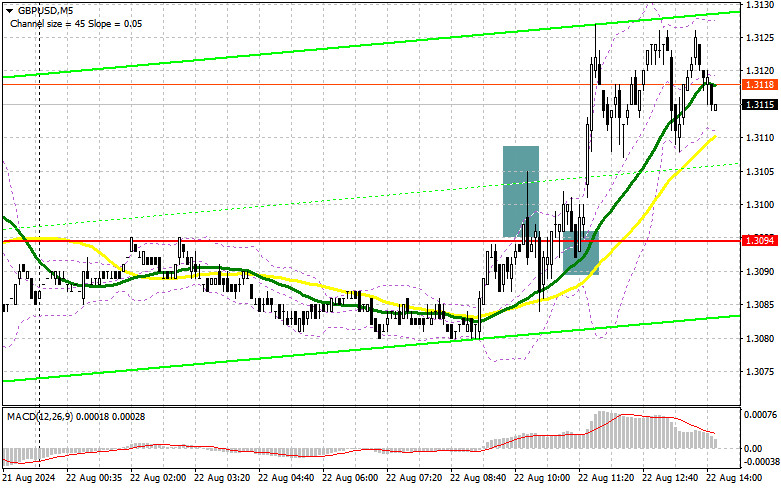

In my morning forecast, I highlighted the 1.3094 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. The rise and formation of a false breakout at this level provided a good entry point for short positions, but it did not lead to a significant decline. The breakout and retest of 1.3094, combined with strong UK statistics, offered an entry point to buy along the trend, resulting in a gain of over 30 points for the pair. The technical picture has been revised for the second half of the day.

To open long positions on GBP/USD:

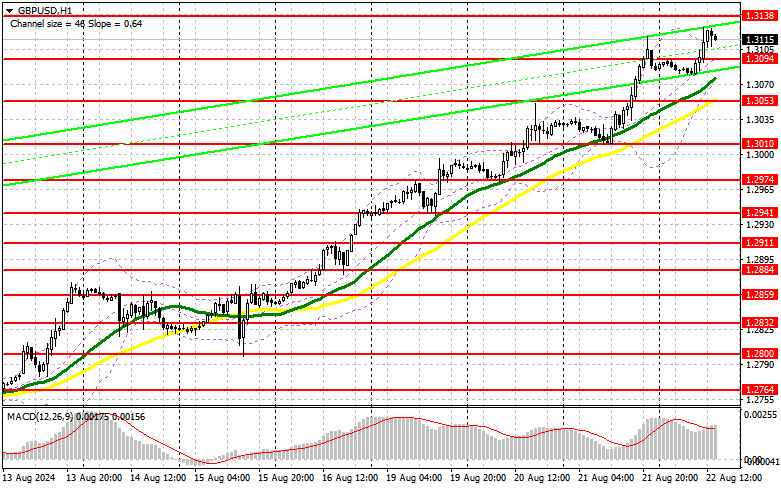

During the U.S. session, we will receive data on the U.S. Manufacturing and Services PMI, as well as initial jobless claims and existing home sales figures. Only very strong figures, significantly exceeding economists' forecasts, can push the pound down to the 1.3094 level—an intermediate support level where I plan to act. A false breakout there will provide an entry point for long positions, aiming for another update of the new monthly high at 1.3138. A breakout and retest of this range from top to bottom will strengthen the chances of further developing the uptrend, leading to a stop-loss sweep of sellers and offering a good entry point for long positions, with a potential target at 1.3177. The ultimate target will be the 1.3209 level, where I plan to take profits. If GBP/USD declines and there is no bullish activity around 1.3094 in the second half of the day—where the moving averages, supporting the bulls, are slightly below—pressure on the pair will increase. This could lead to a drop and a retest of the next support at 1.3053. A false breakout would be a good condition for opening long positions. I plan to buy GBP/USD on a rebound from the 1.3010 low, targeting a correction of 30-35 points within the day.

