The euro-dollar pair ended the previous week at around 1.1232, that is, above the Bollinger Bands average line and above the Tenkan-sen and Kijun-sen lines (on the daily chart), while the Ichimoku indicator formed a "Golden Cross" signal which cautioned a possible trend reversal. That is, from a technical point of view, the pair retained the potential for further price growth. But the eur/usd bulls need an appropriate fundamental argument.

Starting on May 13, the trading week is full of macroeconomic reports, although key European and US indicators have already been published over the past two weeks. Nevertheless, the expected releases will complement the fundamental picture by folding the corresponding puzzle. By and large, the dollar and the euro are now at a crossroads, balancing on the verge of stalling. Dollar bulls are closely watching the US inflation indicators, while the European currency reacts to the general dynamics of macroeconomic indicators, hoping for a further recovery of the eurozone economy.

Here it is worth noting that the external fundamental background could not support the dollar: despite the actions and comments of Trump, the Chinese showed a low-key response and continued trade negotiations. The vice premier of China even noted a certain constructiveness in the negotiations, although he acknowledged the existence of remaining differences, which will be discussed at the next meeting to be held in Beijing. A similar position was voiced by the US president. In other words, the risk of a resumption of the trade war has declined: Trump even stated that the imposed duties could be abolished after further negotiations.

Due to this fact, the main focus of EUR/USD traders is once again returning to macroeconomic statistics. Monday in this context is absolutely empty: today the interest of investors can only be caused by the speech of the head of the Federal Reserve Bank of Boston, Eric Rosengren. This year, he has the right to vote in the Fed, so his comments may affect the dynamics of trading. Rosengren was a consistent hawk for a long time, but at the beginning of this year he was concerned about the increased risks (first of all, the relatively weak inflation rate). Given the latest data on the growth of the consumer price index, his rhetoric is unlikely to toughen.

We learn the key data on the growth of German inflation on Thursday. Germany is the "locomotive" of the European economy, so this indicator is important for the euro. German inflation rose to 1% in April on a monthly basis and to 2% in annual terms. The harmonized consumer price index (adjusted for changes in taxes) also showed a positive trend, and a significant one. The final figures for April will be published today. According to most experts, they will coincide with the initial assessment, providing background support for the euro.

Also on Tuesday, traders of the pair will track the release of the Sentiment Index in the business environment from the ZEW Institute in Germany and throughout the eurozone. The German indicator in April showed the strongest increase over the last year. For the first time since March 2018, the indicator came out of the negative area, and traders could not but pay attention to this fact. In addition, the increase in the index as a whole in the eurozone also exceeded the zero value (for the first time in the last year) and exceeded analysts' expectations, having updated the 11-month high. According to preliminary forecasts, positive dynamics will follow in May, both in Germany and in Europe as a whole. If this forecast is confirmed, the euro will get quite strong support, as in this case we can talk about a persistent trend.

On Wednesday, the EUR/USD pair will respond to macroeconomic reports from China and the United States. So, the Chinese authorities will publish data on the growth of industrial production. Last month, this figure surprised investors with a record growth of up to 8.5%. In April, the indicator is expected to decline to 6.5%, but if China again surprises with the growth of industry, then the risk-taking in the market will noticeably increase, putting strong pressure on the US currency.

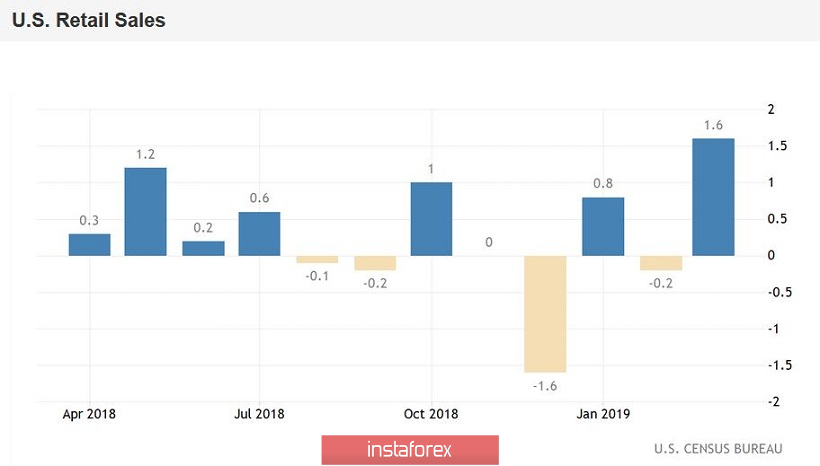

US retail sales data will be published during the US session on Wednesday. In March, this figure went out of the negative area (including without car sales) - the index rose to 1.6% and 1.2%, respectively. This week we will learn April figures, which, according to preliminary forecasts, will be worse than March figures. Taking into account auto sales, the index should fall to 0.2%, excluding - to 0.7%.

On Thursday, EUR/USD traders should pay attention to the speech of ECB Vice President Luis de Guindos, announced the probability of resuscitation of the QE program. Given the dynamics of macroeconomic indicators in Europe, he can change his position on this issue, thereby providing support for the euro. Also on Thursday, Fed representatives will speak - Neil Kashkari (does not have the right to vote) and Laell Brainard (with the right to vote). There will be no important economic reports on this day - the only thing that is of interest is the indicator of building permits issued in the United States.

But on Friday, all the attention of euro-dollar traders will again be focused on the inflation rate - this time in the eurozone. The final data for April will be published on this day. Let me remind you that the preliminary assessment turned out to be much better than expected - the general consumer price index jumped to 1.7%, while core inflation rose to 1.2%. According to the overwhelming majority of experts, these figures will not be revised downward. This fact will strongly support the euro, as some analysts have previously doubted the "credibility" of the April result.

On Friday, the US currency will respond to the rhetoric of the Fed representatives: on the last trading day, John Williams and Richard Clarida will speak. This year, they have the right to vote in the Fed, so their assessment of the current situation will have an impact on the dollar's position.

Thus, in terms of the foundation, the EUR/USD pair has the potential for further growth - at least to the lower boundary of the Kumo cloud on the daily chart (1.1275). If the eurozone economy will show signs of recovery, the upward dynamics may continue - up to the middle of the 13th figure (that is, to the upper boundary of the Kumo cloud).