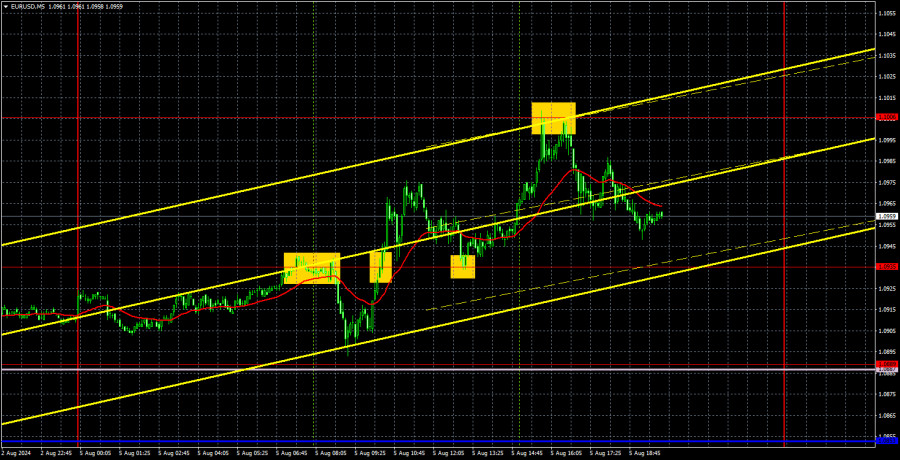

Analysis of EUR/USD 5M

On Monday, the EUR/USD pair showed relatively high volatility and sustained its growth, which began on Friday. At first glance, it was unclear what caused the new bullish momentum. On second glance, it was still not entirely clear. However, a bit later, it became evident that many markets experienced a "black day" on Monday. The cryptocurrency market, the U.S. stock market, and many stock markets worldwide closed in record "losses." Therefore, the increased volatility in the currency market results from the same events.

The events are quite simple but not obvious. Over the weekend, rumors emerged that the Federal Reserve might lower the key rate by 0.5% in September and conduct 2 or 3 such "extreme" easings by the end of the year. Many experts began to proclaim at every corner that a recession for the American economy was inevitable, and the Fed should urgently save the situation. It is hard to say how much this information corresponds to real affairs. However, rumors even began to appear in the market about an emergency Fed meeting to be held before September to decide on easing monetary policy.

If these rumors continue circulating in the market, the U.S. dollar may continue its free fall. Admit that if Friday's reports had not been disastrous again, the pair's current rise would not have happened. There wouldn't have been a panic in the markets. Therefore, technical analysis is irrelevant here. Four trading signals were formed on Monday, two duplicating each other. Only the second and fourth signals were profitable, but due to good volatility, the profit was decent.

COT report:

The latest COT report is dated July 30. The illustration above shows that the net position of non-commercial traders has been bullish for a long time and remains so at this time. The bears' attempt to move into their zone of dominance failed miserably. The net position of non-commercial traders (red line) has declined in recent months, while that of commercial traders (blue line) has grown. They are roughly equal at this time, suggesting a new attempt by the bears to retake the lead.

We also still do not see any fundamental factors allowing the euro to gain significant momentum, and the technical analysis tells us that the price is in the consolidation zone—in other words, in a flat range. The general downtrend in the euro remains, but the market decided to take a break for six months.

At the moment, the red and blue lines are slightly moving away from each other, which indicates that long positions on the single currency are increasing. However, given the flat conditions, such changes cannot be the basis for long-term conclusions. During the last reporting week, the number of longs in the non-commercial group decreased by 5,900, while the number of shorts increased by 12,100. Accordingly, the net position decreased by 18,000. According to COT reports, the euro still has the potential for decline.

Analysis of EUR/USD 1H

In the hourly time frame, EUR/USD again showed a sharp and strong growth, but, from our perspective, it does not offer "great prospects" for the euro. Panic prevailed in the markets on Friday and Monday, yet the euro remains within the same horizontal channel of 1.0600-1.1000, as it has for the past seven months. We believe there is a high likelihood of a new bounce from the 1.1000 level unless the Federal Reserve holds an emergency meeting this week.

For August 6, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0797, 1.0843, 1.0889, 1.0935, 1.1006, 1.1092, as well as the Senkou Span B (1.0851) and Kijun-sen (1.0894) lines. The Ichimoku indicator lines can move during the day, so this should be considered when identifying trading signals. Remember to set a Stop Loss to break even if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

The only relatively important event on Tuesday will be the Eurozone retail sales report. But who is concerned about this report now? The market will look for new signals about a possible emergency rate cut from the Fed and closely monitor other markets tomorrow. The state of panic may persist, and panic always results in chaotic movements.

Explanation of illustrations:

Support and resistance levels: Thick red lines near which the trend may end.

Kijun-sen and Senkou Span B lines: These Ichimoku indicator lines, transferred from the 4-hour timeframe to the hourly chart, are strong lines.

Extreme levels: Thin red lines from which the price previously bounced. These provide trading signals.

Yellow lines: Trend lines, trend channels, and other technical patterns.

Indicator 1 on COT charts: The net position size for each category of traders