The EUR/USD currency pair continued its downward trend for most of Thursday's trading session. Only the euro's appreciation (or the dollar's decline) on Wednesday evening prevents a further sharp depreciation. Recall that inflation data was released in the United States on Wednesday, indicating another escalation in the price growth rate to 9.1% y/y. However, the pair could only update their daily lows by 2 points. The 1.0000 barrier showed resiliency and prevented bears from falling below it, which likely explains the euro's gain in the evening – it was entirely technical. On Thursday night, though, it became evident that it would not endure long. During the fourth trading day of the week, the pair retraced slowly to the 1.0000 level, demonstrating its inability to normalize its movements. Consequently, the technical picture has not changed in any way. All indications continue to go downwards, and there is no technical purchase signal.

Regarding the "foundation," the situation is comparable. What could have altered the recent inflation report? For instance, if the CPI finally began to decelerate, it could indicate that the Federal Reserve would begin to moderate its aggressive monetary policy. But inflation has risen again, so we now assume that the Fed may hike rates by 1.00% on July 26-27. And what else can be done if, even at 1.75%, inflation shows no signs of abating? In light of this, we also believe that the rate may need to be increased above 3.5%, where the Fed plans to end its cycle of monetary policy tightening. These stories and events are like manna from heaven for one dollar. The stronger the rate climbs, the greater the likelihood that the US dollar will continue to grow. Eventually, the rate will reach the maximum permissible level; nevertheless, this moment is not imminent.

The gas embargo might not be required. Moscow may cease supplying the EU with natural gas.

In the meantime, the European Union is preparing its seventh new sanctions package. It was revealed yesterday that it will not include a ban on Russian gas imports, as many EU nations have not yet had time to prepare for such a step. However, remember that Europe's gas supplies are already dwindling. Transit via Ukraine has reached its lowest levels in six years, and the Nord Stream pipeline is currently unable to transport gas to Europe. According to Moscow, the pipeline requires maintenance, which will be completed on July 21. However, Brussels is concerned that Moscow may engage in "gas blackmail" and halt all shipments of "blue fuel" to Europe. In light of these events, the European Union has prepared an economic plan intending to prepare as swiftly as possible for the potential cessation of gas supplies from Russia.

Remember that Russia is not the only nation that exports natural gas to the EU. Nevertheless, it is also the largest exporter. The EU strategy recommends that businesses replace gas in production with other fuel types and undertake a variety of auctions and tenders to reduce gas use. The statement will also advocate lowering the heating and air conditioning temperatures of numerous buildings and organizations throughout the winter. Consequently, it can be predicted that this winter will be frigid in Europe if Moscow launches a gas war with the European Union. Since many businesses rely on gas for energy, industrial production may also be affected. Well, we reiterate that relations between the European Union and the Russian Federation are not improving. Thus it is unlikely that geopolitical tension will diminish in the near future. Due to the excessively high risks associated with the EU economy, the geopolitical war in Ukraine can continue to have a devastating effect on the euro, which is not in demand on the foreign exchange market. Given the full passivity of the ECB, it is quite difficult for the euro currency to bet on a significant appreciation versus the US dollar.

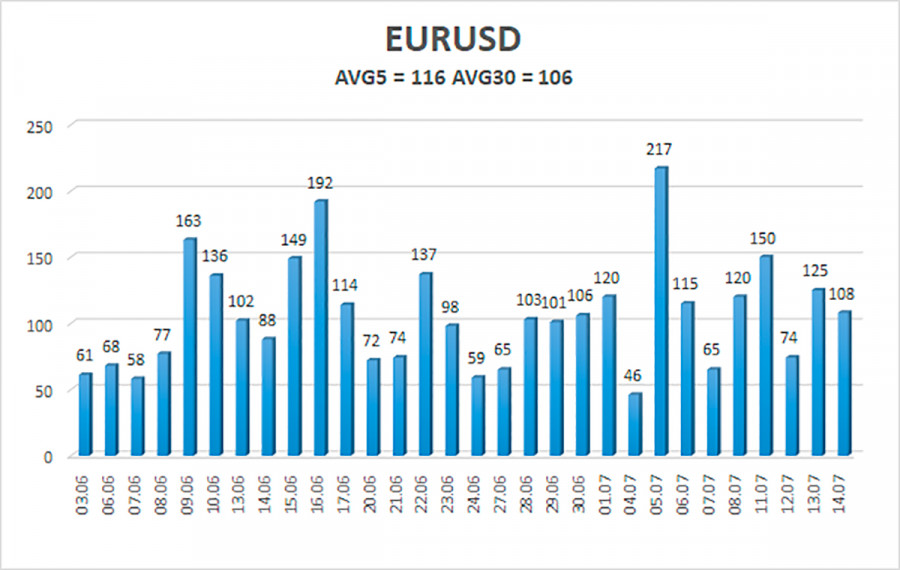

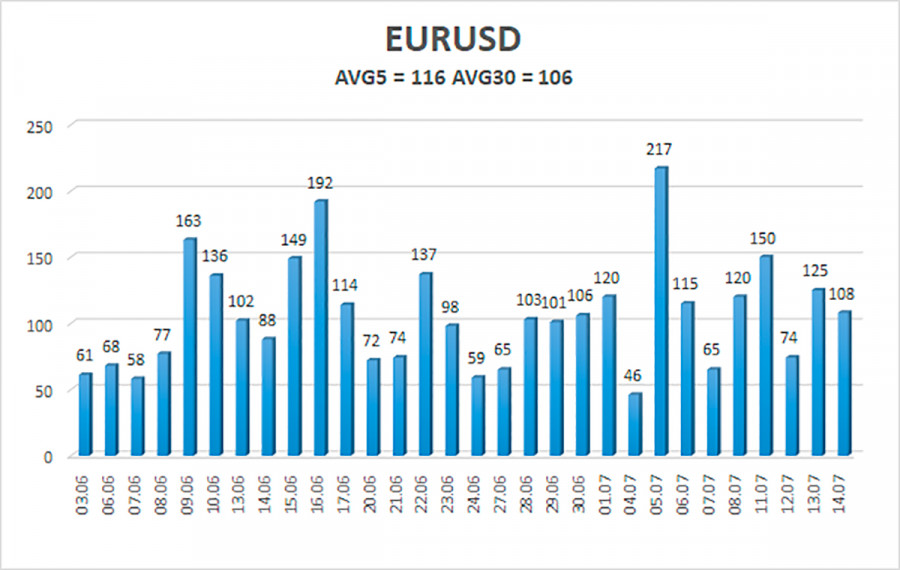

As of July 15, the average volatility of the euro/dollar currency pair for the previous five trading days was 116 points, which is considered "high." Thus, we anticipate the pair to trade between 0.9894 and 1.0123 today. A reversal of the Heiken Ashi indication upwards indicates that the pair will seek to correct again.

Nearest support levels:

S1 – 1.0010

S2 – 0.9888

S3 – 0.9766

Nearest resistance levels:

R1 – 1.0132

R2 – 1.0254

R3 – 1.0376

Recommendations for Traders:

The EUR/USD pair resumed its downward trend. Maintain short positions with a target of 0.9894 until the Heiken Ashi indicator rises. When the pair is trading above the moving average with a target of 1.0254, it will be prudent to buy.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

The moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.