For long positions on GBP/USD:

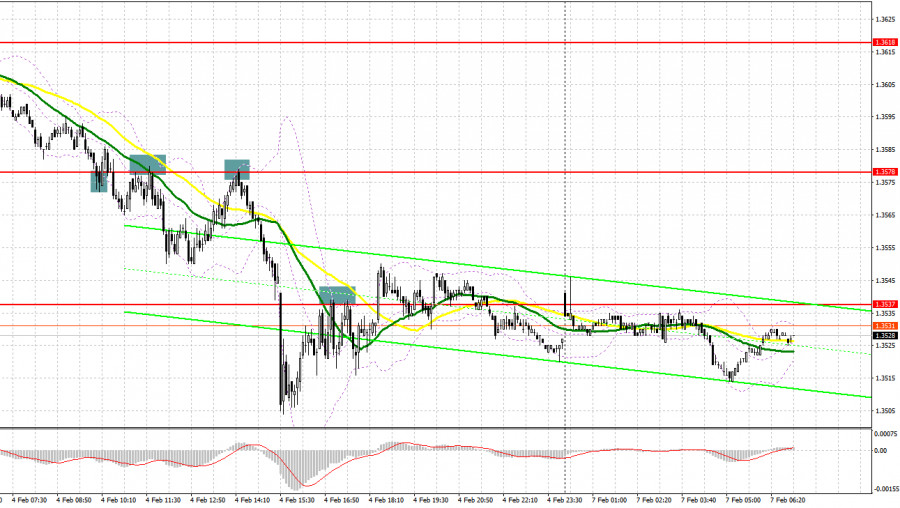

On Friday, there were quite a lot of signals to enter the market. Let's take a look at the 5-minute chart and see what happened there. In my morning review, I outlined the level of 1.3578. In the first half of the day, a false breakout as part of a bullish trend seemed to be an excellent signal for going long but, unfortunately, there was no upward movement in the end. A repeated breakout of this range and a retest from the bottom up formed a sell signal. The second entry point for opening short positions at this level had been formed before the data on the US labor market was released. As a result, it the pound fell by more than 70 pips.

Strong data on the US labor market weighed on the pound, leaving no chance for a correction even in the afternoon. A slow pace of economic recovery and high inflation are scaring off buyers even after the recent rate hike by the Bank of England. Amid the lack of important reports today, the pound/dollar pair may stay under pressure.

