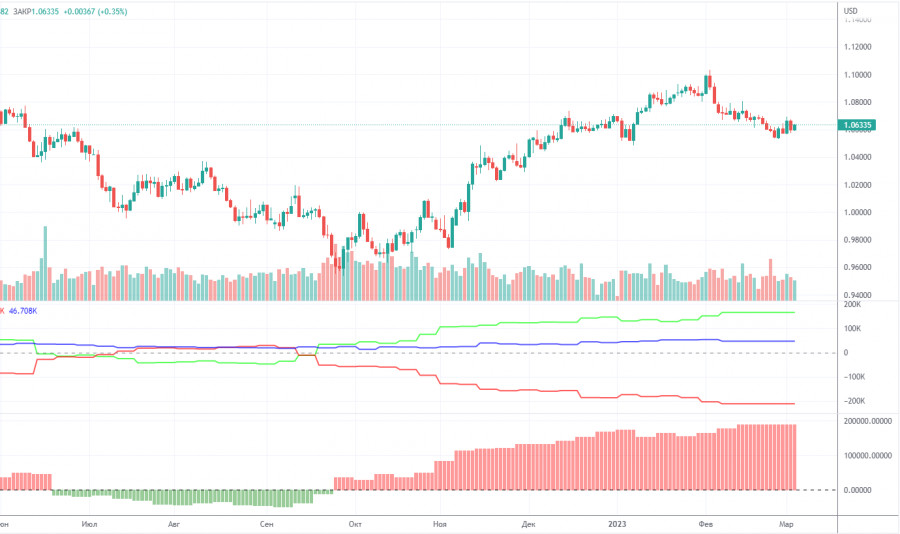

5M chart of EUR/USD

EUR/USD continued a very weak, upward, corrective movement on Thursday. Volatility was very low again, but there was a very concrete explanation in the form of a complete absence of fundamental and macroeconomic events. The pair could not crawl even to the nearest Ichimoku indicator line, although it has been correcting for two days. Therefore, there is no new conclusion regarding the pair's movement and outlook over the past two trading days. We have to wait for the reports, which may determine the dollar's future, until the next FOMC meeting, which will be held on March 21-22. I still expect the pair to fall, i.e. the rise of the USD. However, today it might take a different scenario, as there is no guarantee that the Nonfarm Payrolls report will be much higher than the forecasted value again.

Speaking of trading signals, the situation wasn't good on Thursday, but why is it so surprising if the pair managed to go "even" 50 pips in a day? Of course, you should not expect that the pair would provide a lot of strong and profitable signals. At first the pair rebounded from 1.0581, and then was down 15 points, which at least let you place the Stop Loss to Breakeven. Further, the pair traded along 1.0581, but by that time it was clear that trading was not active on Thursday. Therefore, traders could quietly close the terminal and leave the market, waiting for a more interesting Friday.

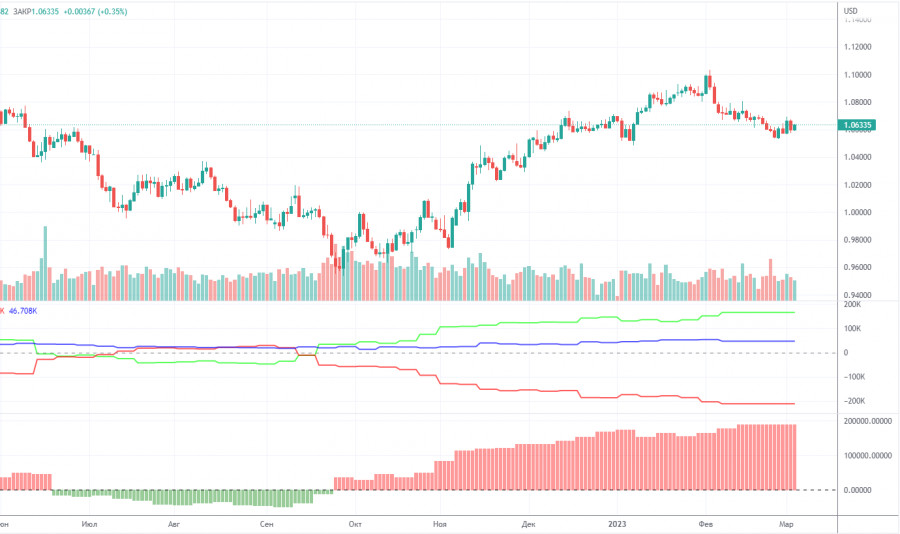

COT report:

On Friday, traders had to learn once again the COT report from February 7. This report was published a month ago. It seems that the Commodity Futures Trading Commission will now publish reports with a month's delay instead of a three-day delay as it was before. In the event of this, the reports will hardly be of great importance. However, we will continue to analyze them. Maybe in the future, the situation will change for the better. So far, we can say that in the last few months, the overall picture has been corresponding to the market situation. On the chart above, we see that the net non-commercial position of large traders (second indicator) has risen since September 2022. The net non-commercial position is bullish and continues to increase with each new week, allowing us to expect the uptrend to stop shortly. Such a signal comes from the first indicator, with the green line and the red line being far apart, which is usually a sign of the end of a trend. The euro has already begun its bearish move against the greenback. So far, it remains unclear whether it is just a downward correction or a new downward trend. According to the latest report, non-commercial traders closed 8,400 long positions and 22,900 short ones. Consequently, the net position rose by 14,500. The number of long positions exceeds that of short ones by 165,000. In any case, a correction has been looming for a long time. Therefore, even without reports, it is clear that the downtrend will continue.

1H chart of EUR/USD

On the one-hour chart, the pair sharply fell, but after that ended it started a correction for two days. Unfortunately, the chart shows that the downtrend can't be considered as completely revived yet. Now the euro's technical picture looks more like a "swing" than a trend. If the data turns out to be disappointing today, the pair might go back to 1.0692, which will make us believe in the "swing". On Friday, important levels are seen at 1.0340-1.0366, 1.0485, 1.0537, 1.0581, 1.0658, 1.0692, 1.0762, 1.0806, 1.0868, and also Senkou Span B (1.0615) and Kijun Sen (1.0610). Ichimoku indicator lines can move intraday, which should be taken into account when determining trading signals. There are also support and resistance although no signals are made near these levels. They could be made when the price either breaks or rebounds from these extreme levels. Do not forget to place Stop Loss at the breakeven point when the price goes by 15 pips in the right direction. In case of a false breakout, it could save you from possible losses. On March 10, the market will pay attention to the U.S. NonFarm Payrolls and the Unemployment report. However, European Central Bank President Christine Lagarde is also going to give a speech in the EU. All in all, it will be a rather volatile and active day.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

Kijun-sen and Senkou Span B are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.