The currency pair EUR/USD continued trading in the same mode as on Friday on Monday. Remember that Easter and other Catholic holidays start on Friday. This meant that the most important reports on the US job market, unemployment, and wages were mostly ignored. Over the weekend, we assumed that the market would process this data with a slight delay, and on Monday, in the second half of the day, we saw this processing. The decline of the pair and, accordingly, the growth of the dollar could not be related to anything other than Friday's macroeconomic statistics. The Easter Monday calendar was empty. Thus, some traders who actively celebrated Good Friday returned to the market on Monday. And the dollar started to grow. We saw a logical and justified market reaction for the first time in recent weeks. The nonfarm payrolls report showed the creation of 236,000 new jobs, which overall matched forecasts. Recall that any value above 200K can be considered positive. Some experts believe that job creation is slowing, meaning the labor market is "cooling down." We have repeatedly said this is not the case because last year's slowdown was due to natural reasons. When the US economy collapsed at the beginning of the pandemic, the next few quarters saw a sharp recovery, including in the labor market. And then, from the peak levels, there was a slow decline to "normal" values. Now, we see the same figures every month as before the pandemic, so 200–300 thousand new jobs per month is an excellent result, consistently shown from month to month.

In addition, the unemployment rate fell again. The same experts who were worried about the "slowing nonfarm sector" also made a big deal out of the "growing problem of unemployment." As we can see, unemployment is not growing and remains at its 50-year low. Therefore, the entire package of statistics can confidently be called "strong," which should have provoked the growth of the dollar. We did not see this growth on Friday, but at least we saw it on Monday. We still believe that the US dollar should strengthen. Consolidation below the moving average may provoke bears into active action.

The euro may still fall to 1.0530.

Since there is nothing to discuss based on Monday's results, we will again turn to the Fed and ECB rates today. According to various analysis and forecasting tools, the probability of the Fed raising its rate by 0.25% once in 2023 ranges from 60% to 80%. In other words, there is no doubt that monetary policy will be tightened at least one more time. At the same time, the potential for the ECB is much higher, which may push the euro/dollar pair up for some time. The European regulator cannot raise the rate for a long time, and in May, it is likely to slow down the tightening pace to 0.25%. This will mean that the ECB is preparing to complete the tightening cycle, and the ECB's rate advantage will be a maximum of 0.75% over the Fed's rate. This is not such a strong divergence between the rates for the European currency to continue growing in the same mode as in recent weeks. The American economy still looks much more confident and convincing than the European one, and rates will soon stop rising in Europe. The euro has grown too fast, strong, and without ground to expect further growth without correction. If the pair corrects at least 250–300 points downward, the market will develop new purchase reasons, but the correction is brewing for now. On the 24-hour TF, it may even mean a new round of decline within the sideways channel with a target around the 1.0530 level.

