The latest US data turned out to be much weaker than expected. The Conference Board's Consumer Confidence Index fell for the first time in four months to 106.7 (expected 115) from a revised value of 110.9 in January. Durable goods orders fell more than 6% in January, and business investments also seem to be at a low level. Expectations for the recovery of the US industrial sector are not being met; and now everyone is focused on the ISM report.

As expected, the Reserve Bank of New Zealand kept interest rates unchanged, and softened its stance, suggesting that the current interest rate level is quite restrictive. Markets were expecting a more hawkish statement, so the kiwi immediately fell on the wave of disappointment after the results of the meeting.

Oil is trading near annual highs, and at one point, Brent momentarily climbed above $83 per barrel. Oil prices reflect several factors – rumors of OPEC+ extending production cuts, the general recovery of the global economy and the associated demand for risk, as well as a slowdown in the dollar's growth.

The data has a minor impact on the market; marginal changes on yields, and the US dollar fluctuated in a narrow range.

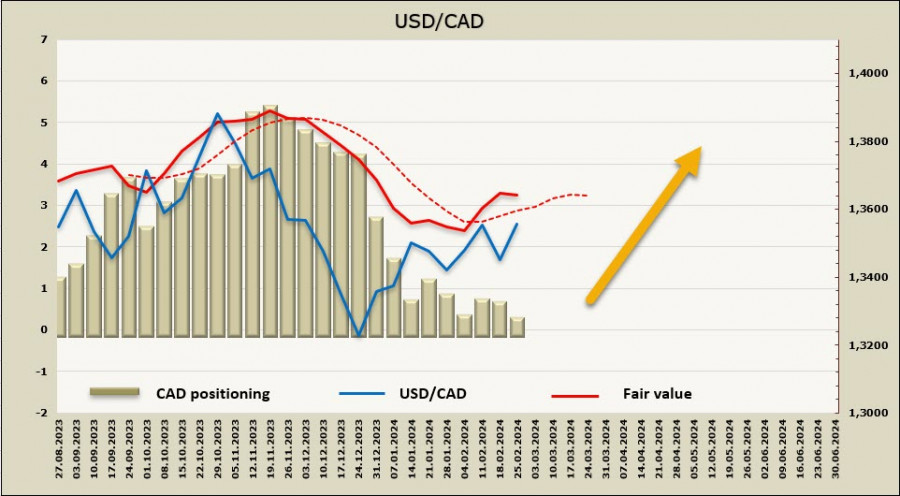

USD/CAD

Canada will release the GDP data on Thursday. After a disappointing 3rd quarter (-1.1%), market players expect a 0.8% growth, driven by increased working hours, strong export growth, and better-than-expected retail sales data in December.

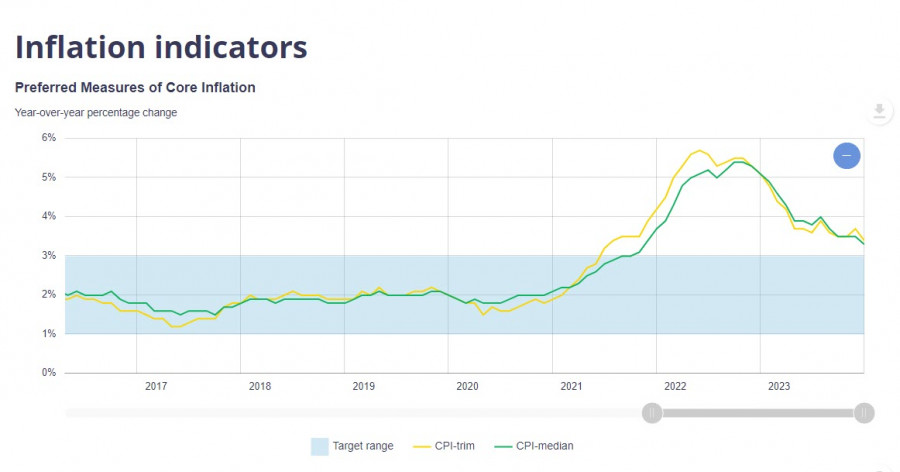

There are practically no fundamental reasons to expect growth from the CAD. The dynamics of bond yields in the US and Canada are clearly not in favor of the latter, and the situation could change with a more hawkish position from the Bank of Canada, with the next meeting scheduled for next week. However, there is little reason to expect upbeat outcomes here, as inflation in January declined much stronger than forecasts, which means that the Bank of Canada has no reason to maintain a hawkish tone.

Most likely, the rate will remain unchanged at 5%, and we will likely hear the same remarks like "waiting for new data to ensure a sustainable slowdown in inflation", and that's about it. The market's reaction is unlikely to work in favor of the CAD, so it is possible that in the coming days, the loonie will remain under pressure, even though the US dollar is also losing its growth incentive.

Overall risk appetite and rising oil prices are supporting the CAD, but to a lesser extent, since the Canadian economy is heavily dependent on the US. The higher the demand in the US, the higher the export and general enthusiasm. Therefore, the key point is the dynamics of yields, and it is currently not working in favor of the CAD, which practically rules out the possibility of a downward reversal in USD/CAD.

