Analysis of GBP/USD 5M

GBP/USD once again rose more than it fell on Friday. For several weeks, we have been anticipating the end of the current uptrend, as we believe that there are no compelling fundamental reasons for its continuation. Occasionally, economic reports provide support to the pound. The recent U.S. reports have more often been disappointing than positive. Still, for instance, on Friday, there were no significant events, no news in favor of the pound, and yet the British currency found reasons to rise. The pair continued to trade higher throughout the day. Thus, with the pound, we are currently observing an unfounded, corrective growth.

There was only one trading signal for the pound, and it formed overnight. With minimal error, the price bounced off the level of 1.2520, after which it rose by about 70 pips and reached the level of 1.2605, where it remained until the market closed. Therefore, it was advisable to manually close the long position near this level. The profit was at least 60 pips, which is quite good. Almost the entire upward movement was captured.

COT report:

COT reports on the British pound also align perfectly with what's happening in the market. According to the latest report on GBP/USD, the non-commercial group closed 4,700 long positions and 6,700 short ones. Thus, the net position of non-commercial traders decreased by another 11,400 contracts in a week. The net position indicator has been steadily rising over the past 12 months, but it has been firmly decreasing since August. The British pound is also losing ground. We have been waiting for many months for the sterling to reverse downwards. Perhaps GBP/USD is at the very beginning of a prolonged downtrend or in the middle of a strong correction. At least in the coming months, we do not see significant prospects for the pound to rise. Even if the entire decline is just a correction, it could still last quite a long time.

The British pound has surged by a total of 2,800 pips from its absolute lows reached last year, which is an enormous increase. Without a strong downward correction, a further upward trend would be entirely illogical (if it is even planned). We don't rule out an extension of an uptrend. We simply believe that a substantial correction is needed first, and then we should assess the factors supporting the US dollar and the British pound. A correction to the level of 1.1844 would be enough to establish a fair balance between the two currencies. The non-commercial group currently holds a total of 52,300 longs and 80,50 shorts. The bears have been holding the upper hand in recent months, and we believe this trend will continue in the near future.

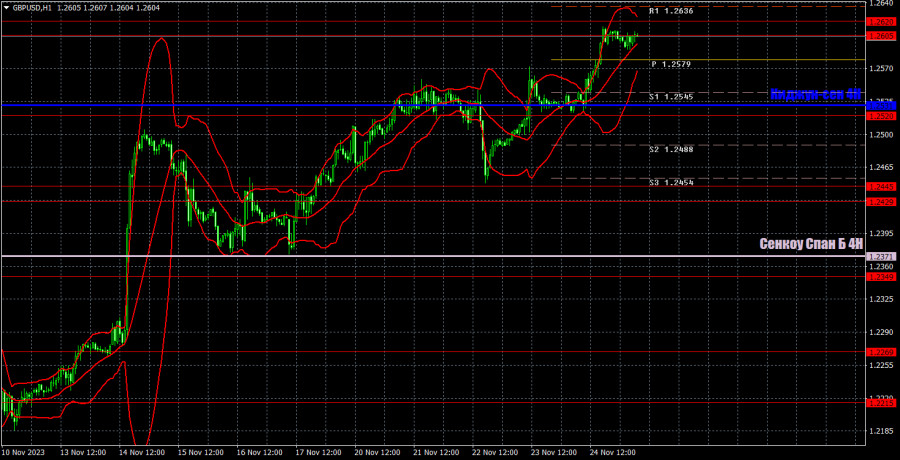

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD continues a corrective trend. Currently, the price cannot even overcome the Kijun-sen line, so there are no technical grounds to expect the pair to fall. On the contrary, the market appears ready to buy despite the fundamental background and the corrective status of the current movement. Therefore, in our opinion, the current upward movement lacks a solid foundation. However, traders have no choice but to follow the market, go with the trend, and consider buying.

As of November 27, we highlight the following important levels: 1.1927-1.1965, 1.2052, 1.2109, 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2605-1.2620, 1.2693, 1.2786. The Senkou Span B (1.2371) and Kijun-sen (1.2531) lines can also be sources of signals. Signals can be "bounces" and "breakouts" of these levels and lines. It is recommended to set the Stop Loss level to break-even when the price moves in the right direction by 20 pips. The Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The illustration also includes support and resistance levels that can be used to lock in profits from trades.

On Monday, there are no significant events planned in the UK and the US, so volatility in the pair and market activity are likely to be low. Nevertheless, the current status of the movement is driven by momentum, so the rise may well continue today.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.