The EUR/USD pair traded with slight gains on Thursday before the Federal Reserve meeting. As usual, movements following the Fed meeting still need to be analyzed. At least 24 hours must pass after a significant fundamental event to conclude its results and the market's reaction. Recall that on Wednesday night, the market reacted sharply to the preliminary results of the U.S. elections, and the subsequent movements throughout the day were chaotic and difficult to analyze. The market trades on emotions during such periods, leading to highly erratic and complex movements.

Looking at the current situation overall, the dollar remains in a strong position. Even if we see short-term declines, traders should not be misled. A glance at the daily or weekly timeframes shows that the dollar has excellent growth prospects. As we've reiterated, there are numerous reasons why the dollar should rise in the medium term. The election of Donald Trump as President of the United States does not alter this outlook, at least for the following year.

It is essential to note that even if Trump introduces new trade wars, makes high-profile decisions, and behaves as usual, it will take considerable time for his initiatives to be implemented and take effect. The dollar remains undervalued, and the market continues to rebalance the EUR/USD pair after two years of the Federal Reserve's monetary policy easing.

Current Fed policy decisions are almost irrelevant. The market has already priced in nearly the entire rate-cut cycle. The only significant trigger for the dollar would be a change in the trajectory of interest rates. For instance, if U.S. inflation rises rapidly, forcing the Fed to pause rate cuts for an extended period, the market would respond with further dollar purchases since its dovish scenario will take much longer to implement. Conversely, if the Fed begins cutting rates more aggressively than expected (e.g., by 0.5% per meeting), the dollar might weaken as such a dovish scenario has not been priced in. However, the dollar remains oversold generally, and the global trend is bearish for EUR/USD. Therefore, a drop to the 1.06 level is the minimum expectation. A decline to 1.0435 is the target over the next 1–3 months. A fall to the 1.02 level is highly likely. Parity remains a realistic goal.

It's crucial to remember that the fundamental backdrop can change, requiring adjustments to movement targets and strategy direction. However, throughout 2024, the fundamentals have never shifted enough to abandon this strategy. The price may attempt another correction over the next week or two, but we ultimately expect a decline.

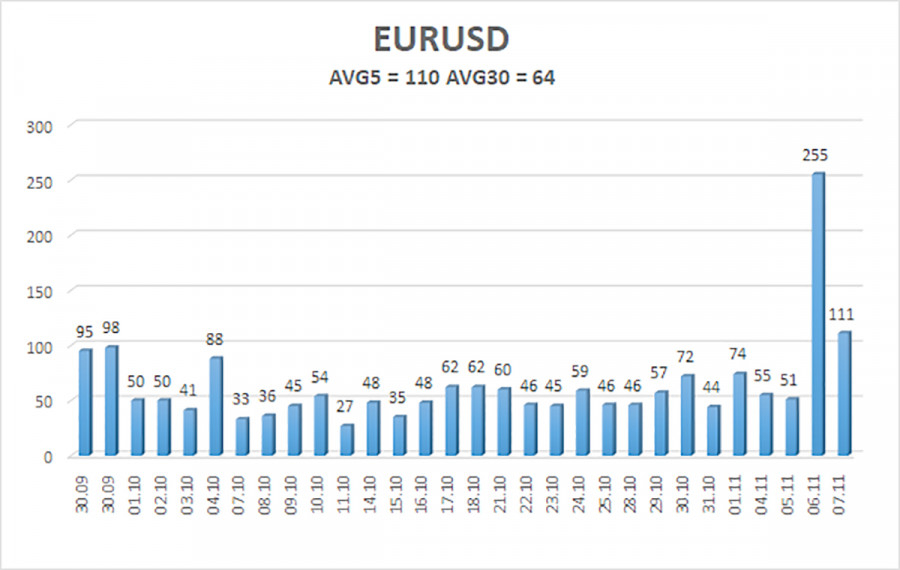

The average volatility of the euro/dollar currency pair over the last five trading days as of November 8 is 110 pips, characterized as "high." We expect the pair to move between 1.0681 and 1.0901 on Friday. The higher linear regression channel is directed downwards; the global downtrend is still intact. The CCI indicator entered the oversold area, warning about the beginning of a new round of correction.

Nearest Support Levels:

- S1: 1.0742

- S2: 1.0681

- S3: 1.0620

Nearest Resistance Levels:

- R1: 1.0803

- R2: 1.0864

- R3: 1.0925

Trading Recommendations:

The EUR/USD pair has resumed its downward trend but initiated a new corrective wave. Over recent weeks, we've expected further declines in the euro in the medium term and continue to support the bearish trend. There is a possibility that the market has worked off all or almost all future Fed rate cuts. If so, the dollar has no more reasons to fall, although there were few before. Short positions can still be considered with targets at 1.0681 and 1.0620 if the price stays below the moving average. If you are trading on a "pure" technical approach, long positions can be considered if the price consolidates above the moving average with targets at 1.0901 and 1.0925.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.