Details of the economic calendar for August 23

Preliminary data on business activity indices in Europe, Great Britain, and the United States were published, which mainly showed a decrease in indicators.

Details of statistical indicators:

In Europe, the index of business activity in the services sector fell from 51.2 to 50.2 points, while the forecast was 50.5 points. The index of business activity in the manufacturing sector fell from 49.8 to 49.7 points, but was expected to decline to 49.0 points. The composite index fell from 49.9 to 49.2 points.

The euro was already heavily oversold at the time of the release of the data, so it was difficult to fall further.

In the UK, the situation is similar. The services PMI fell from 52.6 to 52.5 points, with a forecast of 52.0 points. Manufacturing PMI fell from 52.1 to 46.0, forecast is at 51.0 points. The composite index fell from 52.1 to 50.9 points.

The pound sterling, like the euro, was oversold; the reaction to the statistical data is zero.

In the US, a similar package of statistical data came out badly. Manufacturing PMI fell from 52.2 to 51.3 points, and services PMI fell from 47.3 to 44.1 points. As a result, the composite index fell from 47.7 to 45.0 points.

The American dollar, overheated by buyers, has entered the pullback stage.

Yesterday, Minneapolis Fed President Neel Kashkari spoke and expressed a very interesting idea—"a strong USD can influence the Fed's policy." In anticipation of Fed Chairman Jerome Powell's speech at the economic symposium in Jackson Hole, these words may encourage traders to sell off the dollar.

Analysis of trading charts from August 23

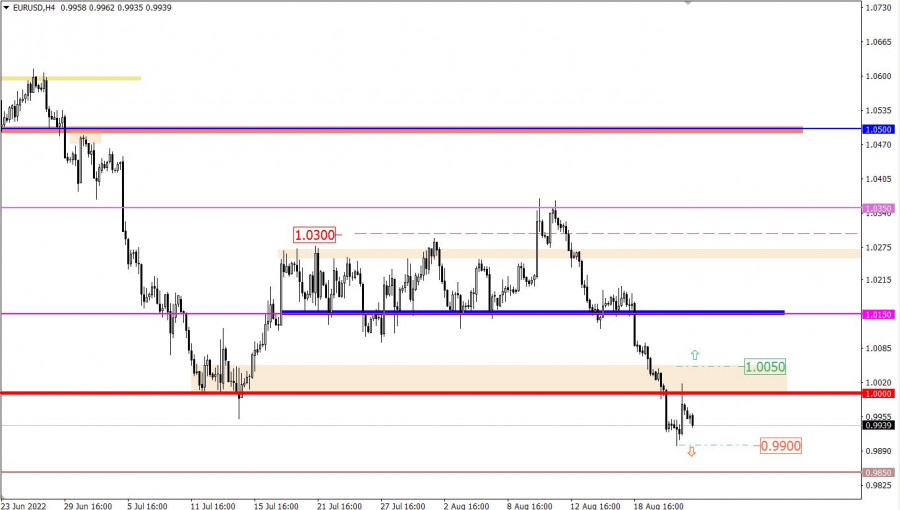

The EURUSD currency pair has firmly consolidated below the parity level (1.0000), which indicates a continuation of the medium-term and long-term downward trend. Coordinates 0.9900 stood as a variable support on the way of sellers, relative to which there was a pullback in the direction of the previously passed level 1.0000.

The daily trading chart shows the price movement at the levels of 2002. The scale of the euro's weakening since June 2021 is about 18%, which is 2,300 points.

The GBPUSD currency pair, after a short stagnation within the support level of 1.1750, increased the volume of long positions. This led to the formation of a technical pullback in the market by about 120 points. Given the 1.5-week overheating of sterling shorts, the current pullback is the least that could have happened on the market.

The daily trading chart shows a prolongation of the medium-term downward trend. The scale of the weakening of the pound sterling since June 2021 is about 17.50%, which is 2,500 points.

Economic calendar for August 24

Today the macroeconomic calendar is practically empty. The only thing to watch out for is orders for durable goods in the United States, which could rise by 0.6%. That will indicate at least the preservation of the current level of consumer activity.

How will this affect the US dollar?

The statistics are positive, but given that the US currency is already overbought, the scale of the reaction to the statistical data may be very modest.

Time targeting:

US Durable Goods Orders (July) – 12:30 UTC

Trading plan for EUR/USD on August 24

In this situation, the euro is under great pressure from sellers, who are dragging the quote down on the speculative mood. A lot of technical signals about the oversold euro are ignored, which eventually leads to inertia in the market.

Presumably, holding the price below 0.9900 will lead to a further decline towards 0.9850 and 0.9650. Earlier in history, a side channel was formed in these, located below the parity level.

The scenario of the transition from the pullback stage to the full-length correction may occur at the moment the price holds above the 1.0050 mark in a four-hour period.

Trading plan for GBP/USD on August 24

Despite the scale of the pullback, the pound is still oversold. For this reason, holding the price above 1.1880 may push buyers to form a full-size correction in the market.

At the same time, in order to prolong the downward trend, the quote needs to stay below the level of 1.1750 in a four-hour period.

What is shown in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.