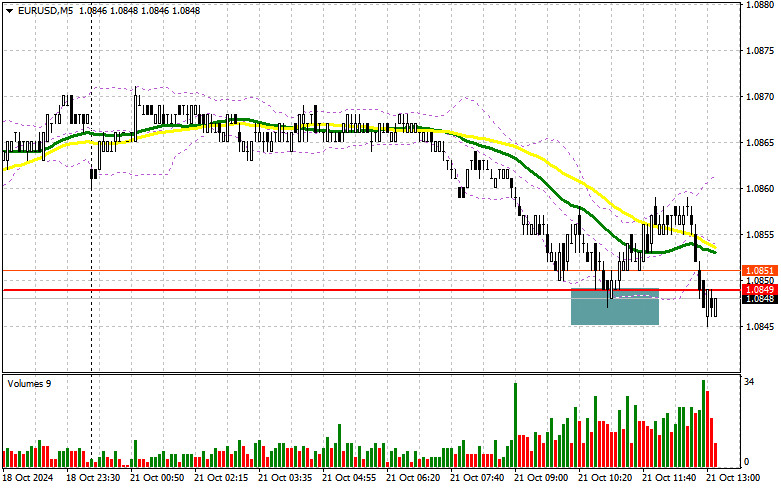

In my morning forecast, I focused on the support level of 1.0849 and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. A decline and the formation of a false breakout at that level provided an excellent entry point for buying the euro, which led to a rise of just 10 points, after which demand for the euro decreased. Low volatility and a lack of important statistics prevent traders from showing significant activity. The technical setup for the second half of the day remains unchanged.

To Open Long Positions on EURUSD:

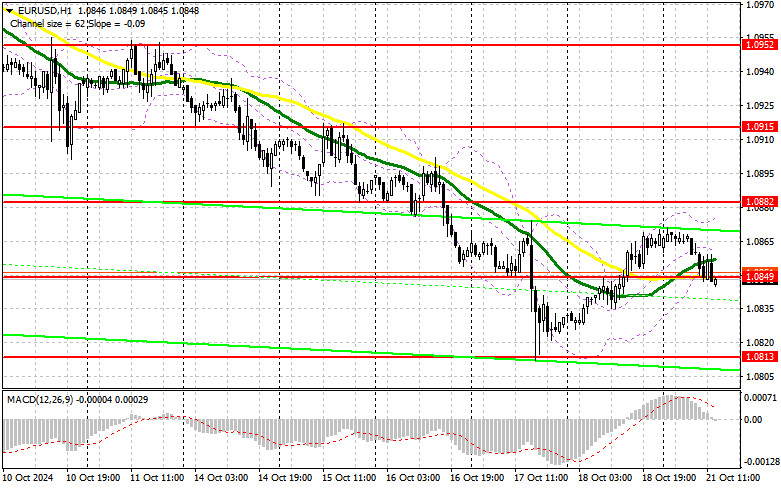

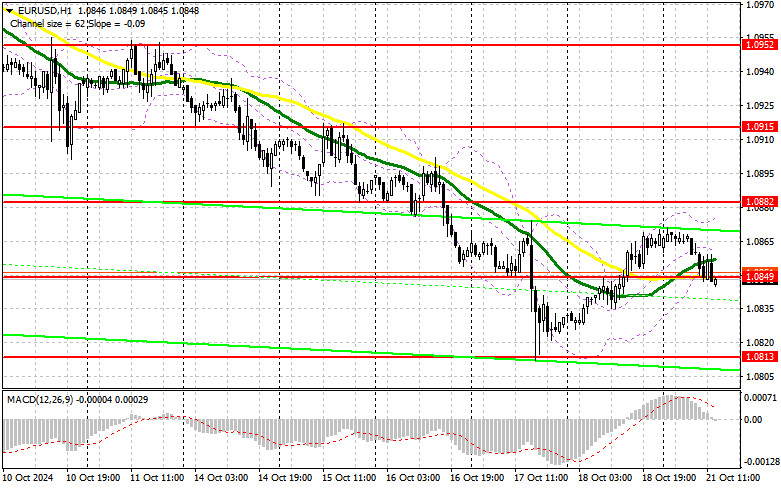

There are no significant statistics in the second half of the day, and the data on the US Leading Indicators Index holds little value. Perhaps we might hear something new in the interview with FOMC member Neel Kashkari, who is known for advocating a more accommodative policy. If the euro declines following his statements, I plan to take action around the major support at 1.0813, but only after a false breakout. This will create a favorable condition for adding to long positions, opening the way back to the level of 1.0849. A breakout and a retest of this range would confirm an ideal entry point for purchases, aiming for a retest of 1.0882. The ultimate target is 1.0915, where I plan to take profit. If EUR/USD declines and there is no activity around 1.0813 in the second half of the day, pressure on the euro is likely to resume, aligning with the trend, creating many challenges for buyers. In that case, I will only enter long positions after a false breakout near the next support at 1.0783. I plan to open long positions immediately on a rebound from 1.0761 with a target for an upward correction of 30-35 points within the day.

To Open Short Positions on EURUSD:

Despite some pressure on the euro, sellers have yet to offer anything compelling. If another false breakout forms around 1.0849, where the moving averages are located, this could offer a chance to open new short positions with the prospect of further decline toward the support at 1.0813. A break and consolidation below this range, as well as a subsequent retest from bottom to top, would be another suitable option for selling, targeting the 1.0783 level, which would further strengthen the bearish market. I only expect to see more active buying around that level. The ultimate target is the area of 1.0761, where I plan to take profit. If EUR/USD rises in the second half of the day without any selling activity at 1.0849, buyers might seize an opportunity for a correction. In that case, I will postpone sales until testing the next resistance at 1.0882. I will also sell there, but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.0915 with a target for a downward correction of 30-35 points.

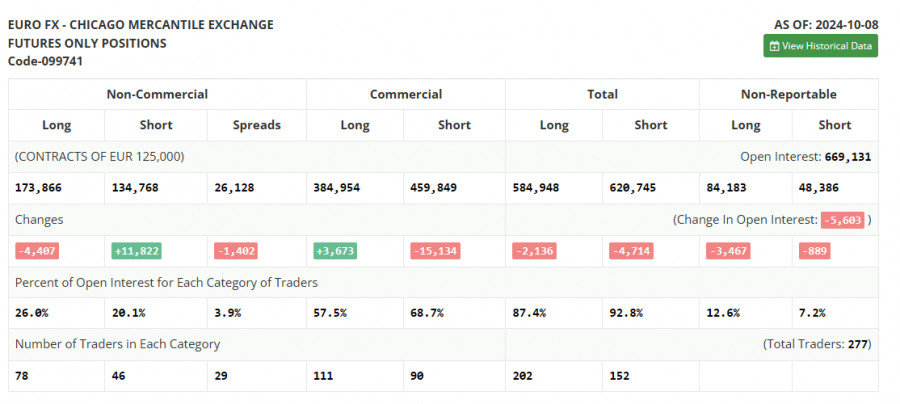

In the COT report (Commitment of Traders) for October 8, a sharp increase in short positions and a reduction in long positions were observed. The report already includes the latest US labor market data, but it does not yet reflect inflation figures, which likely led to an increase in short positions on the euro. For now, everything is working in favor of the US dollar, and only strong European statistics in the near term could halt the bearish market for this trading instrument. However, this does not rule out a medium-term upward trend for the pair, and the lower the pair goes, the more attractive it becomes for purchases. The COT report indicates that long non-commercial positions decreased by 4,407, reaching 173,866, while short non-commercial positions increased by 11,822, reaching 134,768. As a result, the gap between long and short positions decreased by 1,402.

Indicator Signals:

Moving Averages

Trading occurs around the 30- and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator around 1.0849 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths volatility and noise to determine the current trend. Period 50, marked in yellow on the chart.

- Moving Average (MA): Smooths volatility and noise to determine the current trend. Period 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): EMA 12 (fast), EMA 26 (slow), SMA 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between non-commercial traders' short and long positions.