The GBP/USD currency pair has been trading with minimal volatility over the past day. Naturally, this did not consider the trading late in the evening, when the results of the Fed meeting became known. Thus, on the eve of the announcement of the result on the rate, the pound continued to be located near its highs, which gave it an excellent opportunity to continue to grow against the US dollar. However, is everything so unambiguous? In recent articles, we have already said that the pound has a better chance of strengthening in a pair with the dollar. First, over the past few days, it has fallen significantly less than the euro. Second, its departure from the year's lows is 1300 points, not 550, as in the euro currency. Third, the meeting of the Bank of England may support it. Fourth, the pound/dollar pair has consolidated above the Ichimoku cloud on the 24-hour TF. Of course, the latter factor has the color of randomness because, at the moment of overcoming, the cloud itself was declining to a greater extent than the price was rising. Nevertheless, there are quite a lot of factors that indicate a possible continuation of the pound's growth.

Nevertheless, the pound remains in the "risk zone." It remains the risky currency of the state, in which three prime ministers are replaced in a year. It remains a currency, the central bank of which first announces its readiness to start the QT program and a week later begins the QE program. And it is unclear what to expect from the Bank of England itself, which will announce the results of its meeting today. Traders believe that the rate may rise by 0.75%, but not everyone agrees with this opinion.

The British regulator can raise the rate by only 0.5%.

It should be recalled immediately that at the Bank of England's last meeting, several monetary committee members voted for tightening by 0.75%, but they remained in the minority. Why can't something like this happen this month? After all, a month and a half ago, the last inflation report spoke of a 10.1% increase in prices. The same as at the time of today's BA meeting. If a month and a half ago, the members of the monetary committee did not take into account the new increase in inflation or did not consider it excessively strong to increase the pace of monetary policy tightening, then why should they do it today? Of course, the regulator is most likely learning from its mistakes, but BA has advocated the gradual tightening of monetary policy since the beginning of the year. And the financial markets, which recently experienced a shock due to Liz Truss' "tax initiatives," do not need a new shock now. And any strong rate hike is a shock to the markets. Therefore, today, on the day of publication of the meeting results, we believe that the probability of a 0.5% or 0.75% rate increase is 50/50. Official forecasts indicate a maximum possible increase of 0.75%.

At the same time, economists from Credit Suisse believe that the pound sterling may rush down if BA raises the rate by only 0.5%. They believe the pound may return to 1.1200 if the tightening is not strong enough. The bank notes that the regulator may remain "conservative" until it becomes known what fiscal policy the new government headed by Rishi Sunak will adhere to. Also, Credit Suisse experts believe that the rate may rise by 0.75%, but at the same time, BA's rhetoric may get a "dovish" color. The final rate level may drop to 4.5%, which is unlikely enough to return inflation to the target level. The pound may lose its fragile advantage over the dollar it has gained recently. If the rate in the UK rises only to 4.5% and it is unknown when it will rise, then the demand for the US dollar may start to grow again since the Fed rate will rise to 4.75% in a few months. The fact that the pound is currently being held back from a strong fall suggests that traders are more interested in information from the BA than from the Fed, with which everything is more or less clear. This week could be a turning point for both major currency pairs.