The short CAD position has been liquidated, with a weekly change of +340 million, and the bearish bias has fallen to -64 million. The net positioning is neutral; however, the price suggests further growth for the USD.

USD/CAD is one step away from the nearest resistance at 1.3586, with the next target at 1.3620. If it manages to settle above this mark, there are no significant resistances further up to 1.3750/70, and only a change in forecasts for the interest rates of the Federal Reserve or the Bank of Canada can stop the growth.

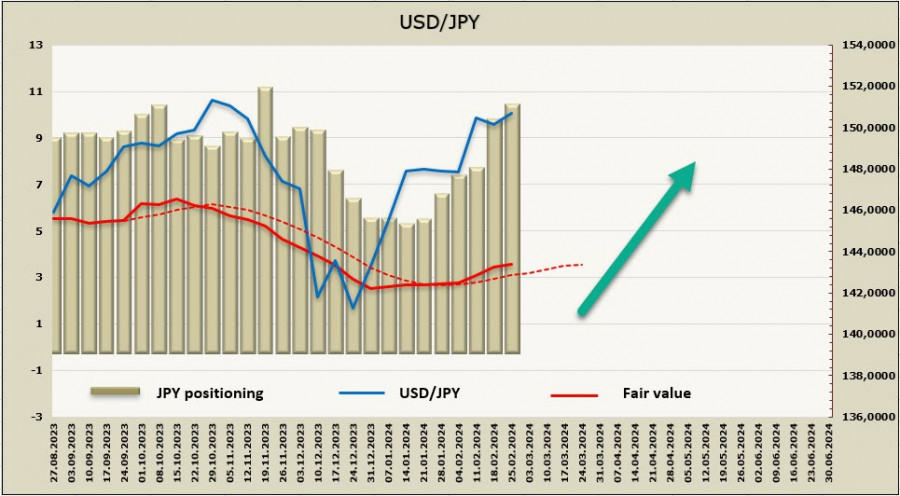

USD/JPY

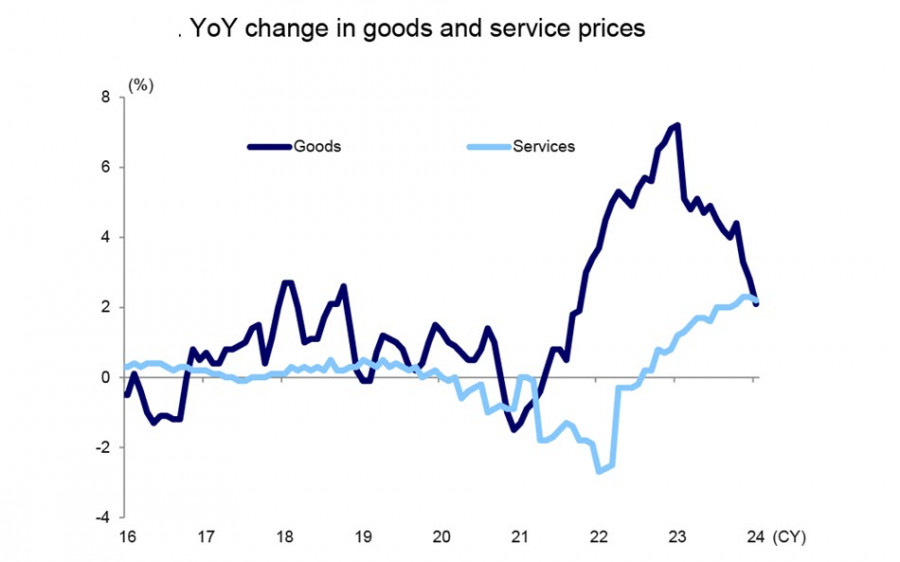

The core CPI fell to 3.5% y/y from 3.7% in December, and overall inflation slowed to 2%. Core CPI inflation is now at its lowest level since March 2022 and is exactly in line with the Bank of Japan's target.

Compared to the 2.8% growth in December, goods prices rose by 2.1%, representing a significant slowdown. Services showed +2.2%, and for the first time in a long period, the growth in prices in the services sector exceeded the growth in prices for goods.

Japan's corporate service prices rose 2.1% year-on-year in January, slowing from a 2.4% annual gain in December. Service prices rose 2.2%, slightly more than goods prices that were up 2.1%.

Mizuho Bank predicts that core inflation will slow to 2% as early as summer.

Japan's economy remains in a growth phase, but the momentum is weak. The question of whether the BOJ will raise the short-term interest rate to zero in April is considered resolved, and the situation will not change despite two consecutive quarters of real GDP contraction and three consecutive quarters of declining consumer and capital spending, which essentially determine the sustainability of domestic demand.

Additional rate hikes are not expected, as core inflation is slowing down in a rapid pace, and the yen will start to strengthen when the European Central Bank and the Fed start lowering rates.

The net short JPY position increased by 819 million to -10.064 billion during the reporting week. The yen is just a step away from the November record low, which suggests that the yen will weaken further. The price is rising.

The yen has been trading in a fairly narrow sideways range just below the multi-year high of 151.92 for two weeks now. We assume that it will continue to trade with low volatility, gradually rising towards 151.92. There is no reason for it to retreat, given the growing risk appetite and the BOJ's ambiguous position.