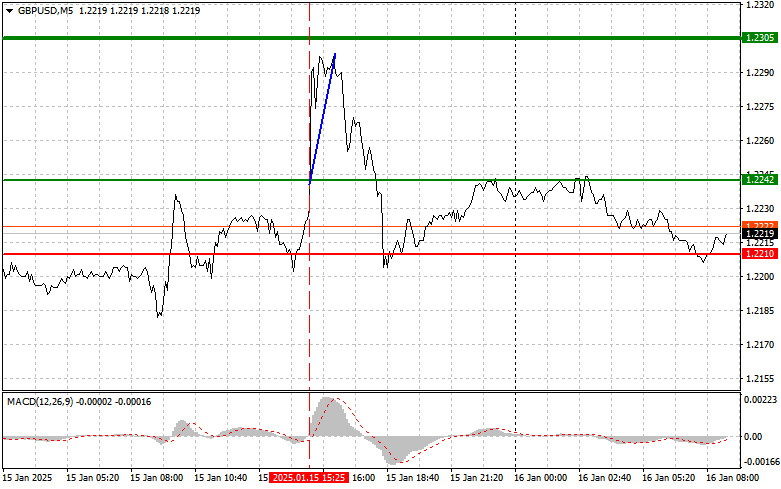

The first test of the 1.2245 price level in the afternoon coincided with the MACD indicator beginning to move upward from the zero level, indicating a valid entry point to buy the pound. Subsequently, we fell just a few pips short of reaching our target level of 1.2305.

Market conditions have become increasingly tense due to conflicting inflation data. The rise in overall inflation in the U.S. has prompted many traders to adjust their forecasts regarding the Federal Reserve's actions. In contrast, core prices, which exclude volatile components like food and energy, have shown a decline, further increasing uncertainty among traders. In light of this dual dynamic, investors have become more cautious. Remarks from Federal Reserve officials, highlighting that no major changes to interest rates are planned, emphasize the importance of a measured approach to trading.

Today's GDP figures serve as a crucial indicator of the country's economic health and can significantly influence currency rates. Investors are closely monitoring this data, hoping for insights into future trends. If the numbers exceed expectations, it could drive the pound higher as market participants begin to price in more optimistic scenarios for the UK economy.

Industrial production is another key metric that reflects the performance of important economic sectors. Growth in this area indicates recovery after previous periods of instability. Positive developments in the industrial sector could boost confidence in the economy and likely support the pound.

The goods trade balance is also a critical factor. A positive trade balance could strengthen the currency, as it signals the competitiveness of British goods in international markets.

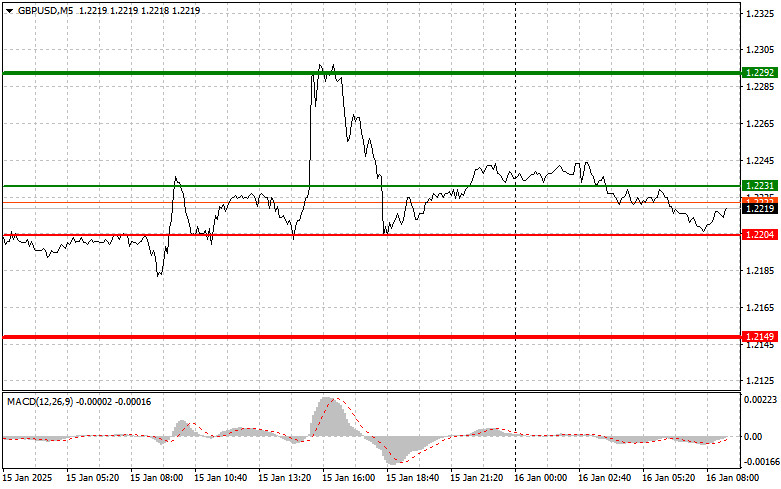

For today's trading strategy, I will primarily focus on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: I plan to buy the pound today at the entry point at 1.2231 (green line) with a growth target of 1.2292 (thicker green line on the chart). In the area of 1.2292, I will exit from purchases and open sales in the opposite direction (calculation for a movement of 30-35 pips in the opposite direction from the level). We can count on the growth of the pound after strong GDP data. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting its growth from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive price tests of 1.2204 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a reversal of the market upwards. We can expect growth to the opposite levels of 1.2231 and 1.2292.

Sell Signal

Scenario #1: I plan to sell the pound today after testing the level of 1.2204 (red line on the chart), which will lead to a rapid decline in the pair. The key target of sellers will be the level of 1.2149, where I will get out of sales, as well as open immediate purchases in the opposite direction (calculation for a movement of 20-25 pips in the opposite direction from the level). It is better to sell the pound as high as possible to continue the forming bearish trend. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive price tests of 1.2231 when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downwards. We can expect a decline to the opposite levels of 1.2204 and 1.2149.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.