Long positions on EUR/USD:

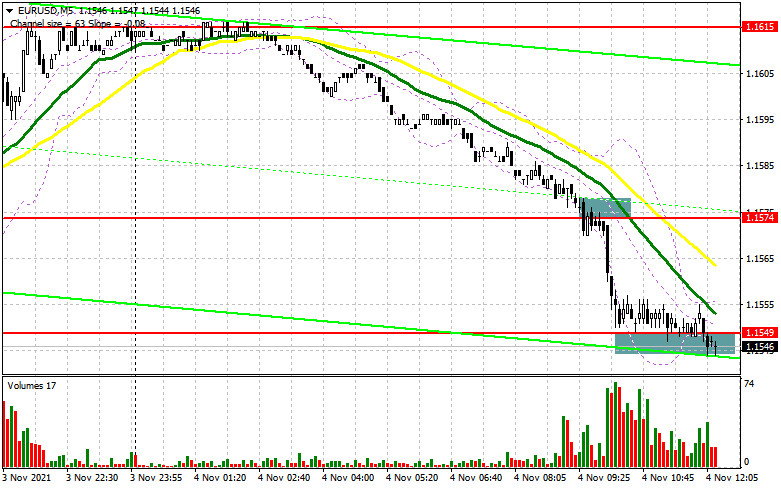

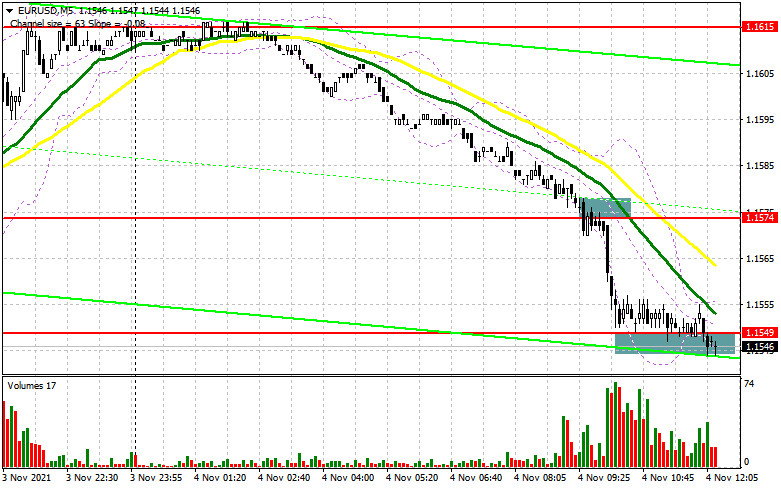

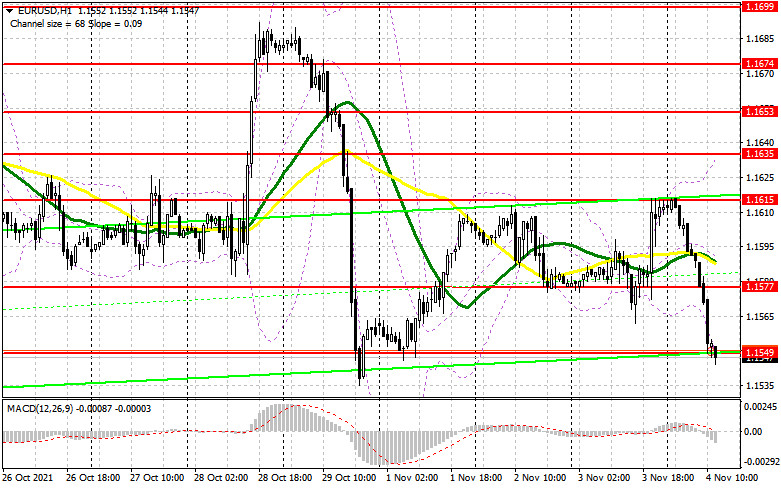

In the morning review, the focus was on the level of 1.1574. I told you to consider entering the market from this mark. Now, let's look at the M5 chart and determine entry points. The price broke and consolidated below 1.1574. A retest of this mark produced a strong SELL signal. As a result, the quote fell by around 25 pips and touched the support level of 1.1549, where a false breakout generated a BUY signal. At the moment of writing, the price failed to increase. The fact that the Federal Reserve announced it would start the tapering of the quantitative easing program could be considered a strong bullish signal for the greenback. In the second half of the day, the pair is likely to remain under pressure.