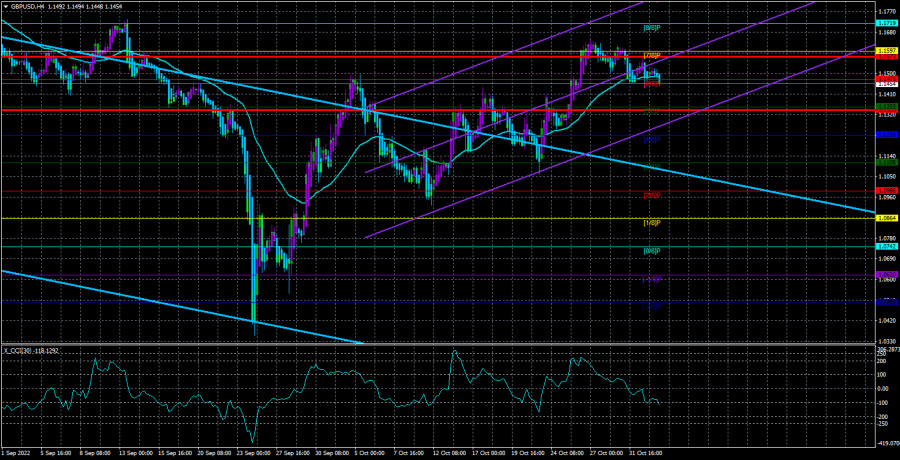

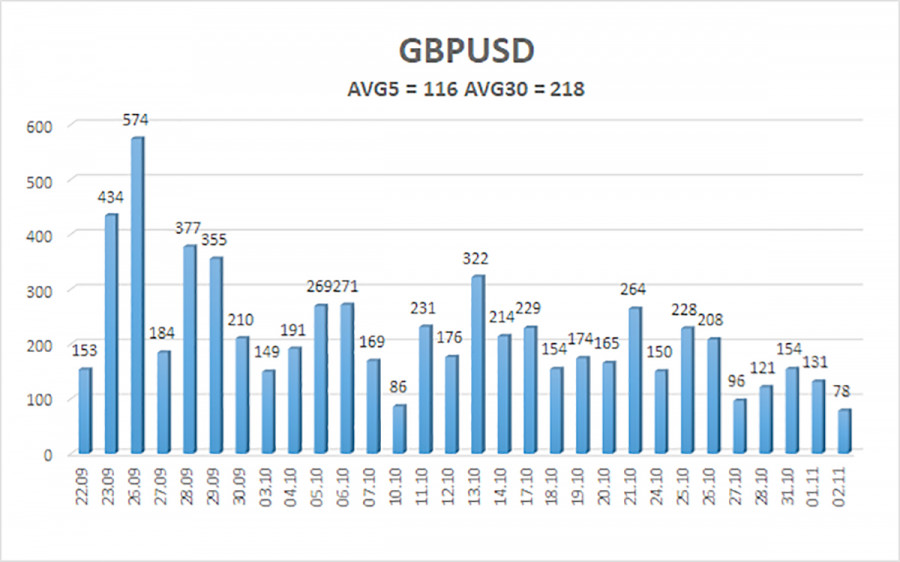

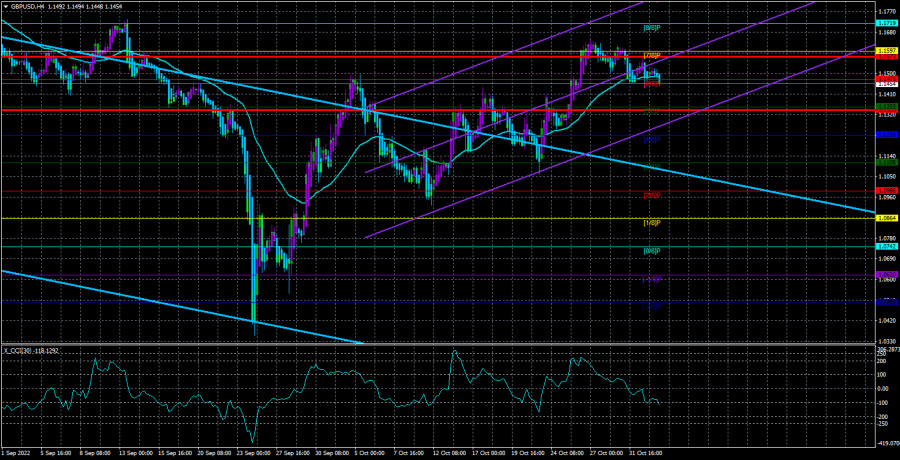

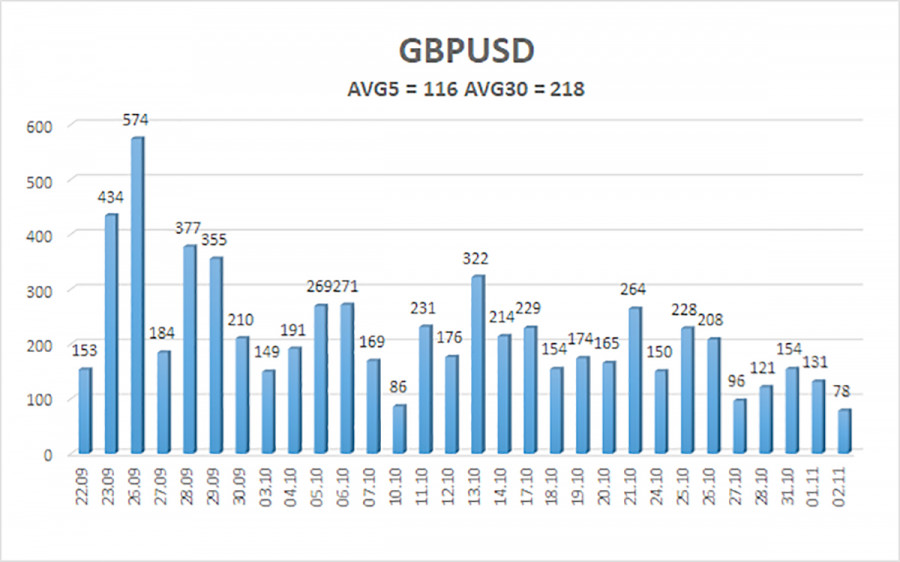

The average volatility of the GBP/USD pair over the last five trading days is 116 points. For the pound/dollar pair, this value is "high." On Thursday, November 3, thus, we expect movement inside the channel, limited by the levels of 1.1339 and 1.1572. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of movement to the north.

Nearest support levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The GBP/USD pair continues to adjust in the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.1597 and 1.1719 should be considered in the event of a price rebound from the moving average. Open sell orders should be fixed below the moving average with targets of 1.1353 and 1.1230.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.