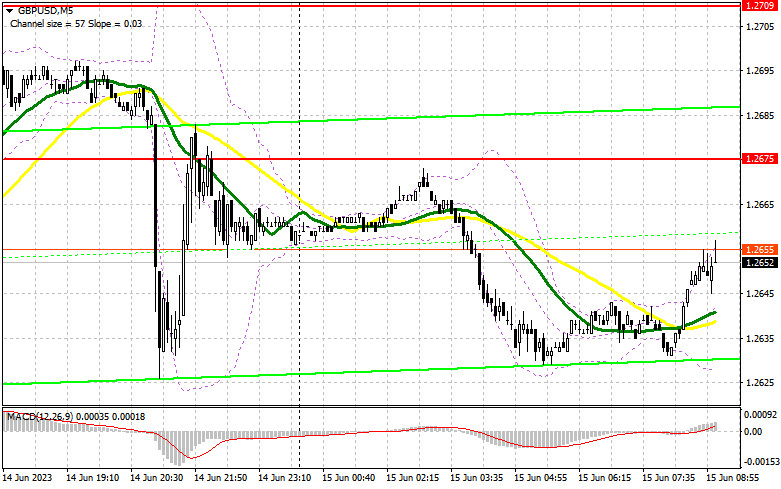

Yesterday, there were no signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the level of 1.2628 to decide when to enter the market. The price broke this level and failed to test it in the opposite direction. As a result, traders did not open long positions. In the second part of the day, traders neither got signals to enter the market.

Conditions for opening long positions on GBP/USD:

