The GBP/USD currency pair continued its upward movement on Friday. Nevertheless, the price has increased almost to its previous peak, the highest in the past year. Thus, the current growth of the pair is quite strong. However, it would be excellent if there were specific grounds and reasons for it. But there are none. The current growth looks unjustified, but something needs to be done about it, as the market wants to maintain the British currency.

On Friday, there was no macroeconomic or fundamental background in the US or the UK. Therefore, traders had nothing to react to. There was absolutely nothing interesting happening in the UK throughout the past week. Only the ISM Business Activity Index and unemployment benefits claims can be noted in the US. These reports turned out to be weaker than expected, so technically, the dollar had reasons to decline. But it fell too strongly again.

The most important question is the issue of the Bank of England's interest rates. After slowing down the pace of tightening to a minimum, we can expect a maximum of 3 rate hikes. One has already occurred. Therefore, a maximum of 2 more. However, during the 2007-2008 crisis, the BOE rate was even higher than the Federal Reserve rate at a certain point. In other words, this time, it could rise to 5.5% or higher. We do not believe in such a scenario, but the market may believe in it. If so, it could be the main reason for the hyper-strong resistance of the British pound against the dollar.

We are awaiting an important week with many significant events. The most important events are scheduled in the US, but there will also be some interesting developments in the UK. On Tuesday, unemployment data, unemployment benefit claims, and wage data will be published. Since the unemployment trend is negative, there is every reason to expect weak values in these reports. And the pound has real grounds to fall unless the market again disregards all the data in favor of the dollar. On Wednesday, monthly GDP reports and industrial production data will be published. These are only some of the most important reports; we do not expect a strong reaction. There will be nothing interesting happening in the UK on Thursday and Friday.

In the US, on Tuesday, the inflation report for May will be published, which may show a decline to 4.1%-4.3% y/y. If such a significant slowdown occurs, the probability of a rate hike at the FOMC meeting will decrease almost to zero, and it will simply decrease at the July meeting. This is a very important report, and the market will likely pay attention to it. On Wednesday evening, the results of the FOMC meeting and a press conference with Jerome Powell will be announced. These are also very important events. Of course, we only sometimes see strong movements, and often there are divergent movements within a short period. But let's remember that the market can respond to important information from the regulator within a day.

Retail sales and unemployment benefit claim reports will be released on Thursday in the US. On Friday, the University of Michigan Consumer Sentiment Index will be published. These reports can only cause a reaction in case of significant deviations from the forecast's actual values. This week, the macroeconomic background can equally support the dollar and the pound. However, the pound continues to rise much more willingly than it falls, so we would not be surprised if the week ends with a new increase in the pair.

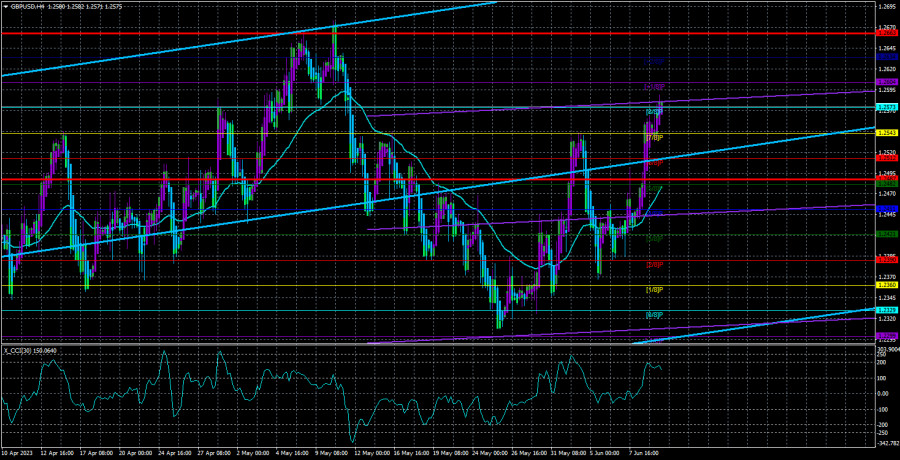

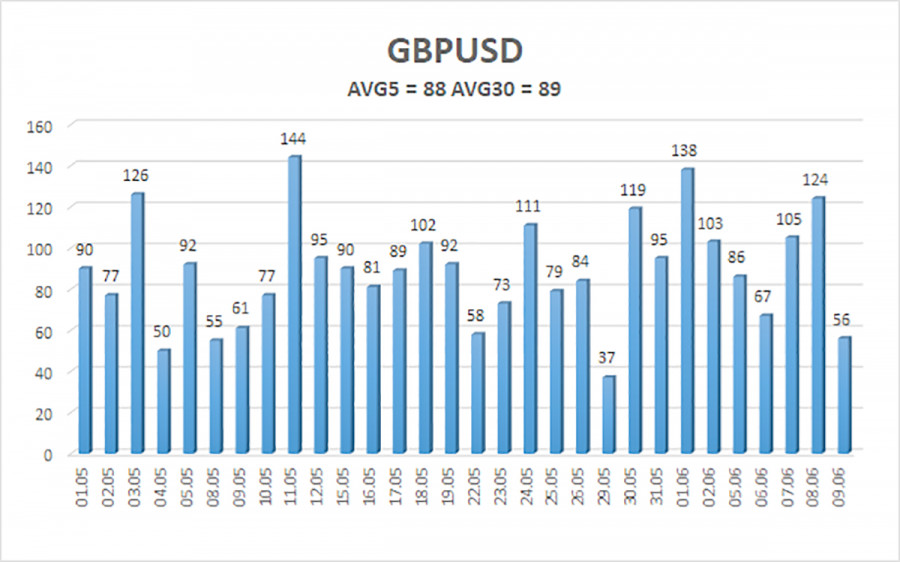

The average volatility of the GBP/USD pair over the past five trading days is 88 pips. For the GBP/USD pair, this value is considered "average." Therefore, on Monday, June 12th, we expect movement within the range limited by the levels of 1.2487 and 1.2663. A reversal of the Heiken Ashi indicator downward will signal a downward correction.

S1 - 1.2573

S2 - 1.2543

S3 - 1.2512

Nearest resistance levels:

R1 - 1.2604

R2 - 1.2634

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair remains above the moving average line, so long positions with targets at 1.2634 and 1.2663 remain valid. They should be held until the Heiken Ashi indicator reverses downward. Short positions can be considered if the price consolidates below the moving average, with targets at 1.2451 and 1.2421. There is also a high probability of volatility swings.

Explanation of the illustrations:

Linear regression channels help determine the current trend. If both channels are directed in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murrey levels are target levels for movements and corrections.

Volatility levels (red lines) represent the probable price channel in which the pair will move in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold region (below -250) or overbought region (above +250) indicates an upcoming trend reversal in the opposite direction.