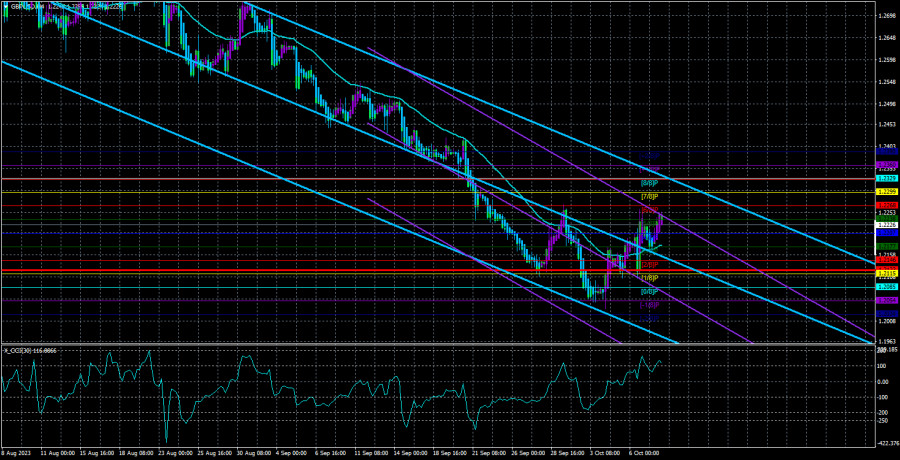

The GBP/USD currency pair on Monday also continued its upward correction, which is based purely on technical reasons. Let's remind you (and it is clearly visible in the illustration above) that the British pound has been falling for more than two months and has lost about 1000 points during this time, which is quite significant. Naturally, after such a decline, an upward correction is required. The CCI indicator entered the oversold zone three times, so the upward movement simply had to start, but even in this case, the market was late in correcting. The dollar offers excellent growth prospects until the end of the year, but a correction is needed in the near future.

Unfortunately, at the moment, we do not see a strong desire among market participants to close short positions. A week ago, the phase of the upward correction ended around the Murray level "6/8" (1.2268). In the last few days, the price approached this level twice and did not attempt to overcome it even once. Therefore, our correction is "ripe," so to speak, but there are concerns that it will be very weak. If the market is not eager to close shorts and open longs, no matter how strong the fundamental and macroeconomic background is, no significant movement will be observed.

The fundamental backdrop, it must be admitted, is currently fully in favor of the dollar. In the article on the euro currency, we noted that the military conflict in Israel is currently not providing support to the dollar, but this conclusion was drawn due to the absence of an increase in the American currency. It is quite possible that some bears are once again pulling the rope in their direction, but they are also contending with the other half of the bears, who are ready to take profits on short positions. In any case, the escalation of the conflict in the Middle East is a positive factor for the American currency.

The Fed may raise rates again, but the market is not yet certain about this. Experts from TD Securities have expressed their views on the possible actions of the Fed at the upcoming meeting. Let's immediately say that this is just one opinion among dozens and hundreds of opinions from similar experts and analysts, so it should not be taken as the ultimate truth. Analysts from this company believe that the Federal Reserve will gather additional data by November to make a decision on the key rate. They are concerned about the rise in yields on US Treasury bonds but note the strength of the labor market. The combination of factors is ambiguous for the regulator because, at the same time, inflation has been rising for two consecutive months and unemployment has risen to 3.8%. Such a level of unemployment is not critical or even high, but it still shows an increase, which is not very good.

We believe that everything will depend on inflation in September. If it turns out that the consumer price index did not slow down in the first month of autumn, or even worse, it increased, then the Fed will go for additional tightening. In favor of a new rate hike is also the fact that the Fed is transitioning to a "+0.25% to the rate/2 meetings" step. The rate was not raised in September, so everything suggests that it will increase in November. Moreover, the labor market continues to show excellent results, no matter what anyone says. Thus, the probability of further monetary policy tightening at the moment is not high, according to various forecasts and instruments, but we believe that in reality, it is higher than 50%.

The Fed still has all the necessary tools to fight inflation, so it would be foolish not to use them. And if the Fed raises rates again by the end of the year, it will be another factor in the growth of the US dollar. By the way, the Bank of England may also raise rates at least once more, but all the tightening measures of the British regulator have long been factored in by the market. We believe that the fundamental background remains fully in favor of the US currency.

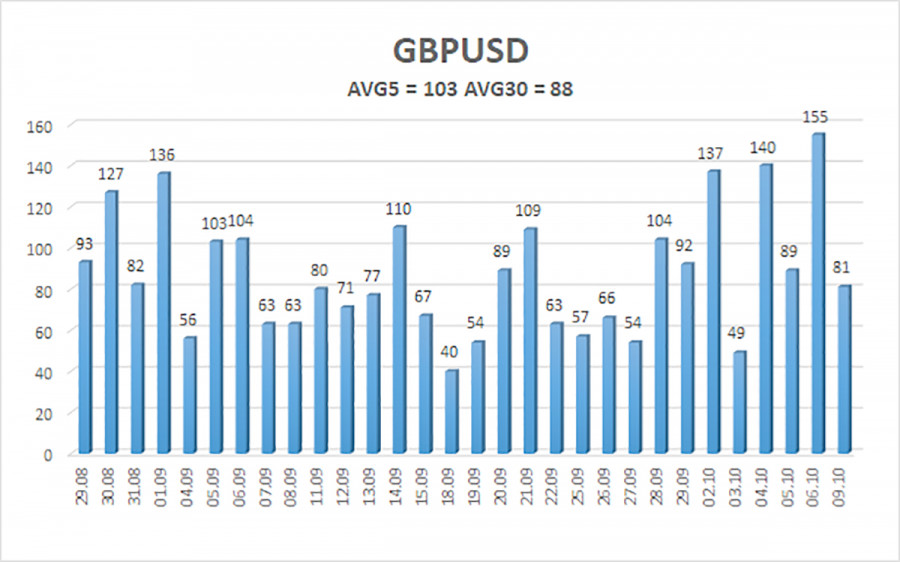

The average volatility of the GBP/USD pair over the last 5 trading days is 102 points. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, October 6th, we expect movement within the range of 1.2078 and 1.2282. A reversal of the Heiken Ashi indicator downward will signal a resumption of the downward movement.

Nearest support levels:

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest resistance levels:

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has started a new phase of corrective movement. Therefore, at the moment, it is possible to consider new short positions with targets at 1.2085 and 1.2024 in case the price settles back below the moving average. Long positions can be considered now, with targets at 1.2207 and 1.2282 until the Heiken Ashi indicator reverses downward.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is strong right now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted at the moment.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold territory (below -250) or overbought territory (above +250) indicates an impending trend reversal in the opposite direction.