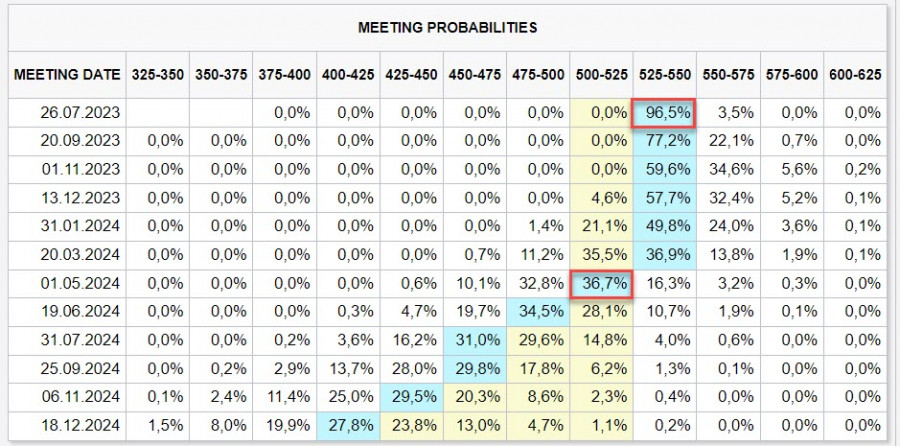

The FOMC is expected to raise the interest rate by 0.25%, marking the end of the cycle. The main focus will be on Federal Reserve Chair Jerome Powell's press conference, which will serve as a guide for market direction in the coming weeks.

Interest rate futures have slightly shifted in favor of the dollar bulls, with the first rate cut now expected in May 2024, not in March as predicted a week ago.

As the July meeting is transitional, without the release of new forecasts, all conclusions will be based solely on Powell's comments. If he signals that the rate hike will be the last one, the dollar will likely fall.

On the other hand, if Powell mentions a possible rate hike in September, which would contradict market expectations, the dollar will rise as the expected yield in the debt market will increase.

On Thursday, several economic data will be released, including the report on durable goods orders, trade balance in goods, and GDP growth rates. On Friday, personal income and expenditure (PCE) data will be released. If Powell doesn't shock the markets with unexpected statements, the reaction to the FOMC meeting's outcome may not be very strong, and the data on Thursday and Friday could be more important in terms of the dollar's prospects.

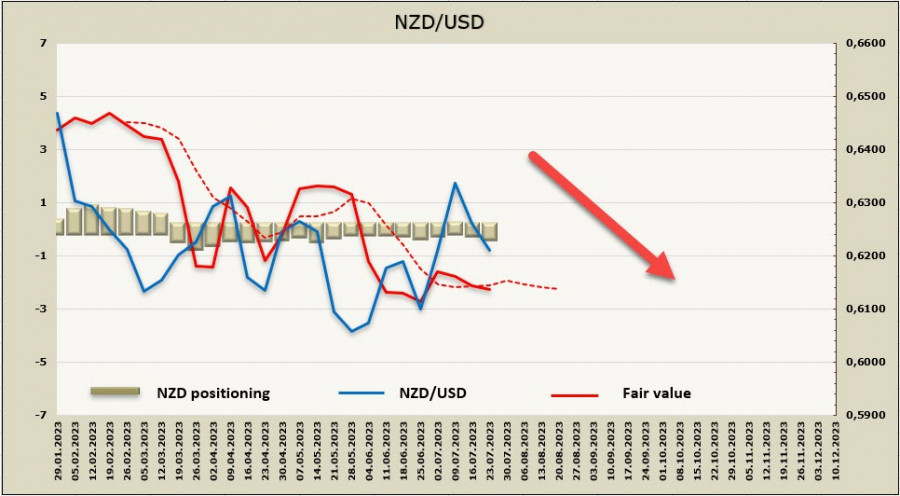

NZD/USD:

Published last week, the Consumer Price Index for the second quarter came in higher than expected, which clearly added to the Reserve Bank of New Zealand's headaches. The concern is not only that the overall inflation slowed down from 6.7% YoY to 6%, worse than forecasted, but also that the core inflation does not seem to be decreasing.

RBNZ's own industry-factor model for core inflation shifted to 5.8% in the second quarter, and revised data indicates that there has been no progress since the fourth quarter of 2022. Worries about inflation stabilizing above the RBNZ's 2% target have increased noticeably.