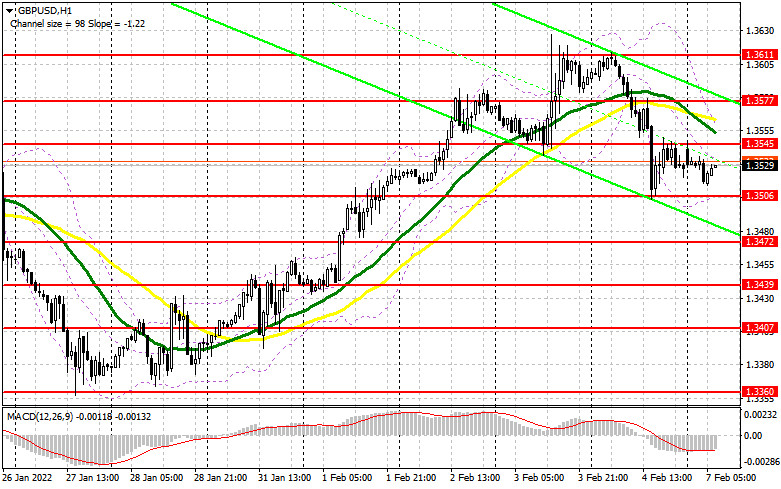

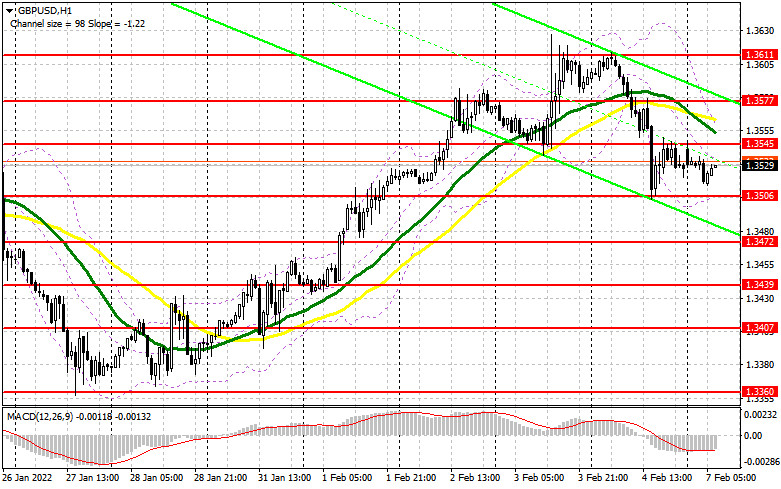

Today, the main goal for bulls will be to defend the support level of 1.3506. From this range, the pair may resume its bullish run that started last week. It is important that the price form a false breakout at this level so that we have the first entry point into long positions. In the UK, only the HBOS house price index is published today, which is of no particular interest to forex traders. Therefore, volatility will be quite low today. Another important task for bulls is to break through and test the level of 1.3545 from top to bottom. This is where the moving averages are located that support the bearish trend. This will create an additional buy signal with a target of 1.3577. A retest of the 1.3611 area, from where the pound started its fall on Friday, is another goal for buyers. I recommend taking profit there. If GBP/USD declines during the European session and bullish activity is low at 1.3506, it is better to wait with buying risk assets. I would advise you to wait for a test of the next major level at 1.3472. Only the formation of a false breakout will give an entry point into long positions. You can buy the pound immediately on a rebound from 1.3439, or even lower from a low of 1.3407, considering a possible correction of 20-25 pips within the day.

For short positions on GBP/USD:

Bears' wild activity on Friday canceled some of the stop-loss orders set by the bulls and resulted in a sharp drop of the pair. Upbeat data from the US labor market was one of the reasons for such a fall in the pound. Today, the primary task of sellers is to protect the key level of 1.3545. An unsuccessful attempt to consolidate above this range will form the first entry point for going short. We can expect a further downward correction of the pair after the bullish run from the last week to the support area of 1.3506, which was tested on Friday. A breakout and a top-to-bottom test of 1.3506 will give an additional entry point for selling the pound with the downward targets at 1.3472 and 1.3439, where I recommend taking profit. If the pair rises during the European session and sellers are weak at 1.3545 amid the lack of economic news, it is better to wait until the price hits the next major resistance level of 1.3577. I would also advise you to open short positions there only in case of a false breakout. You can sell GBP/USD immediately on a rebound from 1.3611, or even higher from the high of 1.3656, considering a possible pullback by 20-25 pips within the day.

