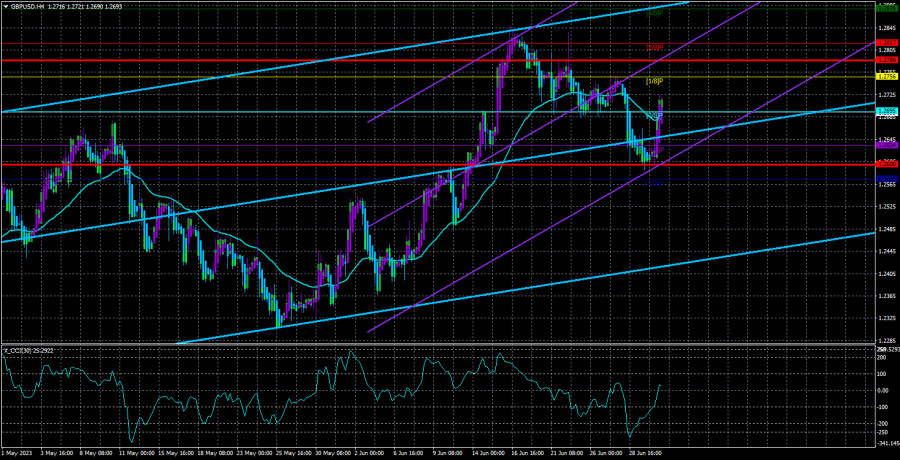

On Friday, the GBP/USD currency pair experienced significant growth, which fundamental or macroeconomic factors could not justify. The pair has crossed the moving average line, but it did so at the intersection of two weeks. Therefore, this consolidation cannot be considered a strong buying signal. Although the British pound remains high and may continue its upward trend, paying attention to macroeconomics or fundamentals seems futile as these factors have long been indicating a decline in the pound. The technical analysis supports this view, showing that the British currency is heavily overbought.

General expert forecasts suggest that the Bank of England may raise interest rates twice this year, despite expectations in May for a pause, signaling the completion of the tightening cycle of monetary policy. However, the reality is that the Bank of England lacks significant influence over high inflation and thus needs to tighten policy to bring inflation down to manageable levels. The British economy continues to teeter on the brink of a recession, with four consecutive quarters closing within the range of -0.1% to 0.1% GDP. This fundamental backdrop does not support the pound's growth, but the market holds a different opinion and continues to buy.

In the 24-hour timeframe, we observe the signs of a potential trend reversal. The upward movement is weakening, but the pair remains above the critical line, indicating no signals for a change in the long-term trend. The pound often experiences formal corrections, as evident on the daily chart.

Monday presents a challenging day ahead. The UK has limited macroeconomic data scheduled for this week, with market participants primarily focusing on business activity indices. On the other hand, the United States typically releases a wealth of macroeconomic data at the beginning of each month. This week alone, crucial indicators such as the ISM business activity indices, NonFarm Payrolls, unemployment figures, labor market reports, and the Federal Reserve's meeting minutes will be published. It's important to note that any event or report can trigger a strong reaction or have no impact. Predicting the values of future reports is impossible, making it challenging to provide a clear forecast for the GBP/USD pair by the end of the week.

Analyzing the overall macroeconomic background, we currently do not see compelling reasons for the British currency to rise, considering the three consecutive quarters of growth in the American economy, the strong state of the labor market (with a 5.25% interest rate), and low unemployment rates. However, if these factors held no significance in the market a month or two ago, it is likely they won't carry significant weight this week either. Locally, the dollar may appreciate based on the same ISM indices or the NonFarm report, but the overall trend is unlikely to change.

Therefore, we recommend closely monitoring the behavior of the GBP/USD pair around the critical line in the 24-hour timeframe this week. A breakthrough of this line would be the first signal of a possible trend reversal. If it occurs, we can expect a downward movement in the pair, irrespective of fundamentals and macroeconomics. Additionally, it's worth noting that on the 4-hour timeframe, the CCI indicator has entered the oversold area, coming only 200 points away from its annual highs. Although an upward correction already occurred on Friday, this signal can be considered as having played out. However, new sales would require a new consolidation of the price below the moving average.

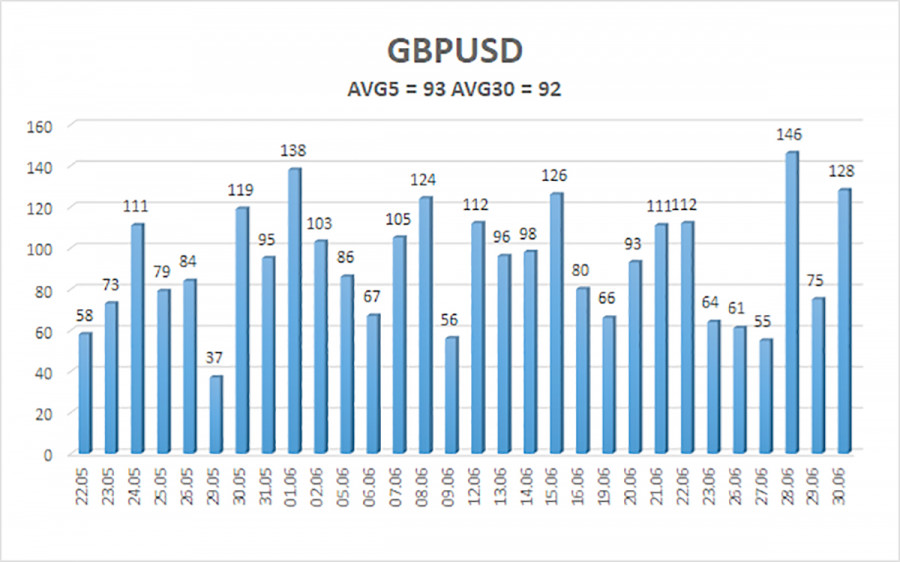

The average volatility of the GBP/USD pair over the last five trading days is 93 pips, considered "average" for this currency pair. Therefore, on Monday, July 3rd, we anticipate movement between 1.2600 and 1.2786. A downward reversal of the Heiken Ashi indicator would indicate a possible resumption of a downtrend.

Nearest support levels:

S1 - 1.2634

S2 - 1.2573

Nearest resistance levels:

R1 - 1.2695

R2 - 1.2756

R3 - 1.2817

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair started a sharp correction. Long positions with targets at 1.2756 and 1.2817 are relevant and should be held until the Heiken Ashi indicator reverses downward. Consideration of new short positions can be made if the price consolidates below the moving average, with targets at 1.2600 and 1.2571.

Explanation of the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels: target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair is expected to move in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an upcoming trend reversal in the opposite direction.