Bitcoin's Path: A Technical Analysis Indicate Bulls Eye $47,584

Bitcoin Halving 2024: A Global Investor Outlook

The anticipation surrounding Bitcoin's next halving in 2024 has ignited widespread speculation and investment strategy adjustments. Bitget's comprehensive study, surveying over 9,000 cryptocurrency investors, unveils a global sentiment brimming with optimism and strategic planning in response to the halving event.

Investor Expectations: A Surge in Confidence

The data reveals a pronounced belief in Bitcoin's potential to outstrip its historical peak, with a majority eyeing price milestones beyond $69,000 post-halving. This sentiment is echoed across diverse demographics, highlighting a universal confidence in Bitcoin's enduring value proposition.

Regional Perspectives: Diverse Outlooks Unfold

Distinct regional sentiments emerge, painting a complex picture of global expectations. Latin American investors display remarkable bullishness, whereas European counterparts exercise caution, embodying a 'short-term cautious, long-term optimistic' stance. This dichotomy underscores the multifaceted impact of geopolitical, economic, and social factors on investment outlooks.

Price Projections: Navigating Through Uncertainty

Investors globally are split on near-term price trajectories, with a significant faction predicting a range between $30,000 and $60,000 around the halving. Yet, the possibility of exceeding $60,000 garners substantial support, particularly in markets buoyed by high optimism.

Investment Intentions: Amplifying Crypto Portfolios

Reflecting on investment strategies, a robust 70% of respondents intend to increase their cryptocurrency holdings, indicating a strong belief in the sector's growth potential. This trend is particularly pronounced in the MENA and East European regions, suggesting an aggressive pursuit of crypto assets as a hedge against economic uncertainties.

Conclusion: Embracing a Future of Opportunities and Challenges

As we approach the 2024 Bitcoin Halving, investor sentiment ranges from cautious optimism to unabashed bullishness. This study not only sheds light on the diverse investor psychology but also underscores the importance of strategic planning in leveraging the halving event. For traders, the key lies in balancing optimism with risk management, preparing for volatility, and staying attuned to global market dynamics.

Bitcoin Market Technical Outlook:

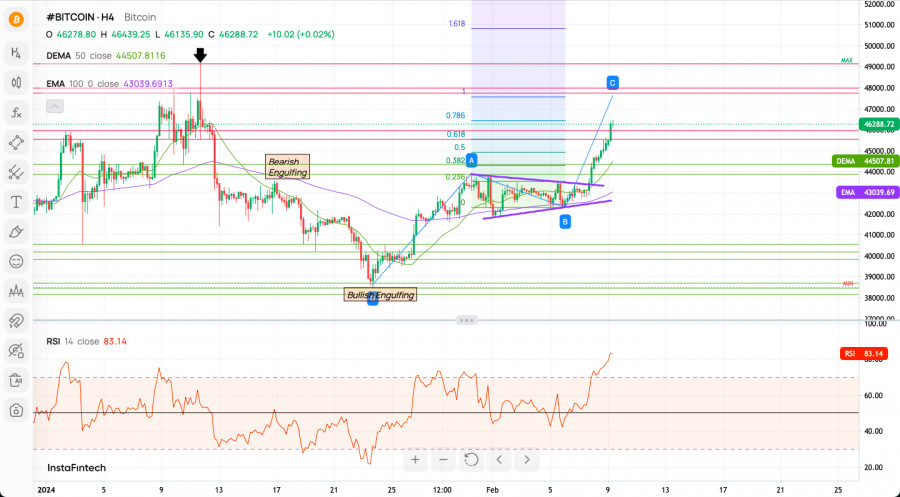

BTC/USD pair has broken out from the triangle pattern and made a new local high at the level of $46,506. The intraday technical support is currently seen at the level of $44,361 and $43,865. The next technical target for bulls is 100% Fibonacci extension of the wave C located at the level of $47,584, just below the key technical supply zone seen between $47,734 - $48,000. The momentum is strong nad positive, but the H4 market conditions are extremely overbought, so a pull-back is on the table.

Elliott Wave Insight: Corrective Phase in Play

H4 chart reveals Elliott Wave pattern: ABC structure underway, with wave C unfolding. Triangle consolidation (wave B) hints breakout, marking the start of wave C.

Projections & Targets: Fibonacci Extensions in Focus

Fibonacci levels guide future moves. Wave C eyes 0.382 Fibonacci level (point A), with potential extension to 0.5 and 0.618. Final target (point C) surpasses 0.618 extension.

Indicators & Sentiment: Bullish Tone Prevails

1H indicators: 21 Buy signals, 2 Sell signals. Moving averages echo bullish sentiment. Sentiment scoreboard: Bullish sentiment dominates (66% bulls vs. 34% bears).

Weekly Pivot Points:

Pivot Points offer insights into trend reversals, support, and resistance.

- WR3: $44,629

- WR2: $43,693

- WR1: $43,312

- Weekly Pivot: $42,765

- WS1: $42,376

- WS2: $41,823

- WS3: $40,887

Trading Insights for Bulls and Bears

Bitcoin Bulls: Monitor support levels for entry points. A breakout above $47,584 could signal further gains.

Bitcoin Bears: Watch for signs of overbought conditions and potential pullbacks. Short-term targets could be near support levels around $43,361.

Useful Links

Important Notice

The begginers in forex trading need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp market fluctuations due to increased volatility. If you decide to trade during the news release, then always place stop orders to minimize losses.

Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. For successful trading, you need to have a clear trading plan and stay focues and disciplined. Spontaneous trading decision based on the current market situation is an inherently losing strategy for a scalper or daytrader.

#instaforex #analysis #sebastianseliga