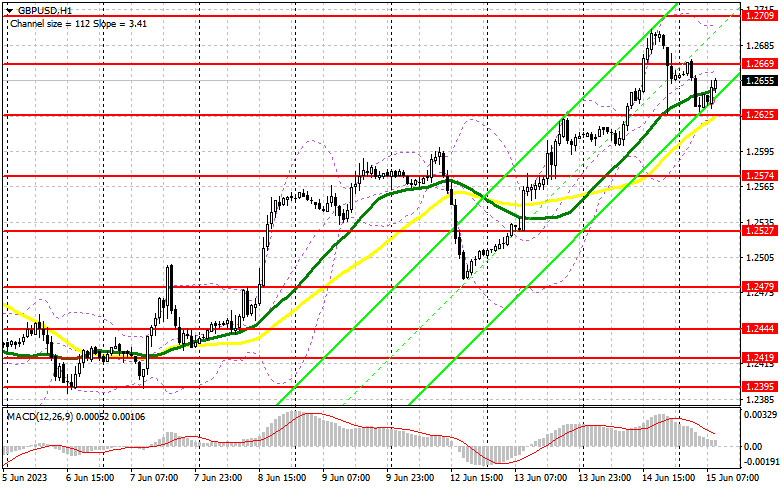

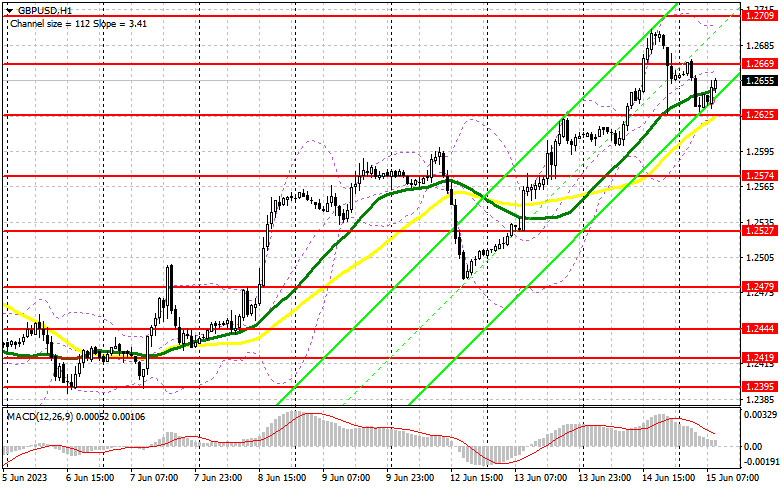

The decision of the Federal Reserve to take a pause in order to raise interest rates twice more in the future led to an active sell-off of the British pound yesterday at the end of the day. Since there is not enough fuel to renew the next monthly highs before the Bank of England meeting next week, I will bet on a downward correction of the pound. The absence of fundamental statistics will also encourage sellers. I expect major buyers to appear during the correction around the support level of 1.2625, where bullish moving averages are located. A false breakout will lead to a long signal in continuation of the bullish scenario. The target for the pair's recovery in this case will be the resistance level of 1.2669. A breakout and consolidation above this range will form an additional buy signal with a surge to a new monthly high of 1.2709, which will only strengthen the uptrend. The farthest target will be the area of 1.2755, where I will lock in profits. If the pair declines to 1.2625 and buyers fail to be active there, which is more likely, pressure on the pound will surge. However, the overall market situation is likely to remain the same. In the best-case scenario, the pair will get stuck in a sideways channel. In the event of this, only protection of the next area at 1.2574, as well as a false breakout, will provide a signal to open long positions. I plan to buy GBP/USD only on a rebound from 1.2527, expecting a correction of 30-35 pips within the day.

Conditions for opening short positions on GBP/USD:

Bears got an excellent opportunity for a downward correction yesterday. Today, they are likely to benefit from the situation. I plan to sell the pound only after a jump from the resistance level of 1.2669 formed late yesterday. A false breakout will be a signal to open short positions, which may lead to a slight drop to 1.2625. Only a breakout and an upward test of this range will considerably affect buyers' positions, returning pressure on GBP/USD and forming a sell signal with the target at 1.2574. The farthest target remains at a low of 1.2527, where I will lock in profits. If the pair rises and sellers fail to protect 1.2669, which cannot be excluded either, bulls will return to the market trying to reach new monthly highs. In this case, it is better to avoid sell orders until the price touches the resistance level of 1.2709. A false breakout will provide an entry point for short positions. If there is no downward movement there, I will open short positions after a rebound from 1.2755, but only with the expectation of a pair's downward correction by 30-35 pips within the day.

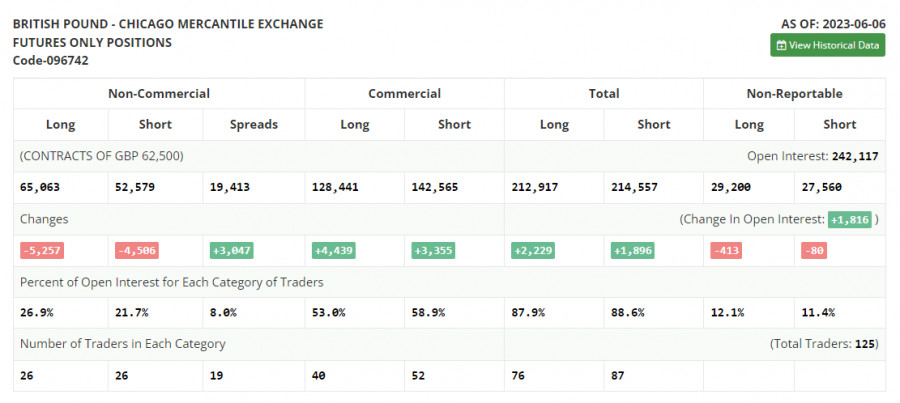

COT report:

In the COT (Commitment of Traders) report from June 6, the number of both short and long positions dropped. The pound has soared recently. This indicates that many traders continue to bet on an increase in interest rates by the Bank of England. Recent forecasts and expectations that the UK economy will avoid a recession this year are also supporting demand for risk assets. Meanwhile, the Fed has taken a pause in the cycle of interest rate hikes, which will also play in favor of GBP/USD buyers. The latest COT report states that short non-commercial positions decreased by 4,056 to 52,579, while long non-commercial positions fell by 5,257 to the level of 65,063. This led to a slight decrease in the non-commercial net position to the level of 12,454 compared to 13,235 in the previous week. The weekly price increased to 1.2434 compared to 1.2398.

Signals of indicators:

Moving Averages

Trading is performed above the 30- and 50-day moving averages, which points to the development of the upward movement.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a decline, the lower limit of the indicator located at 1.2625 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.