The GBP/USD currency pair did not attempt to correct itself yesterday. All we observed was a hint at a minimal downward retracement. There was no sign of the pair decreasing anywhere. The British pound continues to surge without substantial reasons or grounds. It's worth recalling that there were no significant reports or events in the United States or the United Kingdom over the last three to four trading days. Only yesterday, the second estimate of the GDP for the third quarter in the United States was published, exceeding forecasts and expected to cause at least a slight strengthening of the American currency. However, it didn't happen. The fact remains whether the market deemed the second estimate insignificant or is currently not considering the possibility of buying the dollar. The dollar isn't growing even when significantly oversold, with concrete macroeconomic reasons supporting it.

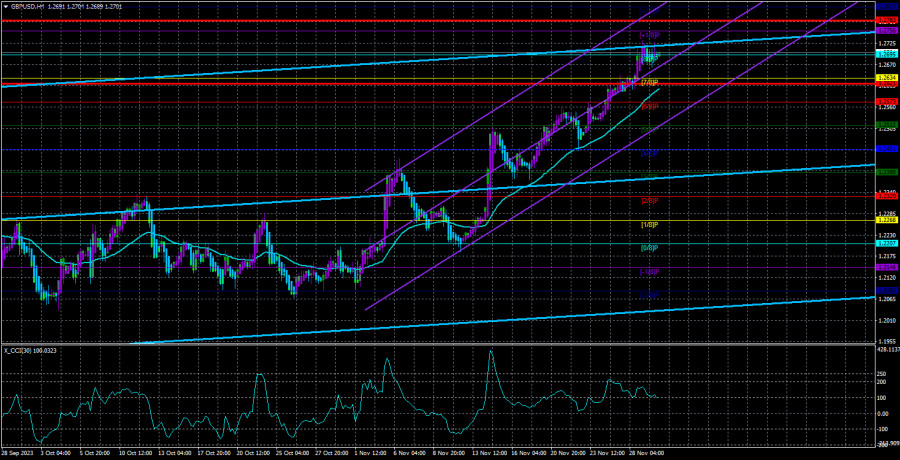

We've discussed the overbought condition of the pair many times. The CCI indicator could be more timely. There can be a considerable time lag between the formation of overbought conditions and the start of a decline. However, our overbought condition is already triple. The longer it persists, the more confidence grows in a substantial decline in the British pound.

As for the U.S. dollar, even many globally renowned experts are perplexed: why is the dollar falling? Of course, one can always argue that the U.S. economy is on the verge of collapse, the national debt is constantly rising, and the Federal Reserve keeps printing billions and trillions of dollars. However, GDP indicators point to economic growth; the U.S. debt has been increasing for decades, and official inflation is only 3.2%. Therefore, official statistics show no special problems with the U.S. economy and the dollar.

Bowman is ready for tightening if necessary. The Federal Reserve's monetary policy remains the most "hawkish" among all major central banks globally. The Federal Reserve has yet to officially announce the end of the tightening cycle, but it is likely to decide on another key rate hike. Federal Reserve representatives speak practically every day, but their rhetoric boils down to the words: if tightening is necessary, the Federal Reserve will do it. So, everything now depends on a combination of inflation, unemployment, and labor market indicators. Economic growth also matters because if the economy is growing rapidly and strongly, business and economic activity increase, which, in turn, fuels inflation. But if inflation slows down, there is no reason to raise the key rate again.

Yesterday, Michelle Bowman said she is ready to support new tightening if necessary. "If inflation stalls or it becomes clear that the current rate is insufficient to return it to the target level, I will be ready to vote for additional tightening," said Ms. Bowman. This news could have triggered the strengthening of the dollar, but there is nothing new in Bowman's words. As we've already mentioned, practically all Federal Reserve's monetary committee members adhere to this viewpoint. Therefore, the market and the dollar did not react to these "conditionally hawkish" statements. And they shouldn't have.

We've said before that there is no point in expecting loud statements from representatives of the Federal Reserve or the Bank of England. Therefore, each subsequent speech repeats the content and meaning of the previous one. The market will not and should not react to such events. The key remains the technical picture because the market pays no attention to fundamentals and macroeconomics. Therefore, as long as the price does not settle at least below the moving average, the uptrend will persist.

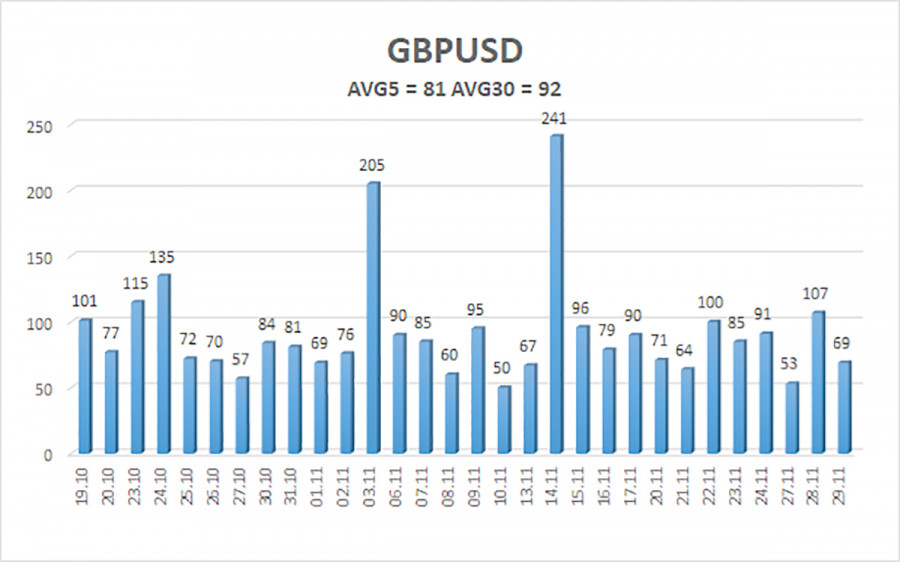

The average volatility of the GBP/USD pair over the last five trading days is 81 points. For the pound/dollar pair, this value is "average." Thus, on Thursday, November 30, we expect movements within the range limited by the levels of 1.2621 and 1.2783. A reversal of the Heiken Ashi indicator back down will indicate a possible turn of the downward correction, which could be the beginning of a downward trend.

Nearest support levels:

S1 – 1.2695

S2 – 1.2634

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2817

Trading recommendations:

The GBP/USD currency pair continues the new spiral of upward movement and is positioned above the moving average line. Short positions can be opened with targets at 1.2512 and 1.2451 if the price settles below the moving average. Long positions formally remain relevant since the price is above the moving average, with targets at 1.2756 and 1.2783. However, the CCI indicator's triple overbought condition and the British pound's illogical rise still signal the danger of opening such deals.

Explanations for the illustrations:

Linear regression channels help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the likely price channel the pair will spend the next day based on current volatility indicators.

The CCI indicator entering the overbought zone (below -250) or oversold zone (above +250) indicates an approaching reversal of the trend in the opposite direction.