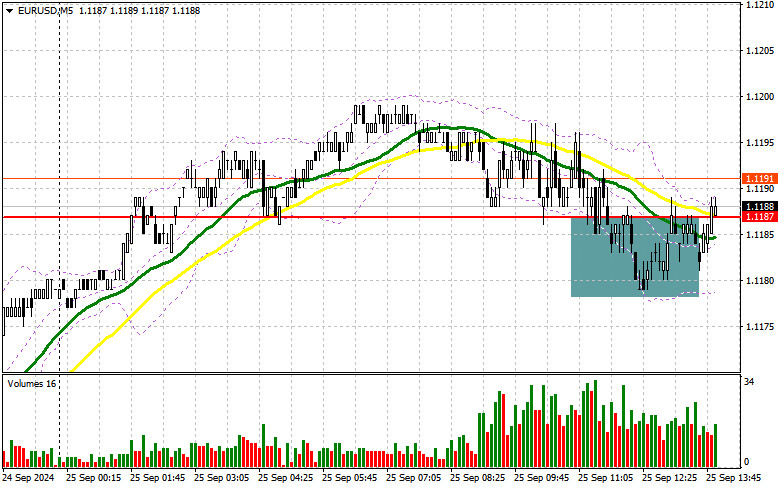

In my morning forecast, I highlighted the significance of the 1.1187 level for making trading decisions. Let's now analyze the 5-minute chart to understand what happened. The decline and the formation of a false breakout around 1.1187 provided an excellent opportunity to buy the euro. However, due to low volatility and trading volume, the expected significant upward movement did not materialize. The technical outlook for the second half of the day remains unchanged.

To Open Long Positions on EUR/USD:

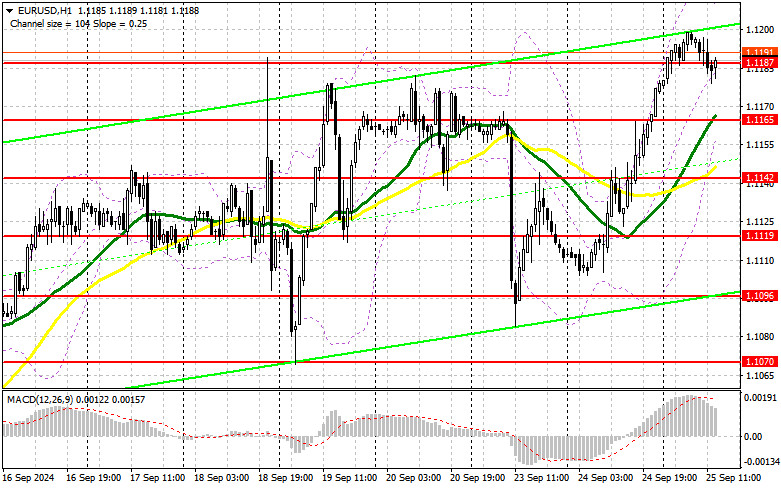

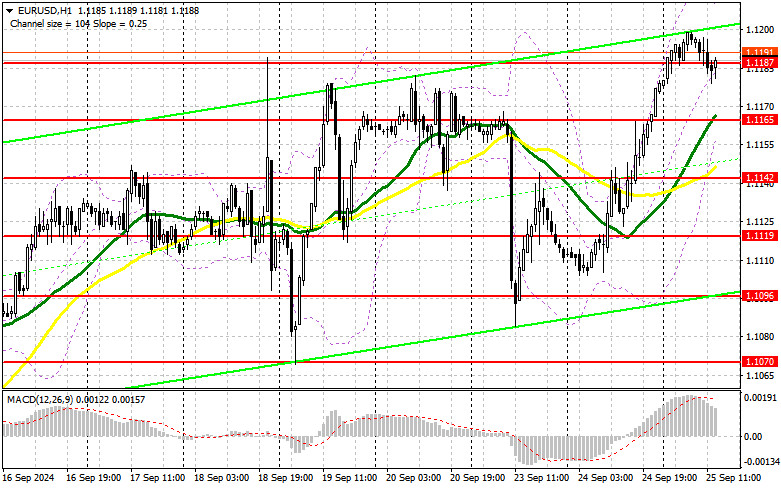

The absence of fundamental statistics primarily accounted for the weak demand for risk assets, including the euro. The entry point established earlier in the day still holds good potential to be effective, particularly if supported by forthcoming U.S. economic data. Weak data on new home sales in the U.S. could propel the EUR/USD to a new weekly high. Comments by FOMC member Adriana D. Kugler might also support the EUR/USD, so the scenario remains favorable for buyers of risk assets. In the event of a decline, only a false breakout near 1.1165, where the moving averages are located, will provide a suitable condition to open new long positions aiming for a return to 1.1187. A breakout and retest from top to bottom of this range could lead to further growth in the pair, with a chance to test 1.1213. The most distant target will be 1.1237, where I will be taking profits. If there is a downturn in EUR/USD and a lack of activity around 1.1165 in the latter part of the day, pressure on the pair will return, potentially leading to a larger sell-off. In such a scenario, I will only consider entering after a false breakout around the next support at 1.1142. I plan to open long positions immediately on a rebound from 1.1119, targeting an upward correction of 30-35 points intraday.

To Open Short Positions on EUR/USD:

Sellers have a chance to drive the euro lower, but strong U.S. statistics and protection of the 1.1187 level are necessary. Only a false breakout there will provide a suitable condition to open short positions aiming for a correction to the support area of 1.1165, where the moving averages favor the bulls. I expect quite active buying there, especially if U.S. labor market data is weak. However, a breakout and consolidation below this range, along with a retest from bottom to top, will offer another selling opportunity, moving toward 1.1096, where I expect substantial euro buying interest to emerge. The most distant target will be the 1.1142 level, which would completely counter the bulls' plans for further growth. I will take profits there. If EUR/USD moves up and bears are absent at 1.1187, bulls will target a new weekly high. In that case, I will delay selling until the next resistance at 1.1213. I will also sell there but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.1237, targeting a downward correction of 30-35 points.

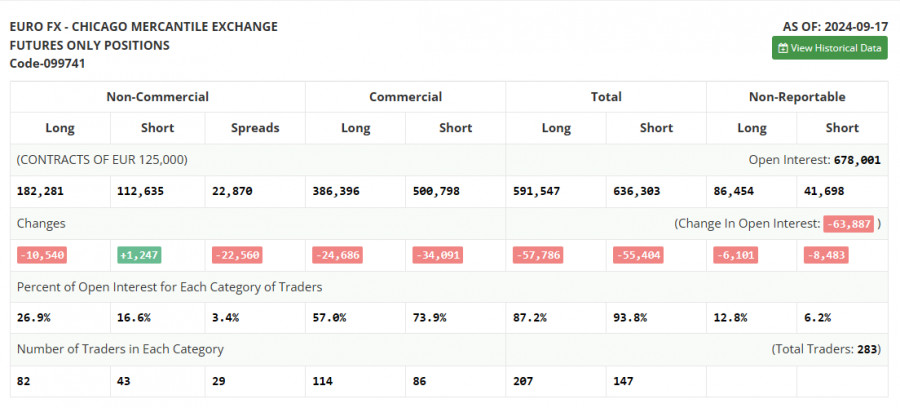

The COT report for September 17 showed a reduction in long positions and a slight increase in short positions. The Federal Reserve's decision to cut rates by 0.5% was unexpected, but traders did not significantly adjust their positions, favoring the strengthening of the euro over the U.S. dollar. Soon, we will only hear speeches from several Federal Reserve and European Central Bank representatives without any significant fundamental statistics, so market volatility may noticeably decrease. However, this does not negate the medium-term upward trend for the euro, and the lower the pair goes, the more attractive it becomes for buying. The COT report indicated that non-commercial long positions decreased by 10,540 to 182,281, while short non-commercial positions increased by 1,247 to 112,635. As a result, the gap between long and short positions narrowed by 20,560.

Indicator Signals:

Moving Averages:

Trading is conducted above the 30- and 50-day moving averages, indicating further growth for the euro.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the daily D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.1165 will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 50, marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12, Slow EMA – period 26, SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open positions of non-commercial traders.

- Short non-commercial positions: Represent the total short open positions of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.