Analysis of GBP/USD, 5-minute chart

Last Friday, the GBP/USD currency pair continued to practically "collapse", so to speak. The US dollar fell another 140-150 points. If you look at Friday's macroeconomic statistics, it becomes clear that the British currency had no reasons to grow. Early in the morning it became known that the British GDP fell by 0.6% in the third quarter, which can hardly be called a "positive factor". However, the pound continued to rise, and to be more precise, the dollar continued to fall. Thus, the market simply ignored the British statistics, preferring to work out the US inflation report, which provoked a storm of emotions. We have an ascending trend line on the hourly timeframe, and on the 4-hour timeframe, the price is above the Ichimoku indicator lines. Thus, we have an upward trend, which does not raise doubts and questions. Nevertheless, we expect at least a serious correction this week.

But in regards to trading signals, the situation on Friday was very bad. Despite the fact that most of the day there was a strong trend movement, all signals were formed only around one level - 1.1760. Thus, traders could work out only the first two. Both were for short positions, in both cases the price went down more than 20 points, but never managed to reach the target level or go a significant distance in the right direction. Therefore, both positions were closed by Stop Loss at breakeven. All subsequent signals should not have been worked out.

COT report

The latest Commitment of Traders (COT) report on the British pound showed a slight weakening of the bearish sentiment. In the given period, the non-commercial group closed 8,500 long positions and 11,500 short positions. Thus, the net position of non-commercial traders increased by 3,000, which is very small for the pound. The net position indicator has been slowly rising in recent weeks, but this is not the first time it has risen, but the mood of the big players remains "pronounced bearish" and the pound remains on a downward trend in the medium term. And, if we recall the situation with the euro, then there are big doubts that based on the COT reports, we can expect a strong growth from the pair. How can you count on it if the market buys the dollar more than the pound?

The non-commercial group has now opened a total of 79,000 shorts and 34,000 longs. The difference, as we can see, is still very big. The euro cannot rise even though major players are bullish, and the pound will suddenly be able to grow in a bearish mood? As for the total number of open longs and shorts, here the bulls have an advantage of 21,000. But, as we can see, this indicator also does not help the pound too much. We remain skeptical about the long-term growth of the British currency, although there are certain technical reasons for this.

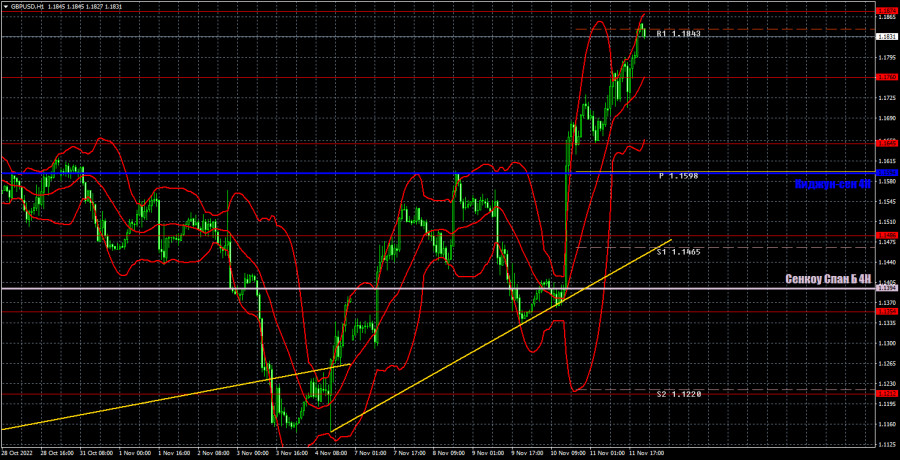

Analysis of GBP/USD, 1-hour chart

The pound/dollar pair continues its crazy growth on the one-hour chart. Even a trend line is not really necessary to determine what the current trend is. We consider such a movement somewhat unfounded, however, the market continues to buy, so the movement can theoretically continue as long as you like. However, this week we still expect a serious downward correction.

On Monday, the pair may trade at the following levels: 1.1354, 1.1486, 1.1645, 1.1760, 1.1874, 1.1974-1.2007, 1.2106. Senkou Span B (1.1394) and Kijun-sen (1.1594) lines can also give signals if the price rebounds or breaks these levels. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. The lines of the Ichimoku indicator may move during the day, which should be taken into account when determining trading signals. Also, there are support and resistance levels that can be used to lock in profits.

There are no major events or reports scheduled for Monday in either the UK or the US. However, the pair may continue to trade in a very volatile manner. As for the direction of movement, we expect a downward correction. The pair cannot rise for the third consecutive day based on the US inflation report alone!

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.