The GBP/USD currency pair continued to grow during the last trading week, although it had no good reasons for this. Recall that last Monday, it became known about the appointment of a new British Prime Minister, Rishi Sunak. We do not believe that the very fact of the change of Prime Minister was so optimistic for the British pound. However, we have already said earlier that the pound has more chances to grow than the euro. Despite some randomness of its last collapse by 1000 points and subsequent recovery by 1100 points, it still collapsed to absolute lows in its entire history. It then quickly moved away from them, indicating a likely end of the global downward trend. After that, the pound grew with and without reason, and last week it overtook the euro, which had reasons for growth.

However, this week there will be a crazy fundamental background for the pound/dollar pair. On Wednesday – the Fed meeting, and on Thursday – the meeting of the Bank of England. Both central banks are 100% likely to raise their key rates, so there is no doubt that a very volatile week awaits us. Unfortunately, it is impossible to predict in advance where the currency pair will move. The market can start working out the results of both meetings in advance; the general mood of the market is of great importance. In general, we would not guess the answer to this question. Formally, the pound sterling retains the chances of a new fall. On the 24-hour TF, the key Senkou Span B line has not yet been overcome, so there may be a rebound from it with the resumption of the fall.

Wednesday, Thursday, and Friday will force traders to trade actively.

Next week will start for the British pound with an insignificant index of business activity in the manufacturing sector for October. According to experts, the indicator will fall to 45.8 points, below the key mark of 50.0. On Thursday, the index of business activity in the service sector and the meeting of the Bank of England. On Friday, the index of business activity in the construction sector. Naturally, the main attention of traders will be focused on the Bank of England, which can raise its rate by 0.75%.

In the US, in addition to the Fed meeting, with which absolutely everything is already clear, business activity indices in all areas, including important ISM indices, will be published. ADP report on changes in the number of employees in the private sector. Well, on Friday, if someone decides to take a break after the meetings of the Fed and the BA, they will not be able to do this since Nonfarmes, the unemployment rate, and wages will be published on this day. Therefore, we are waiting for a crazy week, and hardly anyone can say where the pound will be by the end of it.

The unemployment rate in the United States is very important now, as it indicates the onset of the "right recession." Recall that the Fed does not consider a slowdown in economic growth a recession if increased unemployment and layoffs of Americans do not accompany it. Thus, reports on unemployment and the labor market are very important. The US economy showed solid growth in the third quarter. Unemployment will either remain at 3.5% or rise to 3.6%. The number of new jobs outside the agricultural sector can range from 200 to 240 thousand, which, from our point of view, is a normal value. Therefore, if it were not for the BA meeting, we would say that the week should turn out to be "absolutely American." However, the market can interpret all the data, so the pair can "fly" from side to side thoroughly.

From a technical point of view, it will be possible to expect a fall not earlier than fixing the price below the moving average. This may happen as early as Monday or Tuesday, and at this point, we will understand how the market is set up for upcoming events.

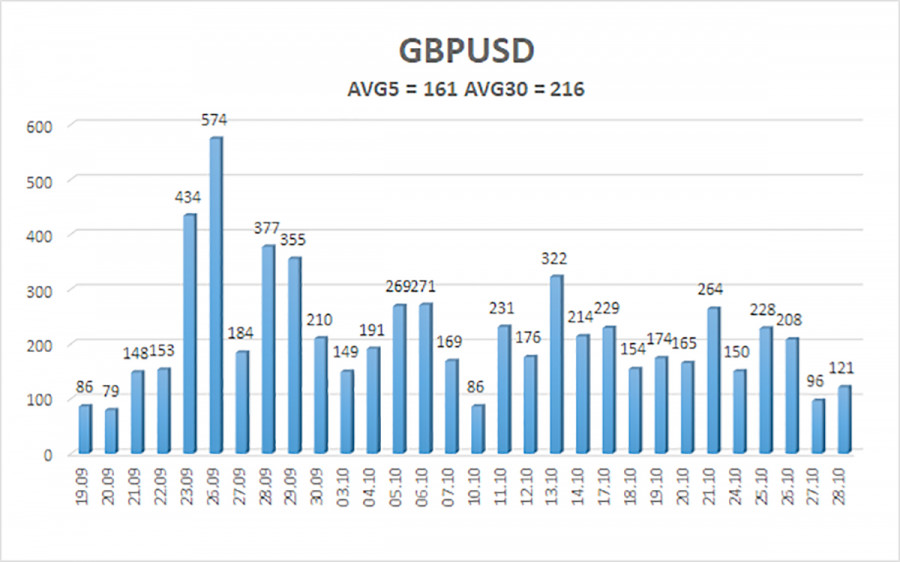

The average volatility of the GBP/USD pair over the last five trading days is 161 points. For the pound/dollar pair, this value is "very high." On Monday, October 31, thus, we expect movement inside the channel, limited by the levels of 1.1453 and 1.1775. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction.

Nearest support levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The GBP/USD pair remains at its local highs in the 4-hour timeframe. Therefore, at the moment, you should stay in buy orders with targets of 1.1719 and 1.1775 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.1353 and 1.1230.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. The trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.