Macroeconomic data scheduled for the second half of the day is expected to push EUR/USD down. Therefore, it would be wise to enter long positions only after a false breakout at 1.1549 with the target at the resistance level of 1.1577. In case of disappointing data on the US jobs market and balance of trade, the price is likely to break and test this level top/bottom. If so, a strong BUY entry point will form with the target at the high of 1.1615. In case EUR/USD continues its bearish run in the second half of the day and there is a lack of bull activity at 1.1549, bulls' task would be to protect the support level of 1.1526. A false breakout at this level will produce a strong BUY entry point. If there is a lack of bull activity there, traders should enter long positions only when the quote reaches 1.1494, where they could buy the pair on a rebound, allowing a 15-20 pips correction intraday.

Short positions on EUR/USD:

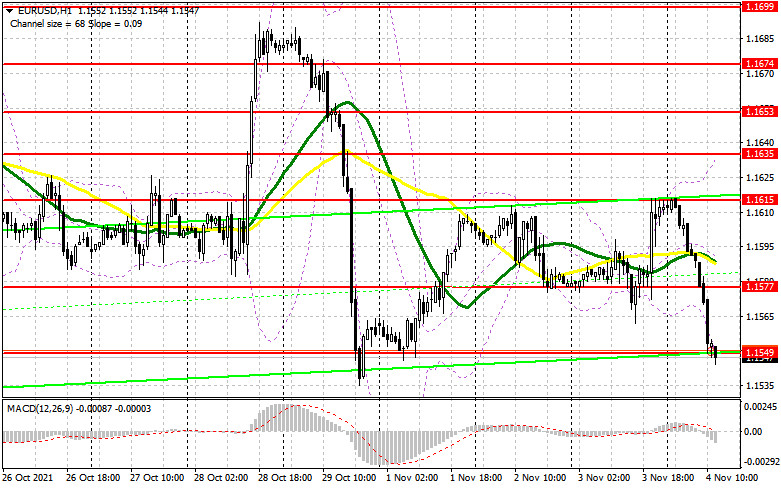

The primary task for euro bears would be to protect the resistance level of 1.1577. There are bullish moving averages above this mark. Only a false breakout of this barrier along with strong initial jobless claims data in the US could form a strong SELL entry point. Consequently, the pair could fall to the support level of 1.1549. A breakout and a test of this mark bottom/top are likely to generate an additional SELL signal with the target at 1.1526. In case of a breakout there, the euro might plunge to 1.1494 where traders should lock in profit. If the price starts to increase in the second half of the day and there is a lack of bear activity at 1.1577, traders should refrain from selling EUR/USD until the price updates the weekly high of 1.1615. Short positions could be opened immediately on a bounce from 1.1635, allowing a 15-20 pips correction. Today, ECB President Christine Lagarde is likely to address the issue of inflation in the eurozone. This could provide support for the euro in the second half of the day. So traders should be careful when selling at weekly lows.

