To open long positions on EURUSD, you need:

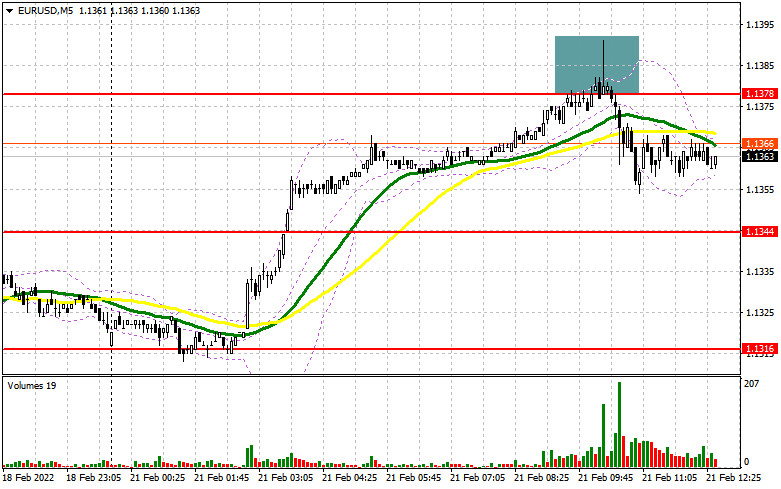

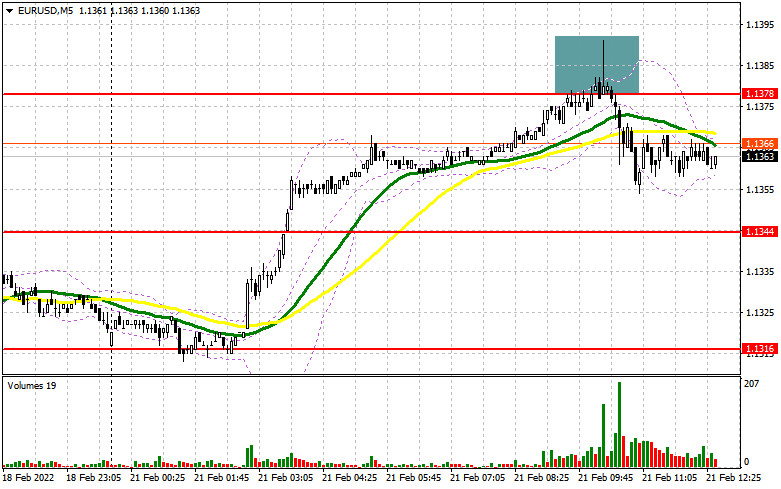

In my morning forecast, I paid attention to the 1.1378 level and recommended making decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened. A slight increase in the euro in the first half of the day occurred immediately after good data on activity in the eurozone, however, due to the low trading volume, buyers did not receive the necessary support from major players, which ultimately led to the pair returning to 1.1378. This scenario led to the formation of a false breakdown and a signal to open short positions on the euro. At the time of writing, the pair has gone down about 25 points and the pressure has decreased. The technical picture has not changed in any way, as has the strategy. And what were the entry points for the pound this morning?