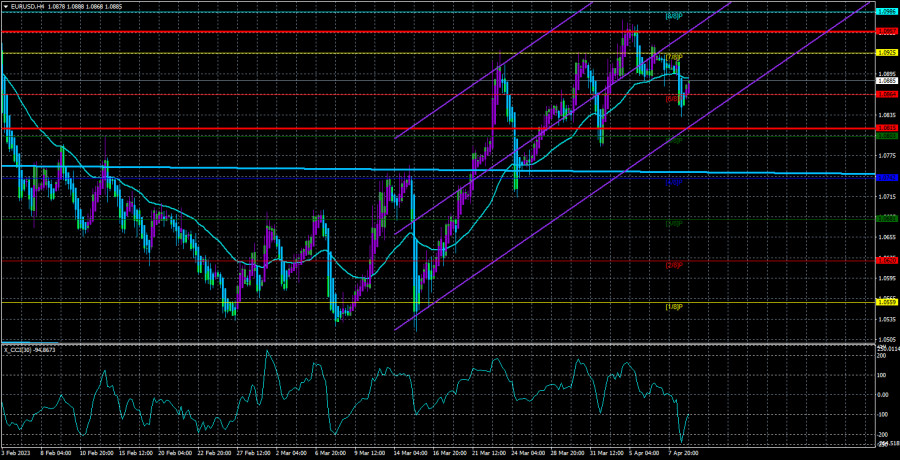

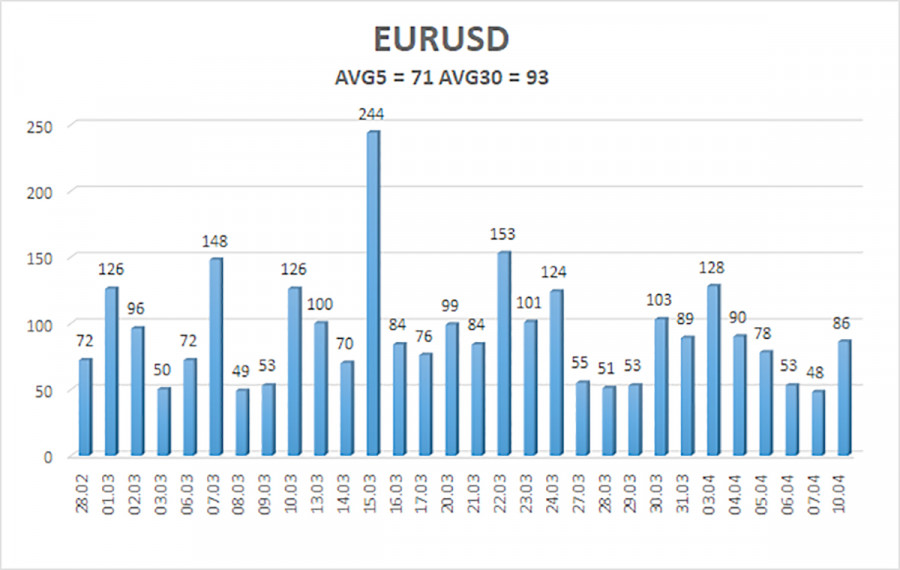

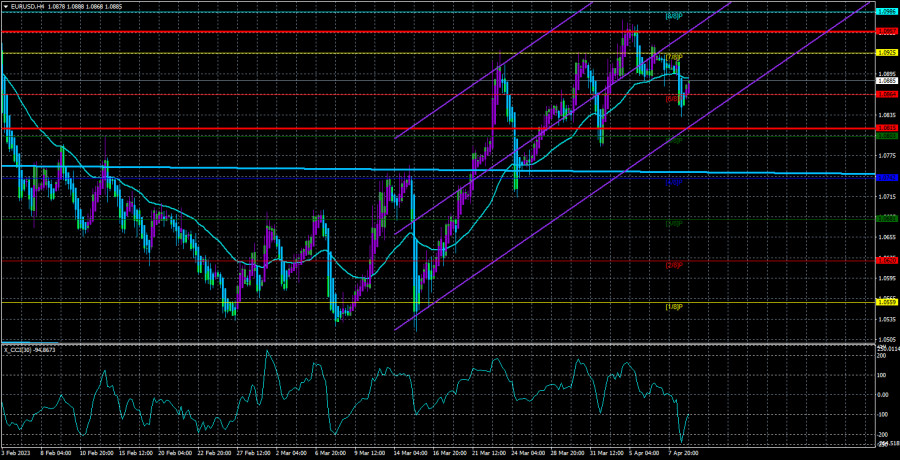

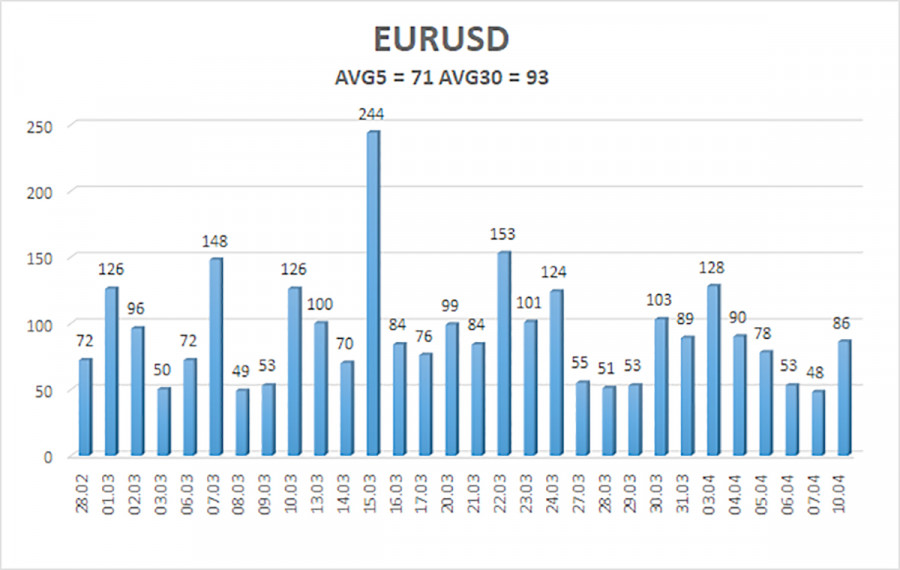

The average volatility of the euro/dollar currency pair over the last five trading days as of April 11 is 71 points and is characterized as "average." Thus, we expect the pair to move between 1.0815 and 1.0957 on Tuesday. If the Heiken Ashi indicator turns around, the price will decline.

Nearest support levels:

S1 – 1.0864

S2 – 1.0803

S3 – 1.0742

Nearest resistance levels:

R1 – 1.0925

R2 – 1.0986

R3 – 1.1047

Trading recommendations:

The EUR/USD pair has consolidated below the moving average line. At this time, new short positions can be considered with targets of 1.0815 and 1.0803 in case of a Heiken Ashi indicator reversal down or a price bounce from the moving average. Long positions can be opened after the price consolidates above the moving average with targets of 1.0925 and 1.0957.

Explanations for illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.