The focus of traders today is the publication (at 15:00 GMT) of the Institute for Supply Management (ISM) report with key indicators on the U.S. manufacturing sector (forecast to decline from 49.0 to 48.5 in December), as well as the minutes from the December FOMC meeting (at 19:00 GMT).

The monthly ISM report publishes (among other data) the PMI in the manufacturing sector of the U.S. economy, which is an important indicator of the state of this sector and the U.S. economy as a whole. The relative decline of the index and the result below 50 is seen as a negative factor for the U.S. dollar, as it indicates a slowdown in business activity.

The minutes from the December Fed meeting may indicate further actions of the U.S. central bank. At the moment, most market participants expect the Fed to raise the interest rate by 0.25% to 4.75% on February 1.

As you know, in December, the Fed leaders raised the interest rate by 0.50% after raising the rate by 0.75% in June, July, September and November.

Federal Reserve Chairman Jerome Powell said during the press conference that much more evidence is needed to be sure that inflation will fall, holding interest rates at peak levels until they are really confident that inflation will decline in a sustainable way.

"That 4.7% unemployment rate is still a strong labor market", Powell said. The Fed "hasn't reached a sufficiently restrictive policy level yet... there is some rate hike to go while the FOMC continues to consider risks to inflation as upward."

It may surpise the market if the Fed hikes interest rates by 0.50% or even 0.75%, rather than 0.25%, at its January 31 and February 1 meetings. However, for Fed policymakers to have more of an argument for that, we have to wait for the updated data on consumer inflation in the U.S. on January 12. And here, we expect a further decline of inflation in December to 6.7% from 7.1%, 7.7%, 8.2%, 8.3%, 8.5%, and a 40-year high of 9.1% in June. Clearly, if the outlook is confirmed, supporters of the Fed's super tight monetary policy slowdown will have more arguments on their side.

And this week, the first important argument for the Fed's leaders when making such a decision will be the publication (on Friday at 13:30 GMT) of the monthly report of the U.S. Department of Labor with data for December. The state of the labor market (together with GDP and inflation) is a key indicator for the Fed in determining the parameters of its monetary policy.

Wages and salaries are expected to have continued to rise in December, while unemployment remained at pre-pandemic lows. The weak point in the Labor Department's report may be the number of new jobs created outside the agricultural sector. Forecasts assumed figures to grow by +200,000 in December (preliminary forecast assumed NFP with a value of +57,000) after rising by +263,000 in November.

If the figure is weaker than the forecast and is below +150,000, the probability of a softer interest rate decision at the upcoming FOMC meeting will increase.

Conversely, if the data from the U.S. Department of Labor report exceeds market expectations, with a strong Bureau of Labor Statistics inflation report (January 12), market participants will expect another tough decision from the Fed leaders and an interest rate hike of at least 0.50%.

The general conclusion that can be drawn from Powell's speech at the December 14 press conference is that "in order to achieve a sufficient level of tightening, it is necessary to continue to raise rates." This means that interest rates will continue to rise. In fact, this is a bullish factor for the dollar.

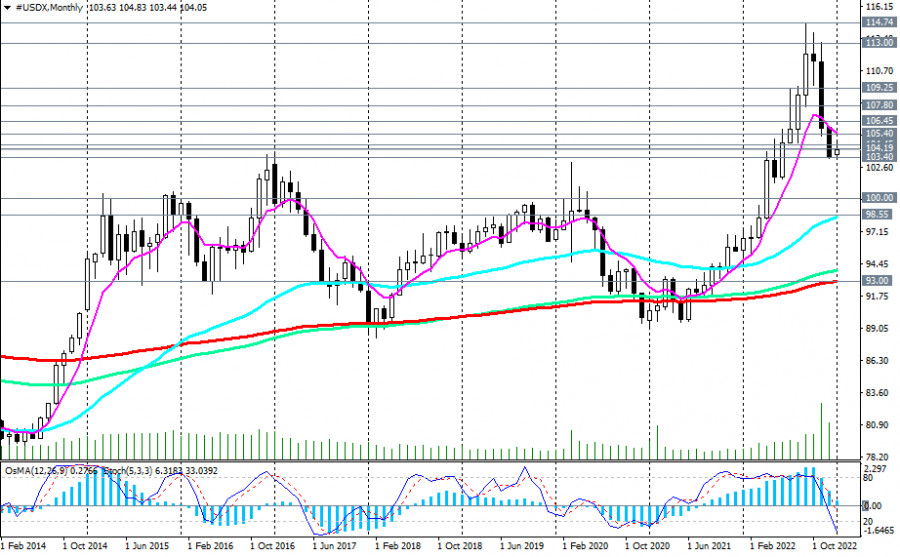

In the meantime, the dollar remains under pressure, and its DXY index is developing a downward trend. DXY futures are currently trading near 103.85, 70 pips above the local low (since July 2022) of 103.15 reached at the end of December.

The dollar is in desperate need of strong news or macro economic drivers. Maybe it will get one this week. Or not—if the aforementioned reports expected today and Friday do not meet the expectations of the market and dollar buyers.

From a technical point of view, the dollar index (CFD #USDX in the MT4 trading terminal) continues to trade in the medium-term bear market zone, below the key resistance levels 105.40, 104.45. The signal for building up short positions will be a breakdown of the last month's low at 103.36.

Long-term downside targets for DXY are at 100.00, 98.55 and 93.00. A breakdown of support at 93.00, in turn, will mark a breakdown of the global bullish trend of the DXY.