To open short positions on GBP/USD:

The sellers tried, but they have been largely unsuccessful recently. It is clear that the pound still has upward potential, and the problems in the U.S. economy will benefit those betting on a weaker dollar and further growth in risk assets, including the British pound. The bears' primary task is to defend the new monthly high at 1.3138. Only a false breakout at this level would be an acceptable option for opening short positions, targeting a correction and a retest of the 1.3094 support, which served as resistance earlier in the morning. A breakout and retest from bottom to top of this range will hit the buyers' positions, triggering stop-loss orders and opening the path to 1.3053, where I expect more active actions from major players. The ultimate target will be the 1.3010 level, where I will take profits. Testing this level will significantly damage the pound's upward potential. If GBP/USD rises and there is no selling activity at 1.3138 in the second half of the day, sellers will have no choice but to retreat further, as the initiative will remain with the buyers. In this case, I will postpone selling until a false breakout forms at 1.3177. If there is no movement downward, I will sell GBP/USD on a rebound from 1.3209, targeting a correction of 30-35 points within the day.

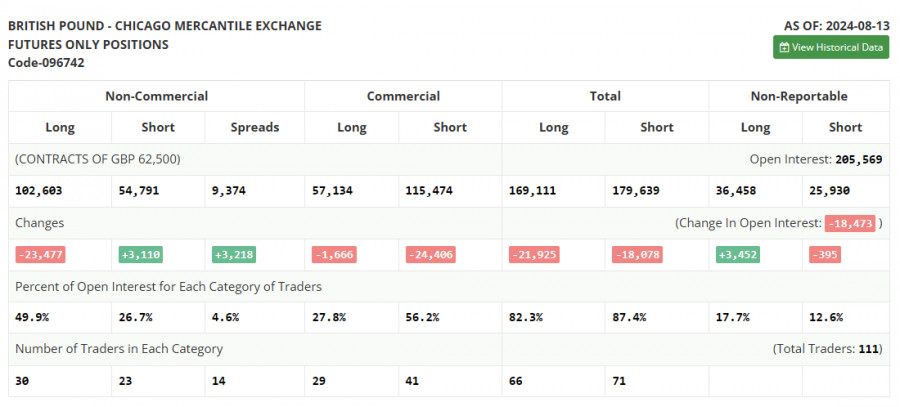

The COT report for August 13 showed a sharp reduction in long positions and a slight increase in short positions. Clearly, recent statements from the Bank of England, which made it clear that it intends to lower interest rates, along with economic data indicating a decline in price pressure, were key reasons for traders to abandon new long positions. The lower the rates, the less attractive the pound becomes. However, despite the softness of the central bank, the pound managed to recover due to the significant weakness of the U.S. dollar, which is still observed due to the same reasons: the Federal Reserve is expected to cut interest rates in September this year for the first time since the beginning of the coronavirus pandemic. The latest COT report indicates that long non-commercial positions fell by 23,477 to 102,603, while short non-commercial positions increased by 3,110 to 54,791. As a result, the spread between long and short positions widened by 3,218.

Indicator Signals:

Moving Averages:

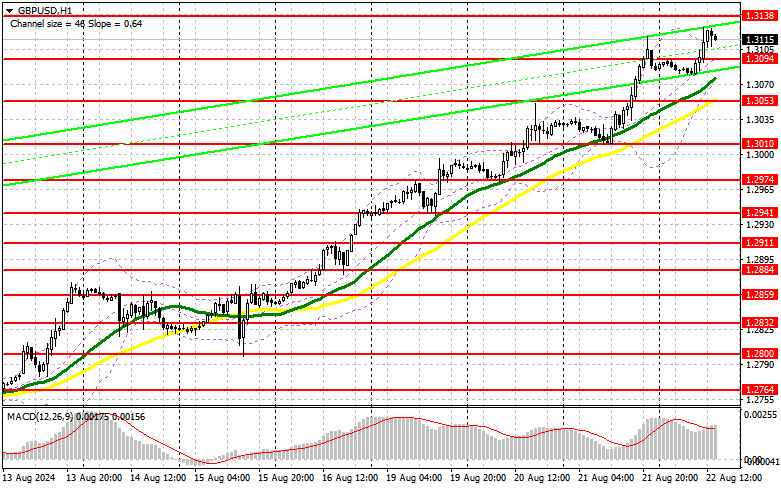

Trading is taking place above the 30 and 50-day moving averages, indicating a further rise in the pound.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.3070 will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.