EUR/USD kicked off the week without sharp swings. However, given the fact that the price has been in the sideways channel for several weeks, traders did not expect any changes. Besides, the economic calendar was empty on Monday. Naturally, there have been situations when the pair changed its trajectory sharply on Monday. Yet, there were no crucial economic reports yesterday.

Only Germany's industrial production data was released. Investors paid zero attention to this report. Germany is just one country out of the 27 countries in Europe and industrial production is not the most important indicator. The figure showed a contraction in March. Industrial production decreased by 3.4% on a monthly basis versus the forecast reading of -1.3%. Bulls were not spoked by this negative indicator. The pair traded sluggishly but still with an increase. Although now any movement is short-lived as the pair is stuck in the narrow range.

Even last week, when two meetings of central banks took place and a lot of crucial US economic reports were published, EUR/USD failed to break out the channel. Therefore, the price is likely to stay in the sideways channel and retain a weak bullish bias. The pair is unable to start a correction.

So, it has no drivers to rise but it is trying hard not to decline. Such a situation may last for a long time. The euro is stuck in the narrow range, filtering out all the sell signals. Any consolidation below the moving average even with an uptrend did not mean that the pair would fall.

Christine Lagarde expects inflation to slow down

As the economic calendar for the US and EU was empty on Monday, let's discuss the events of last Friday. ECB President Christine Lagarde said she expects a further slowdown in the Consumer Price Index. She stressed the impact of monetary tightening has a long-term effect on the economy. A similar opinion has already been voiced by BoE and Fed officials. So, traders were not surprised by her comments. However, analysts struggle to say how fast it will decrease and to what level consumer prices will drop. The ECB continues to raise rates but is already preparing for the end of the tightening cycle.

Lagarde also said that wage growth caused by the tight labor market and high inflation will boost core inflation for some time. However, both types of inflation will gradually decrease. The faster and stronger inflation falls, the higher the probability of the end of the tightening cycle in the next three months. The majority of analysts expect two more rate hikes by 0.25% from the ECB.

Chairman of SNB Thomas J. Jordan pointed out that high inflation remains a big problem for Switzerland. This is why he could not rule out further monetary tightening. Although traders did not get any new information from his speech, his statements increased demand for the euro. ECB is likely to have a long-term plan when it comes to monetary policy. Speculators clearly understand what level the rate could reach. so, they are pricing it in. The euro may jump only if the ECB's rhetoric is more hawkish.

It is better to trade on the lower timeframes because the movements are very weak in the flat market. A lot of false signals appear on the 4H chart. The CCI indicator has already signaled an overbought status twice. However, the US dollar has not been able to benefit from it.

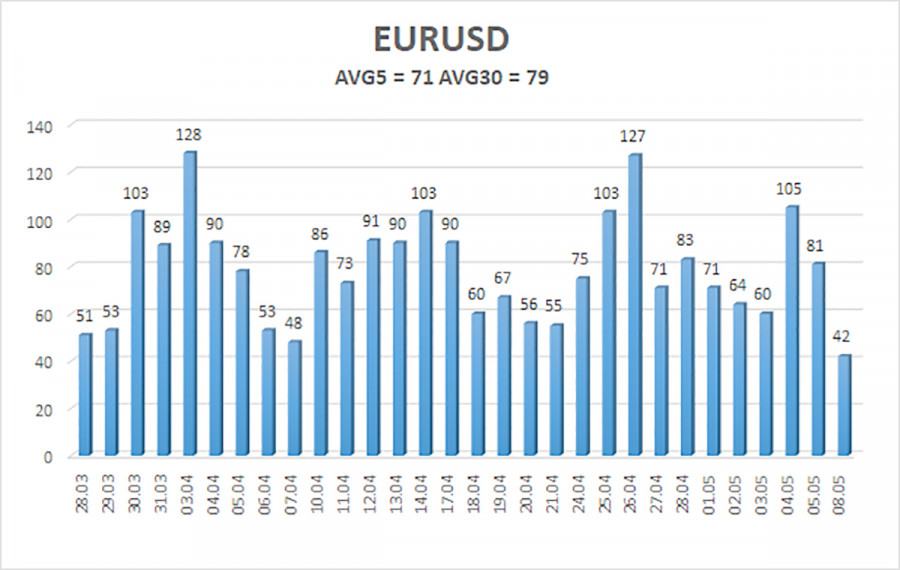

The average volatility of the euro/dollar pair over 5 days totaled 71 pips on May 9. This is an average indicator. The pair is likely to move between the levels of 1.0951 and 1.1093 on Tuesday. A downward reversal of the Heiken Ashi indicator will signal a new decline in the sideways channel.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair is trying to climb but it looks more like the continuation of the sideways movement. This is why I would advise you to trade on the reversals of the Heiken Ashi indicator or on the lower timeframes where it is easier to discern intraday trends.

On the chart:

Linear Regression Channels help to determine the current trend. If they move in the same direction, the trend is strong now.

Moving Average Line (20.0 period, smoothed) helps identify the short-term trend as well as the trajectory of the price

Murray levels are target levels for price movements and corrections.

Volatility levels (red lines) are the price channel where the pair is projected to move the next day, based on current volatility indicators.

The CCI indicator. Its slide into the oversold area (below -250) or a rise to the overbought area (above +250) signals a trend reversal.