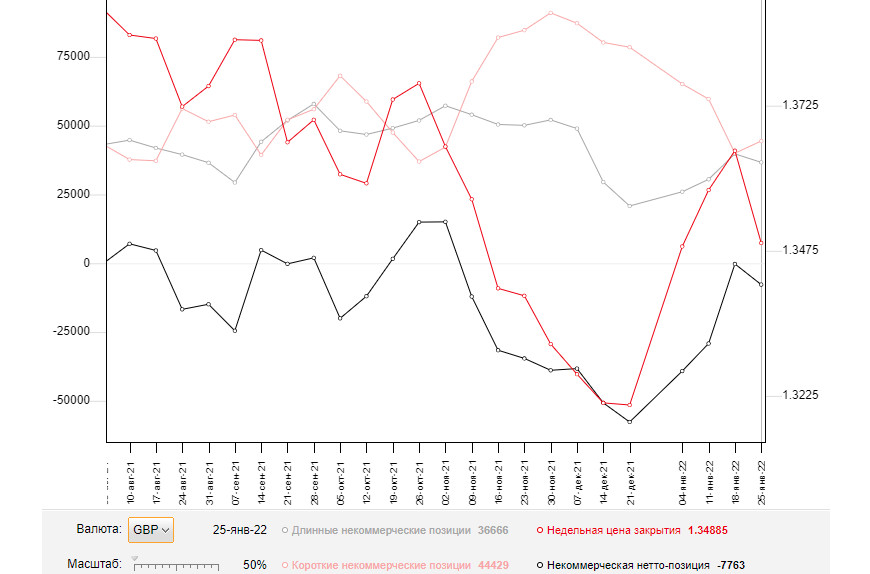

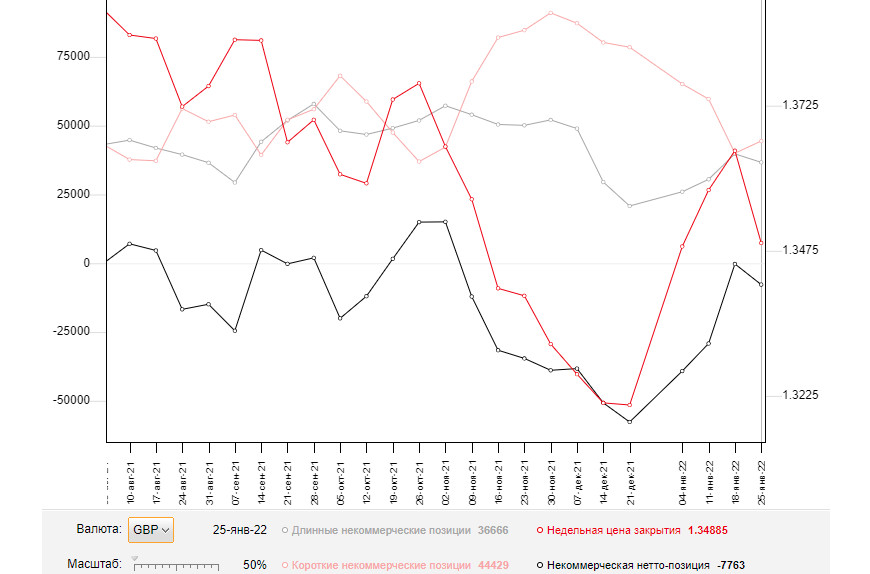

The COT report (Commitment of Traders) for January 25 revealed an increase in the number of short positions and a sharp drop in the long ones. This made the market bearish again sellers, but the situation may change dramatically this week. Bears tried to continue the downtrend but it was not easy to do. Even the statement made by the US Federal Reserve about a rate hike in March did not support sellers. The demand for the pound is likely to recover gradually. This Thursday, the committee of the Bank of England will meet to decide whether to raise the rate once again. However, the pound will remain under pressure due to the overall fundamental situation, which is limiting its upward potential. At the same time, on a bigger scale, the outlook for the British pound is positive, and the current downward correction makes it more attractive. In any case, the Bank of England's decision to raise interest rates later this year will push the pound to new highs. The COT report from January 25 indicated that the number of long positions of the non-commercial group of traders fell from 39,760 to 36,666, while short positions rose from 40,007 to 44,429. This caused the negative non-commercial net position to fall from -247 to -7,763. The closing price of the week dropped from 1.3647 to 1.3488.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates an ongoing correction on the pair.

Please note the time period and prices of moving averages are analyzed only for the H1 chart which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

A breakout of the upper boundary at 1.3550 will facilitate growth, while the breakout of the lower boundary around 1.1160 will put more pressure on the pair.

Description of indicators:

• A moving average determines the current trend by smoothing volatility and noise. 50-day period; marked in yellow on the chart;

• A moving average determines the current trend by smoothing volatility and noise. 30-day period; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA, 12-day period; Slow EMA, 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long position opened by non-commercial traders;

• Short non-commercial positions represent the total number of short position opened by non-commercial traders;

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.