Labor market data will be published on August 2nd, and the main focus will be on the average wages. If the data exceeds expectations, it may inevitably shift the forecast for RBNZ's peak interest rate to a higher level, which could provide grounds for a bullish momentum for the New Zealand dollar.

The net short position for NZD increased by 150 million during the reporting week, reaching -227 million, with a positioning that is neutral with a slight bearish bias. The calculated price has gone below the long-term average and is pointing downwards.

The probability of a downward movement for NZD/USD increased slightly over the past week, with the target zone being seen around 0.6110/30. The main movement may begin on August 2nd, after the labor market data is published.

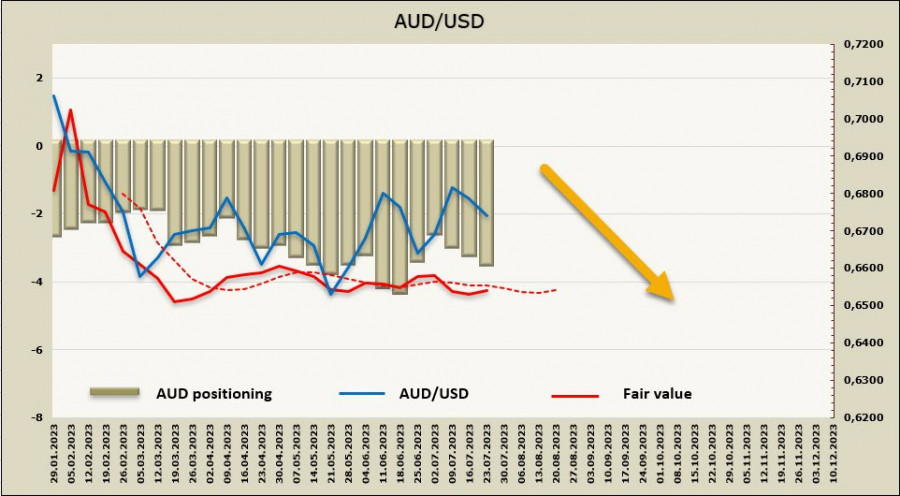

AUD/USD:

The Consumer Price Index in Australia slowed down much more than expected in the second quarter, with inflation growth reaching 0.8% against a forecast of 1%, and annual inflation slowing down from 7% to 6%.

Before the release of the Q2 inflation report, the Australian dollar had its best session among G10 currencies, reacting to a noticeable strengthening of the yuan. This movement was triggered by a series of statements from China after the closing of the Politburo meeting on Monday.

The latest statement contained the most convincing signs of significant political stimulus in areas aimed at boosting economic activity after a very weak (by Chinese standards) GDP growth of 0.8% in the second quarter. Specifically, the Politburo pledged to strengthen support for macroeconomic policies, abandoning previous mentions that houses are "for living in, not for speculation," replacing it with a reference to adapting to changes in "demand and supply" characteristics in the property market and "optimizing property policies."

There was also a clear reference to exchange rate stability, which had not been seen for several years. As a result, the USD/CNY pair fell by 0.7%, and as of the New York closing, the AUD/USD pair rose by 0.8% to a high of 0.6795, along with a more than 4% increase for the Hang Seng Index, including a 10% gap for real estate sector stocks.

The rise in the Australian dollar was also supported by the overall increase in commodity prices, including a more than 1% rise in copper, aluminum, and iron ore prices, as well as a 4.7% increase in nickel prices. Meanwhile, oil continues to rise after recent gains, with WTI and Brent crude oil rising by another 1% or so in the last 4 hours.

Thus, rapid inflation deceleration would stop the bullish momentum for AUD, and now we need to wait for the outcome of the FOMC meeting.

The net short position for AUD increased by 418 million during the reporting week, reaching -3.433 billion, with a firmly bearish positioning. The calculated price is below the long-term average, but there is no specific direction.

AUD/USD can not find a reason to rise, despite the evident weakness of USD. We expect it to fall, as a faster-than-expected inflation deceleration gives the Reserve Bank of Australia the opportunity not to rush with another rate hike. The likelihood of growth towards resistance at 0.6902 has decreased, and the target is seen in the support zone around 0.6700/10, and further at 0.6620/30.