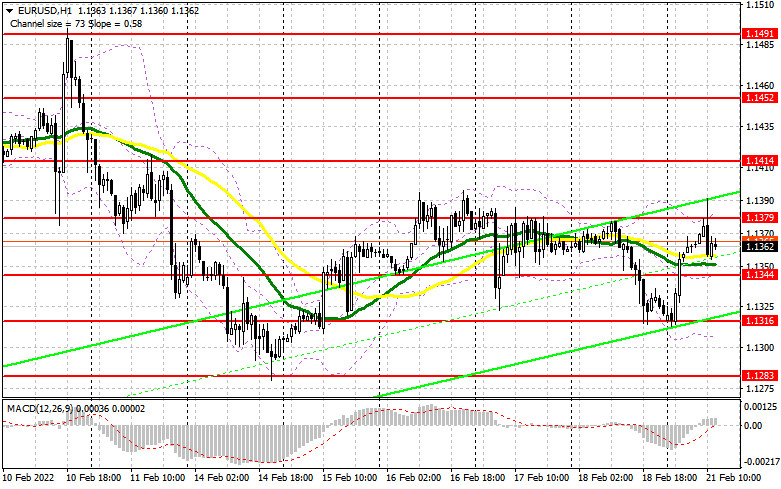

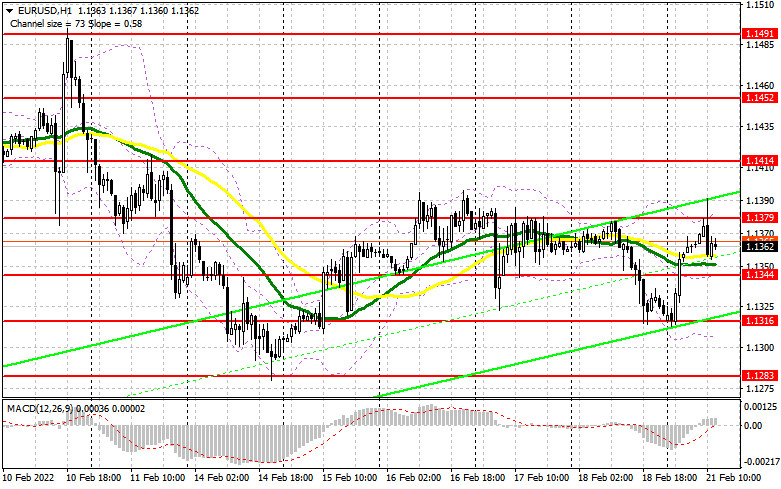

In the afternoon, we are waiting for very low volatility and the same low trading volume. The reason for this is Presidents' Day in the USA. Due to the weekend, stock exchanges will be closed, which will significantly affect the trading volume. There are also no fundamental statistics on the American economy. For this reason, I expect trading to remain within the side channel. Only serious changes in the geopolitical arena will be able to influence the direction of the pair. The important task of the bulls for the second half of the day remains to protect the support of 1.1344, to which the pair is now heading. Moving averages pass just above this level, which retains some advantage for euro buyers. Only the formation of a false breakdown at the level of 1.1344 forms the first entry point into long positions in the continuation of the upward correction. However, to count on a larger recovery of EUR/USD and the pair going beyond the side channel, more active actions of buyers and a breakout of the resistance of 1.1379 are needed, which could not be fixed above in the first half of the day. A breakout and a top-down test of 1.1378 will lead to another buy signal and open the possibility for the pair to recover to the area of 1.1414, near which it will become a little easier for euro buyers to "breathe". The breakdown of this range will resume the bullish trend and open a direct road to the highs: 1.1452 and 1.1491, where I recommend fixing the profits. However, as I noted above, a day off in the US can "put on pause" the plans of buyers of risky assets. With the aggravation of the US-Russia-Ukraine geopolitical conflict, the demand for the US dollar will return quickly, so be careful with buying euros at current highs. A striking example is the inability of bulls to get above 1.1379 even against the background of strong statistics on activity in the manufacturing sector and the service sector of the eurozone countries. If the pair declines during the American session and there is no activity at 1.1344, everything can end very badly. Therefore, it is best not to rush purchasing. The optimal scenario would be a false breakdown at 1.1316, but you can buy the euro immediately for a rebound from the 1.1283 level, or even lower - around 1.1235 with the aim of an upward correction of 20-25 points within a day.

To open short positions on EURUSD, you need:

Sellers showed themselves in the resistance area of 1.1379, forming from there an excellent entry point into short positions, which I analyzed above. Until the moment when trading is conducted below this range, you can count on a further fall of the pair. Given that the volatility will be very low in the afternoon, we can expect the pair to return to the middle border of the side channel. In the second half of the day, the bears need to continue to defend the resistance of 1.1378. The formation of a false breakdown at this level by analogy with what I discussed above, as well as the lack of data on the US - all this will be a signal to open short positions to reduce EUR/USD to the area of the middle of the 1.1344 channel. A breakdown of this area and a reverse test from the bottom up will give an additional signal to open short positions already with the prospect of falling to a minimum of 1.1316. A more distant target will be the 1.1283 region, but its renewal will be possible in the event of an aggravation of the situation and a military conflict on the territory of Ukraine. In the area of 1.1283, I recommend fixing profits. If the euro rises during the American session and there are no bears at 1.1379, it is best not to rush with sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1414. You can sell EUR/USD immediately for a rebound from 1.1452, or even higher - around 1.1491 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for February 8 recorded the growth of long positions and the reduction of short ones. This report already takes into account the meeting of the European Central Bank, at which its president Christine Lagarde made it clear to all market participants that the regulator will act more aggressively if the observed picture with inflation does not change, or changes for the worse. Last week, officials from the ECB took a wait-and-see attitude, and a technical reversal of the bull market led to a decline in the EUR/USD pair. Demand for risky assets also decreased due to the risk of a military conflict between Russia and Ukraine. However, a more weighty argument for the observed downward movement of the EUR/USD pair is the actions of the Federal Reserve System in relation to interest rates. On Monday, February 14, an extraordinary meeting was held, the results of which were preferred to be hidden from the public - this is even more adding fuel to the fire that is flaring up around high inflationary pressure in the United States. Some economists expect that the central bank may resort to more aggressive actions and raise rates immediately by 0.5% in March this year, rather than by 0.25%, as originally planned. This is a kind of bullish signal for the US dollar. The COT report indicates that long non-commercial positions increased from the level of 213,563 to the level of 218,973, while short non-commercial positions decreased from the level of 183,847 to the level of 180,131. This suggests that traders continue to build up long positions with every good decline in the European currency. At the end of the week, the total non-commercial net position increased slightly and amounted to 38,842 against 29,716. The weekly closing price jumped and amounted to 1.1441 against 1.1229 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates market uncertainty.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.1380 will lead to new growth of the euro. In the case of a decline, the lower limit of the indicator around 1.1300 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.