Analysis of EUR/USD 5M

EUR/USD continued to trade higher on Tuesday. The euro gradually drifted higher on Monday, while it sharply strengthened on Tuesday. The basis for this remains shrouded in mystery. Yes, the meetings of the European Central Bank and the Federal Reserve are behind us, signaling the end of the "blackout period." Starting from Monday, we started receiving information from central bank representatives, but in general, they repeated the same things that Lagarde and Powell mentioned last week. It is now clear that both central banks will reduce rates next year, and the timing of the easing cycle will depend on the pace of inflation.

The final estimate of the eurozone inflation report was released on Tuesday. The second assessment did not differ from the initial one, and there was no market reaction. The euro started to appreciate during the US session in the absence of significant economic data, and the reports that were published turned out mixed and could not trigger a new decline in the dollar. Thus, we consider it illogical for the pair to move this way.

Speaking of trading signals, only two were generated, and they duplicated each other. Initially, the pair surpassed the level of 1.0935 and then bounced off it from above. Subsequently, EUR/USD continued to move higher, and the price rose by about 40 pips. Traders could make 40 pips of profit.

In regards to the technical picture, it remains unchanged. The pair is still above the Ichimoku indicator lines and is moving towards the level of 1.1006, which is the latest local high. If it surpasses this mark, the euro will continue to rise further.

COT report:

The latest COT report is dated December 12. In the first half of 2023, the net position of commercial traders hardly increased, but the euro remained relatively high during this period. Then, the euro and the net position both decreased for several months, as we anticipated. However, in the last few weeks, both the euro and the net position have been rising. Therefore, we can conclude that the pair is correcting higher, but the correction cannot last long because it is still a correction.

We have previously noted that the red and green lines have moved significantly apart from each other, which often precedes the end of a trend. Currently, after a small correction, these lines are diverging again. Therefore, we stick to the scenario that the upward trend should come to an end. During the last reporting week, the number of long positions for the "non-commercial" group decreased by 3,800, while the number of short positions increased by 1,100. Consequently, the net position decreased by 4,900. The number of BUY contracts is still higher than the number of SELL contracts among non-commercial traders by 148,000. In principle, it is now evident even without COT reports that the euro should continue to fall.

Analysis of EUR/USD 1H

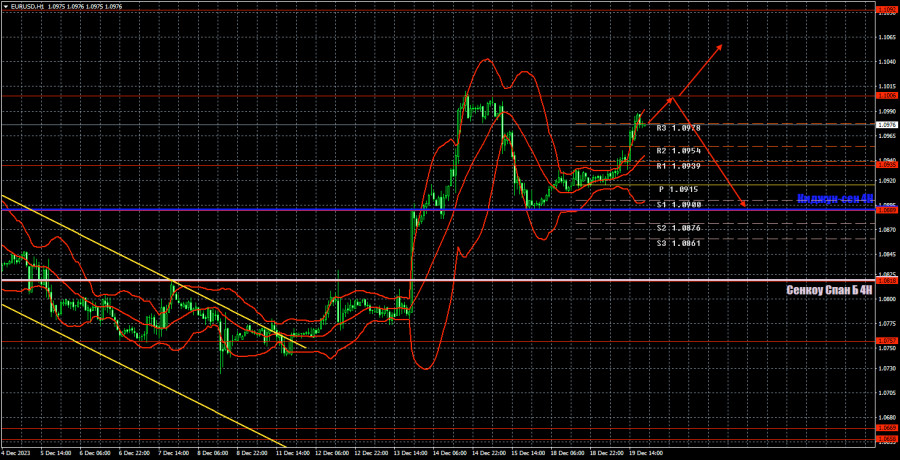

On the 1-hour chart, EUR/USD sharply increased last week, reaching the psychological level of 1.1000. We believe that the euro has risen very high already, but this week the price is increasing again, although it has no reason to do so. Therefore, trading along with the trend remains the only option.

The price rebounded from the range of 1.0872-1.0889, and the pair surpassed the level of 1.0935. Therefore, traders can stay in long positions with 1.1006 as the target. A rebound from this level will likely trigger a decline, and you can consider selling the pair with 1.0935 as the target.

On December 20, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0818, 1.0889, 1.0935, 1.1006, 1.1092, 1.1137, as well as the Senkou Span B (1.0819) and Kijun-sen (1.0889). The Ichimoku indicator lines can shift during the day, so this should be taken into account when identifying trading signals. There are also auxiliary support and resistance levels, but signals are not formed near them. Signals can be "bounces" and "breakouts" of extreme levels and lines. Don't forget to set a breakeven Stop Loss if the price has moved in the right direction by 15 pips. This will protect against potential losses if the signal turns out to be false.

On Wednesday, there are no important reports or events scheduled in the European Union and the United States, except for the new home sales report. Therefore, traders may hardly analyze any data on Wednesday. We believe that the euro shouldn't rise further, but if it continues to do so, it will become clear that we are dealing with a trend that follows the current momentum.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.