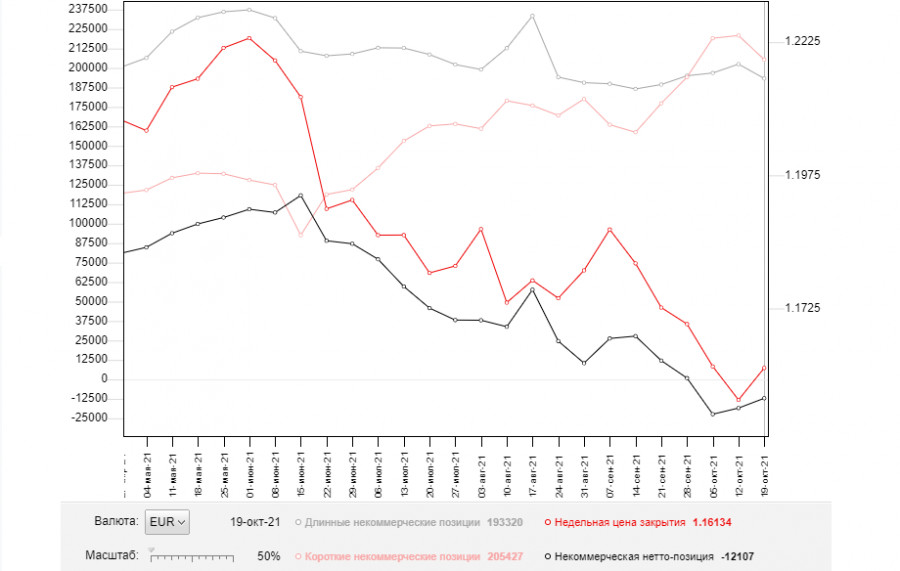

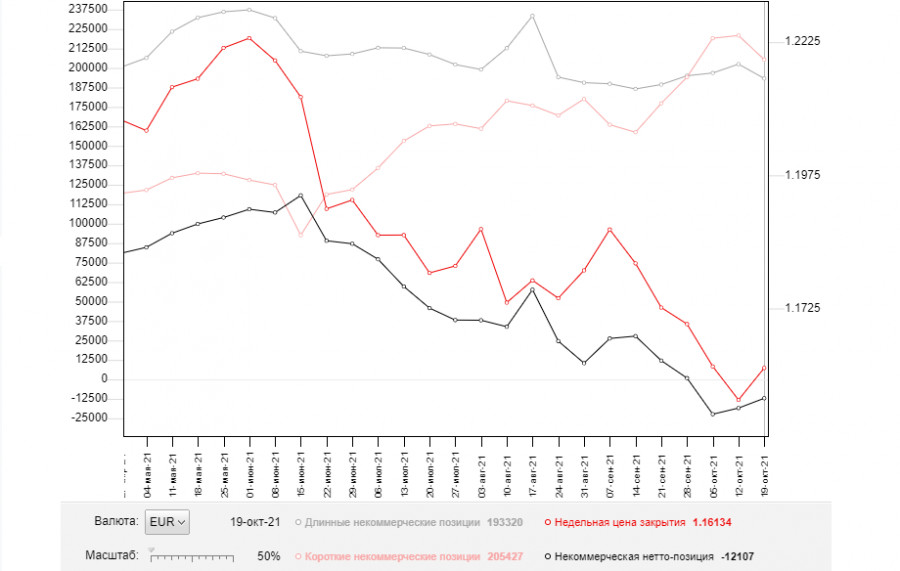

The Commitment of Traders (COT) report as of October 19 logged a decrease in both short and long positions, which led to a slight recovery in the negative delta, as more bears than bulls exited the market. Business activity in the manufacturing and services sector in the eurozone declined this week. However, a more serious issue affecting the euro in the short term is the fourth wave of the coronavirus pandemic that is now tightening its grip on the European Union. A steady pace of business activity and the beginning of the tapering process in the United States will provide support for the American economy. At the same time, the greenback is unlikely to take advantage of the situation because investors could turn to risk assets. The COT report revealed that long non-commercial positions fell to 193,320 from 202,512, while short non-commercial positions dropped to 205,427 from 220,910. At the end of the week, the total non-commercial net position increased to -12,107 versus -18,398. The weekly closing price rose to 1.1613 from 1.1553.

Indicator signals:

Moving averages

Trading is carried out below 30- and 50-period MAs, indicating a bearish market.

Important! The period and prices of moving averages are viewed by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands

The euro is expected to plunge if the price breaks the lower band at 1.1545. In case of growth, the quote is likely to encounter resistance at the upper band at around 1.1635.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.